The Justice Department filed a civil antitrust lawsuit today to block JetBlue Airways Corporation’s (JetBlue) proposed $3.8 billion acquisition of its largest and fastest-growing ultra-low-cost rival, Spirit Airlines, Inc. (Spirit). The Attorneys General of the Commonwealth of Massachusetts, the State of New York, and the District of Columbia joined in the action under an alleged violation of Section 7 of the Clayton Act, 15 U.S.C.§18.*

“JetBlue’s proposed acquisition of Spirit eliminates a disruptive, low-cost option for millions of Americans. Whether they fly Spirit or not, travelers throughout the United States benefit from an independent Spirit because where Spirit competes, other airlines – including JetBlue – are forced to compete more vigorously by lowering fares, offering greater innovations, and delivering more consumer choice,” said Principal Deputy Assistant Attorney General Doha Mekki of the Justice Department’s Antitrust Division. “This transaction occurs against the backdrop of years of airline consolidation in the United States.”

The complaint, filed in the District of Massachusetts, alleges that Spirit’s low-cost, no-frills flying option has brought lower fares and more options to routes across the country, making it possible for more Americans – particularly price sensitive consumers who pay their own fares – to travel. JetBlue’s acquisition of Spirit would eliminate the “Spirit Effect,” where Spirit’s presence in a market forces other air carriers, including JetBlue, to lower their fares. The deal also would eliminate half of the ultra-low-cost capacity in the United States. This will lead to higher fares and fewer seats, harming millions of consumers on hundreds of routes.

JetBlue is a Delaware corporation headquartered in Long Island City, New York. In 2022, it flew more than39 million passengers to approximately 107 destinations around the world, earning about $9.1 billion in revenue. Spirit is a Delaware corporation headquartered in Miramar, Florida. In 2022, it flew more than 38 million passengers to approximately 92 destinations in the Americas, earning about $5 billion in revenue.

“JetBlue and Spirit compete fiercely today on hundreds of routes serving millions of travelers. By eliminating that competition and further consolidating the United States airlines industry, the proposed transaction will increase fares and reduce choice on routes across the country, raising costs for the flying public and harming cost-conscious fliers most acutely,” Justice said.

*From the DOJ filing:

JetBlue first considered buying Spirit as early as 2017 and again in 2019, but ultimately abandoned those plans. But after Spirit announced a merger agreement with Frontier in February 2022, JetBlue reinstated its plan. JetBlue had previously informed its Board of Directors that a Frontier-Spirit merger would “limit any potential major inorganic growth opportunity,” i.e., consolidation via merger, for JetBlue. And JetBlue had made it clear that it also feared another airline merging with Spirit because that would leave JetBlue a “smaller and less relevant player in the industry.”

As a result, on April 5, 2022, JetBlue made an unsolicited offer to acquire Spirit. JetBlue’s bid to take over Spirit occurred against the backdrop of the Northeast Alliance, JetBlue’s de facto merger in Boston and New York City with American Airlines, the largest airline in the United States.

In response to JetBlue’s offer, Spirit’s Board of Directors retained “top-tier aviation and economic consultants,” who engaged for four weeks with “JetBlue and its advisors” to develop an “informed view” of the proposed transaction. Based on that assessment, Spirit’s Board of Directors recognized the antitrust and regulatory risks of mergers in an already- consolidated airline industry, and recommended that Spirit shareholders vote to adopt the merger agreement with Frontier instead, concluding that “consummation of the proposed JetBlue combination, with the [Northeast Alliance] remaining in place, seemed almost inconceivable.”

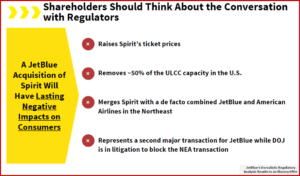

“Even putting aside the Northeast Alliance,” Spirit warned that JetBlue’s stated plans to reconfigure Spirit’s planes would “significantly diminish capacity” and “result in higher prices for consumers.” Accordingly, “a court . . . will be very concerned that a JetBlue-Spirit combination will result in a higher-cost/higher fare airline that would eliminate a lower- cost/lower fare airline and remove about half of the [ultra-low-cost] capacity in the United States.”

JetBlue, for its part, was not ready to give up its plans to acquire Spirit, and so it launched a hostile takeover bid. On May 16, 2022, JetBlue announced a tender offer for $30 per share—a significant cash premium over Frontier’s existing offer—and urged Spirit shareholders to reject the proposed Frontier merger. Spirit characterized JetBlue’s proposal as a “cynical attempt to disrupt Spirit’s merger with Frontier, which JetBlue views as a competitive threat.” 13 Spirit later published a presentation, one slide of which is excerpted below, highlighting the harm to competition that would result from an acquisition by JetBlue.

