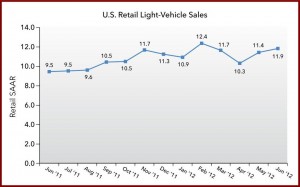

June new-vehicle retail sales in the U.S. are projected to come in at 994,800 units, which represent a seasonally adjusted annualized rate or SAAR of 11.9 million units. Auto sales volume is expected to increase 15%, compared with June 2011, after adjusting for one additional selling day this month. While still far below the level of auto sales pre-Great Recession, total light-vehicle sales are forecasted at 14.5 million units with retail sales at 11.6 million units.

Total light-vehicle sales in June are predicted at 1,265,900 units, which is a 16% increase from June 2011. Fleet volume is expected to reach 21% of total sales in June, after falling below 20% in May.

“Many major manufacturers are posting year-over-year retail sales gains this month, while maintaining strong new-vehicle prices,” said John Humphrey, senior vice president of global automotive operations at J.D. Power and Associates, the source of the data. “Average incentive levels, while up 9% versus a year ago, are down 5% from May. All indicators point toward an industry that continues to get healthy.”

Power noted that gasoline prices in the United States have fallen steadily since April, which has weakened demand for hybrid and electric vehicles. As gas prices increased from $3.33 per gallon in November 2011 to $3.84 per gallon in April 2012, the combined share of retail sales of hybrid and electric vehicle sales increased from 1.7% to 4.6% during period. However, as gas prices have dropped since April, so has the market share for hybrid and electric vehicles, which has been trending downward during the past two months and is now at 3.4%. LMC Automotive, the owner of Power, expects hybrid and electric vehicle sales to make up 3.2% of total light-vehicle in 2012.

After two months of upward revisions in its auto sales forecast, LMC Automotive is maintaining forecast for 2012. Total light-vehicle sales are projected at 14.5 million units with retail sales at 11.6 million units.

“Despite a rising level of uncertainty with the economic recovery, consumers remain resilient in their willingness to purchase new vehicles,” said Jeff Schuster, senior vice president of forecasting at LMC Automotive. “Concerns regarding the macro-economic environment and another potential summer slowdown have increased, but we expect the sales pace to remain strong and stable throughout the second half of the year.”