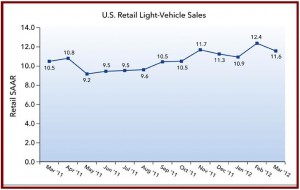

March new auto retail sales are projected at 1,085,800 units in the United States. This translates to the highest monthly vehicle sales volume in more than two and one-half years, according to J.D. Power and Associates. Power also predicts a seasonally adjusted annualized rate (SAAR) of 11.6 million units.

Forecast light-vehicle sales in March – at 1,372,400 units total – are a 6% increase from March 2011. In addition to what Power says is a strong retail performance, fleet mix has been higher than normal for the first two months of the quarter, with January and February averaging 24%. March is expected to finish slightly lower at 21% of total sales. Fleet sales are dominated by the Detroit Three automakers, as offshore brands generally forego the lower profit and potentially brand damaging business.

The 2012 outlook for vehicle sales remains positive, as the first quarter selling rate is expected to come in at 11.6 million units for retail and 14.4 million units for total light vehicles. This sales tempo is ahead of the Power forecast for the full year of 11.4 million units for retail light-vehicles and 14.1 million units for total light vehicles.

“Barring any future shock related to geopolitical issues in the Gulf region and further upward pressure on the price of oil, we believe sales will continue on a solid pace for the balance of the year,” said John Humphrey, senior vice president of global automotive operations at J.D. Power and Associates

North American light-vehicle production through February is up nearly 23%, compared with the same period in 2011.

- BMW leads the European manufacturers in year-to-date production volume increases, up 42% due to higher production of the X3.

- The Japanese OEM production volume continues in recovery mode, with volume up 26% YTD February from YTD February 2011.

- The Detroit Three had ~20% year-over-year increase in production volume.

Production levels are expected remain at a higher level in the first quarter of 2012, with volume forecasted at 3.8 million units, up almost 15% from the first quarter of 2011. Looking ahead to second quarter production, an increase of 18% from last year is expected, with nearly 3.7 million units to be built. This is not as strong as it seems since last year’s second quarter was affected by the Japan earthquake and supply disruptions.

Vehicle inventory declined to a 57-day supply at the beginning of March, compared with a 66-day supply at the beginning of February. Car inventory is at below-normal levels with a 48-day supply in March, down from 60 days in February, while truck inventory levels fell to a 66-day supply from 72 days.

| U.S. Sales | March 2012 | Feb 2012 | March 2011 |

| New Retail | 1,085,800 units

+7% March ‘11 |

887,924 | 978,471 |

| Total Sales | 1,372,400 units

+6% March ‘11 |

1,147,140 | 1,244,009 |

| Retail SAAR | 11.6 million | 12.4 m | 10.5 m |

| Total SAAR | 14.1 million | 15.0 m | 13.0 mi |