Pingback: American Airlines and JetBlue Alliance Blocked | AutoInformed

Justice Department Statements on District Court Ruling Enjoining American Airlines and JetBlue’s Northeast Alliance – AutoCrat.

Attorney General Merrick B. Garland and Assistant Attorney General Jonathan Kanter for the Justice Department’s Antitrust Division issued the following on 19 May 2023 regarding the U.S. District Court for the District of Massachusetts’s ruling in favor of the Justice Department and the Attorneys General of six states and the District of Columbia in their civil antitrust lawsuit to stop the Northeast Alliance between American Airlines and JetBlue:

“Today’s decision is a win for Americans who rely on competition between airlines to travel affordably,” said Attorney General Merrick B. Garland. “The Justice Department will continue to protect competition and enforce our antitrust laws in the heavily consolidated airline industry and across every industry.”

“We are pleased with the court’s decision. The outcome of this litigation recognizes the value of competition in the airline industry,” said Assistant Attorney General Jonathan Kanter of the Justice Department’s Antitrust Division. “We are grateful to our state law enforcement partners and the dedicated and talented Antitrust Division staff that investigated and tried this important case.”

The court’s decision follows a multi-week trial that began in September 2022. The Justice Department sued to stop American Airlines and JetBlue from continuing the Northeast Alliance. The Northeast Alliance is a series of agreements between American Airlines and JetBlue through which the two airlines have consolidated their operations in Boston and New York City. The court ruled that JetBlue and American Airlines’ decision to stop competing in Boston and New York, where they are major players, violated Section 1 of the Sherman Act because it increased fares and reduced choice for American travelers in many domestic markets for scheduled air passenger service.

The Attorneys General of California, Maryland, New Jersey, and North Carolina have joined a civil antitrust lawsuit filed by the Justice Department’s Antitrust Division, the Commonwealth of Massachusetts, the State of New York, and the District of Columbia to block JetBlue’s proposed $3.8 billion acquisition of Spirit Airlines. The Antitrust Division and the state Attorneys General filed an amended complaint in the District of Massachusetts on 31 March 2023. – AutoCrat. (Justice Sues to Block JetBlue’s Purchase of Spirit Airlines)

“We look forward to litigating this important case alongside our state law enforcement partners to stop JetBlue from eliminating its rival, Spirit,” said Principal Deputy Assistant Attorney General Doha Mekki. “Today we welcome the States of California, Maryland, New Jersey, and North Carolina, who join the complaint toprotect the benefits of competition in the airline industry on behalf of their residents.”

Our complaint alleges that JetBlue’s acquisition of Spirit would particularly hurt those travelers who can least afford to see travel costs rise. Ultra-low-cost carriers like Spirit play a key role in the economy. They make air travel possible so more Americans can take a hard-earned family vacation or celebrate and mourn together with loved ones. We allege that the proposed merger would lead to fewer seats and higher prices for travelers. And we allege that the proposed merger would heighten the risk that remaining airlines would coordinate to raise prices. As Spirit’s own presentation put the point, “a JetBlue acquisition of Spirit will have lasting negative impacts on consumers” – and many of the consumers it hurts will be the most cost-conscious travelers.

Our complaint rests on well-established theories of anti-competitive harm. It is also an example of an enforcement action that promotes access to goods and services for all Americans, including those who are most likely to need ultra-low-cost carriers to fly. As a senior Spirit official told Congress in 2020, “Spirit’s product is designed for highly-price sensitive travelers,” like “ordinary individual consumers [and] families,” who are an “under-served segment in today’s market.” And this case is not unusual. Threats to competition like those alleged here are particularly likely to harm working- and middle-class families, who may struggle to withstand the price increases that consolidation often brings. The department’s commitment to ensuring economic opportunity and fairness means holding those concerns in the front of our minds.

Keeping the economy open to all Americans, regardless of income status, is a priority across the department. That effort includes the Civil Division taking on nursing homes who defraud vulnerable seniors; the Tax Division shutting down tax preparers who exploit workers and families; and the Antitrust Division going to court to fight companies that fix their workers’ wages.

It includes working to improve the bankruptcy process to provide a fresh start to deserving debtors. In recent months, the Civil Division has put out guidance to ensure that student loans are properly treated in bankruptcy, and the U.S. Trustee Program has launched a pilot program so that debtors no longer need to take a day off work to attend a meeting of creditors.

And it includes redoubling our environmental justice efforts to ensure that all Americans, regardless of income, background, or place of residence – be it Jackson, Mississippi, LaPlace, Louisiana, or elsewhere – have clean air, safe drinking water and a healthy environment.

This work is more than the sum of its parts: Together, our efforts represent the department’s commitment to ensuring that our government and our economy work for everyone. – Vanita Gupta is Associate Attorney General at the Justice Department