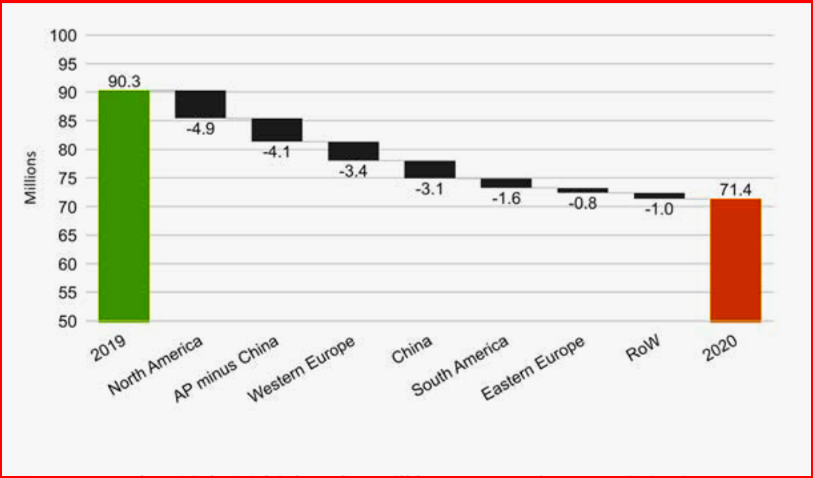

Almost all major vehicles markets suffered steep year-over-year declines in March. The beginning of a downward spiral of unknown duration, according to consultancy LMC with 2020 dropping to 71 million units compared to, gulp, 90 million in 2019. (After Worst Collapse Since the 1930s, The Recovery is?)

Almost all major vehicles markets suffered steep year-over-year declines in March. The beginning of a downward spiral of unknown duration, according to consultancy LMC with 2020 dropping to 71 million units compared to, gulp, 90 million in 2019. (After Worst Collapse Since the 1930s, The Recovery is?)

This is the best-case scenario in AutoInformed’s view. Located in Michigan, which is a major participant in the global automotive economy, we are still waiting while social distancing for April to make COVID-19 magically disappear in the national Administration’s Panglossian view. This is a reign where even Voltaire’s more amusing version of a “stable genius” could not hang onto a senior level job as court jester. (Most Say Trump Too Slow in Coronavirus Response)

Both the US and Western Europe had lock-downs in effect for only part of March, and not across all land boundaries. With stricter and broader social controls taking place in April, those markets will decline more abruptly than they have.

Korea is worthy of note, despite its small size relative to other major markets, as it was one of the few growth markets in the world in March. This is offering hope to some, as an example of how a “well-managed” response to the virus outbreak can lead to a significantly better economic outcome, in this case in terms of vehicle sales.

Bringing some, well, old familiarity to the markets probably cannot happen in less than several months and for most markets, vehicle sales declines in the 20-30% range are expected for 2020 overall, according to consultancy LMC. Is this the new normal?

LMC assumes that Light Vehicle sales will bottom out in April in Europe and North America, but the recovery, “while broadly V-shaped, is unlikely to be rapid in the subsequent months.”

LMC drying notes that the auto industry must contend with the reopening of factories, re-establishment of the supply chain, engagement “with a shocked and (likely) still socially distancing consumer and the reopening of sales channels, including dealerships.” Furthermore, a deep, though short-lived (short lived -editor?), economic recession is now the consensus expectation.

LMC predicts that launches from March to June are expected to experience an average delay of one to two months in Europe and North America. This includes the Audi A2, Nissan Qashqai/Rogue Sport and GM’s Large SUVs.

