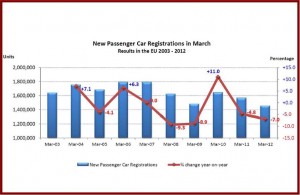

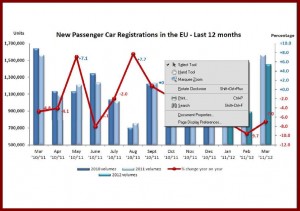

EU car sales in both March and Q1 posted large declines yet again declines, as the Eurozone crisis continued and the region heads for its fifth straight year of auto sales declines, ACEA said today.

The crisis in economic policy continues in Europe with governments pursuing contraction instead of expansion. Automakers with union contracts still have not restructured to reflect declining demand.

According to the European Auto Manufacturers Association, from January to March, auto sales dropped 7.7% at 3,312,657 new registrations. Only the German (+1.3%) and British (+0.9%) markets slightly expanded, while the Spanish market dropped by 1.9%, and Italy (-21.0%) and France (-21.6%) faced much sharper downturns. These economies are headed for Great Depression levels of unemployment if they are not already there.

In March, demand for new cars in the EU declined for the sixth consecutive month, -7% at 1,453,407 compared to March of 2011. March registrations have not been at this level since 1998. Results in March varied across the EU as Italy (-26.7%), France (-23.2%) and Spain (-4.5%) saw their markets contract whereas the UK (+1.8%) and Germany (+3.4%) performed better than they did in the same month a year earlier.

If this trend keeps up – and given contractionist policies of the EU governments, there is no reason to predict any economic stimulus -, 2012 might see an even greater drop in auto sales than those incurred during the Great Recession in 2008-2009.

Even the number one automaker Volkswagen Group is flat in sales at ytd, with a commanding, but with a growing, 23.6% market share, up 1.8% compared to Q1 2011.

The dismal sales data, which has potential implications for the U.S. presidential election since all the Detroit Three companies are mired in losses from their European operations as previous taxpayer assistance and bailouts remain controversial, confirmed what ACEA President Sergio Marchionne, the CEO of Fiat S.p.A. said earlier this year. “EU must counter economic headwind with a strong industrial policy,” said Marchionne.

No signs of this so far even though more than 12 million European families depend on automobile employment, with 2.3 million direct jobs and another 10 million in related sectors, according to ACEA. Roughly speaking the car industry represents 6% of total European employment. Cars also represent a major source of income for the EU member states. Vehicle taxes contribute €360 billion yearly to government revenues.

General Motors and Fiat, the owner of Chrysler, posted declines in share, as well as vehicle sales in excess of the overall market decline ytd, with sales off to 271,711 (-12.3%) and 212,802 (-20.3%) respectively. Both are losing money in Europe, of course, well documented by AutoInformed.

Ford, also losing money in Europe, is flat in share at 8.8% – tied with GM and Renault Group for third place with Fiat in sixth. Ford is outperforming the overall market by a hair, with sales of 275,717 ytd, off -6.5%.

Even the number one automaker, Volkswagen Group, is flat in sales at ytd, but with a commanding, and growing, 23.6% market share, up 1.8% compared to Q1 2011.