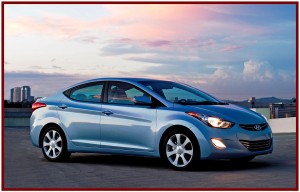

The biggest beneficiary was Hyundai Motor America, which posted record April sales at 61,754, up 40%.

With gasoline approaching $4 a gallon on a national average – $5 in California, the U.S.’s largest auto market – Korean automakers Hyundai and Kia posted huge U.S. sales percentage gains in April far above the overall market growth of 18%, albeit on relatively small bases. The Japanese Big Three – Toyota, Honda and Nissan – all lost some ground in April as supply disruptions from the Japan Earthquake started to effect inventories and hurt sales.

However, while rising gasoline prices might be good in the short term for automakers with fuel efficient lineups, historically they ultimately hurt auto sales and the overall economy after several months as consumers look for other ways to save the money that is being siphoned off at the pump.

The biggest beneficiary was Hyundai Motor America, which posted record April sales at 61,754 units, up 40% compared with what was then a record-breaking period last year. For the year, Hyundai total sales are up 31%, with retail volume rising 40%. Sales to fleet accounts are down 45% for the year with fleet now representing 13% of the total sales mix year-to-date and 11% for April. In contrast Detroit Three automakers typically run at about 30% fleet sales.

Kia Motors America also soared on the sales charts, setting all-time record monthly sales record of 47,074, a 57% increase from April 2010, and a 7% increase over the previous record set last month. Demand for the all-new 2011 Optima midsize sedan continues to increase, while sales of the Soul passed 10,000 for the second consecutive month. The Sorento was Kia’s best-selling vehicle for the 16th consecutive month, and Sorento posted its best-ever sales of more than 12,000 units.

At Toyota, Japan’s largest automaker and the number one selling offshore brand in the U.S., sales were flat. Toyota Motor Sales (TMS), U.S.A. posted April sales results of 159,540 units, a decrease of 2.4% compared to the same period last year, on a daily selling rate (DSR) basis. On a raw volume basis, unadjusted for 27 selling days in April 2011 compared to 26 selling days in April 2010, TMS sales were up 1.3% over the year ago month. TMS remained solidly in third place in the U.S. for the month, behind General Motors and Ford Motor, and note that Toyota is still buy accutane without rx posting roughly three times the sales volume of Hyundai. (See Toyota April U.S. Sales Remain Flat as Auto Industry Grows 18%)

North American Toyota plants are currently running at 30% of the originally planned capacity and going forward inventories will continue to decline at least through the summer. “If a customer places an order, we’ll find the car for them,” said Bob Carter, Toyota Division group vice president and general manager, Toyota Motor Sales, U.S.A.

At Honda the situation was similar. American Honda Motor posted April sales of 124,799 an increase of 5.7% based on the daily selling rate compared to April 2010 results of 113,697. American Honda year-to-date sales of 432,777 represent an increase of 14.6%. Two of the immediate Honda causalities are the all new 2012 Civic and CRV – both among the best selling vehicles in the United States.

Production of the 2012 Honda Civic will be scant at least through the summer months. While dealers will continue to receive Civics, supply will be “severely restricted with limited availability of certain models,” Honda said.

The previously scheduled fall launch of the all-new 2012 CR-V will be delayed by at least one month. To bridge to the launch of the new model, Honda will extend production of the current 2011 CR-V, which remains the best selling SUV in America. (See 2012 Honda CRV Delayed at Least One Month in U.S. New 2012 Civic Scarce Through September. Both Were Best Sellers) Note that Chrysler Group with sales of 117,225 vehicles, a 22% increase compared with sales in April 2010 at 95,703 units is now within stalking distance of Honda. It was Chrysler’s best April sales since 2008 before the global financial markets collapsed. (See Chrysler Group Reports U.S. April Sales Increased 22% )

Nissan North America reported April U.S. sales of 71,526 units versus 63,769 units a year earlier, an increase of 12%. Nissan Division sales were up 14.5% for the month at 64,765 units. Sales of Infiniti vehicles decreased 6.2% from the prior year, to 6,761 units. For 2011, NNA sales have increased 22% to 356,884 units. Nissan Division deliveries are up 23% to 322,287. Infiniti sales have increased 12% to 34,597 units.

“Nissan took advantage of consumer shifts due to rising fuel prices, resulting in strong increases for fuel-efficient models like Sentra, Altima and Rogue,” said Al Castignetti, vice president and general manager, Nissan Division.