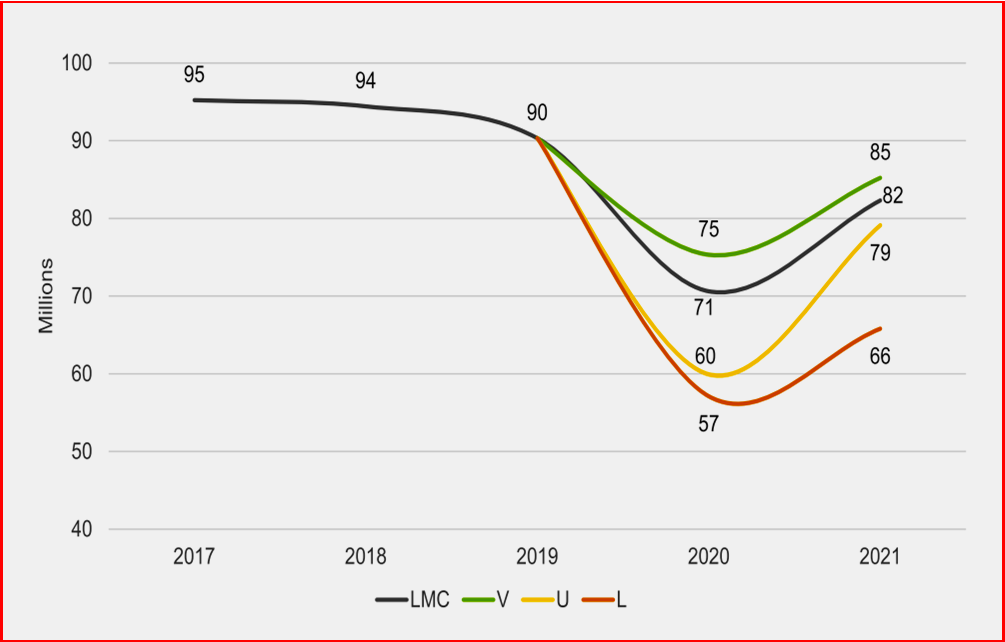

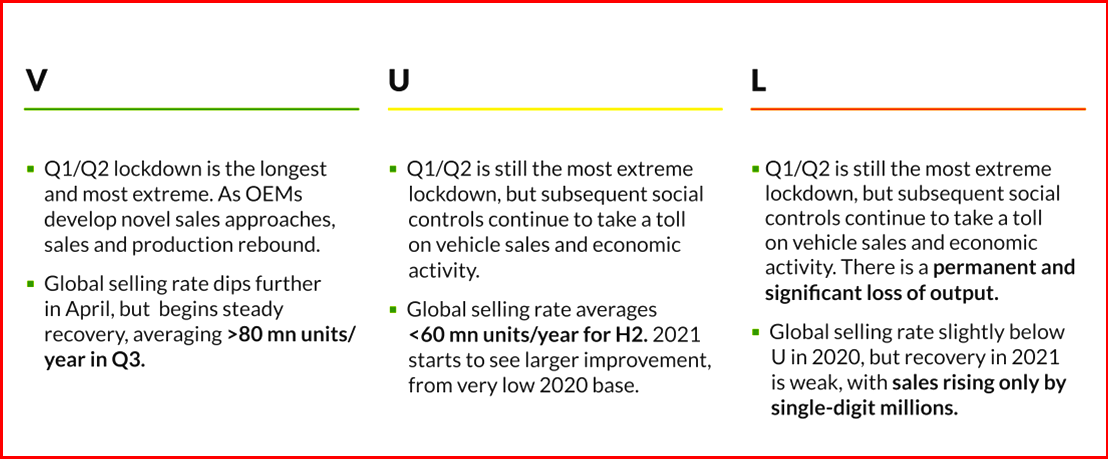

LMC recovery curves as outcomes while the light vehicle market is still in the declining phase, as it is now, ranging from the more optimistic V-shaped recovery to the damaging and long-lived L-shaped plot. LMC thinks the V- and U-shaped scenarios as being somewhat less likely and of similar probability to one another. The L-shaped recovery is judged to be the least probable of the three.

During the second half of 2020, there is “greater risk of an extended delay for many programs. The Mustang Mach-E job one was pushed out to September and a three-month delay is expected for the Jeep Grand Cherokee. In addition, lower volume programs, or those that do not contribute as much to margins, will be lower priority as production resumes.”

During the second half of 2020, there is “greater risk of an extended delay for many programs. The Mustang Mach-E job one was pushed out to September and a three-month delay is expected for the Jeep Grand Cherokee. In addition, lower volume programs, or those that do not contribute as much to margins, will be lower priority as production resumes.”

Redesigns and New Entries

- 470 launches over 18-month period

- 92 started, but ramp-up impacted

- 214 expected to be delayed by 2+ months

- 81 at risk of slipping into 2021

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

March Global Light Vehicle Sales Plunge. Prelude to Rest of the 2020 Year or the Trend for Years After?

This is the best-case scenario in AutoInformed’s view. Located in Michigan, which is a major participant in the global automotive economy, we are still waiting while social distancing for April to make COVID-19 magically disappear in the national Administration’s Panglossian view. This is a reign where even Voltaire’s more amusing version of a “stable genius” could not hang onto a senior level job as court jester. (Most Say Trump Too Slow in Coronavirus Response)

Both the US and Western Europe had lock-downs in effect for only part of March, and not across all land boundaries. With stricter and broader social controls taking place in April, those markets will decline more abruptly than they have.

Korea is worthy of note, despite its small size relative to other major markets, as it was one of the few growth markets in the world in March. This is offering hope to some, as an example of how a “well-managed” response to the virus outbreak can lead to a significantly better economic outcome, in this case in terms of vehicle sales.

Bringing some, well, old familiarity to the markets probably cannot happen in less than several months and for most markets, vehicle sales declines in the 20-30% range are expected for 2020 overall, according to consultancy LMC. Is this the new normal?

LMC assumes that Light Vehicle sales will bottom out in April in Europe and North America, but the recovery, “while broadly V-shaped, is unlikely to be rapid in the subsequent months.”

LMC drying notes that the auto industry must contend with the reopening of factories, re-establishment of the supply chain, engagement “with a shocked and (likely) still socially distancing consumer and the reopening of sales channels, including dealerships.” Furthermore, a deep, though short-lived (short lived -editor?), economic recession is now the consensus expectation.

LMC predicts that launches from March to June are expected to experience an average delay of one to two months in Europe and North America. This includes the Audi A2, Nissan Qashqai/Rogue Sport and GM’s Large SUVs.

LMC recovery curves as outcomes while the light vehicle market is still in the declining phase, as it is now, ranging from the more optimistic V-shaped recovery to the damaging and long-lived L-shaped plot. LMC thinks the V- and U-shaped scenarios as being somewhat less likely and of similar probability to one another. The L-shaped recovery is judged to be the least probable of the three.

Redesigns and New Entries

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.