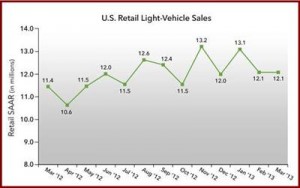

U.S. new-vehicle sales are projected to grow again in March, as both the light-vehicle retail selling rate and the total light-vehicle rate are even with February’s 12.1 million units and 15.3 million units, respectively. March new-vehicle retail sales are expected to come in at 1,158,000 light vehicles, which represents a seasonally adjusted annualized rate or SAAR of 12.1 million units. If true, the J.D. Power forecast, based on the first 14 selling days of the month, means a 10% increase from the year before.

Part of the reason for increasing sales appears to be the direct result of the U.S Treasury continuing increase in the money supply by running government printing presses non-stop in an attempt to keep the economy expanding. As a result, easy credit has returned to the marketplace. Customers also appear to be ignoring, if not mocking, the dire predictions of crisis, tragedy and collapse by bickering politicians in Washington. What fiscal cliff? What sequester?

The average new-vehicle retail transaction price, now at $28,504, is up 3% from March 2012 as automakers trim incentives particularly on fuel efficient cars that are increasingly in demand. Leases account for 23% of new-vehicle retail transactions in March 2013, up from 20% in March 2012. Moreover, the percentage of retail sales with a 72-month or longer loan is at record levels, reaching 32% in March 2013, an increase from 30.4% in March 2012.

“While longer loan terms have traditionally been a cause for concern to the industry due to the risk of purchase cycle extension, it is not necessarily as daunting as it may seem,” claimed John Humphrey, of J.D. Power and Associates.

“The longer loans are being offset by more leasing and the low interest environment, which means that consumers are able to put more of their monthly payment towards their loan principal rather than interest fees.”

Humphrey also said that strong used-car values mean that consumers have more equity in their trades and can finance lower amounts. In addition with the increase in sub-prime lending –also the result of the increasing money supply, consumers who have been shut out of the market in recent years are finding that a longer loan makes buying a new vehicle affordable.

| U.S. | Mar. 2013 | Feb. 2013 | Mar. 2012 |

| New Sales | 1,158,000 +10% ‘12 | 928,130 | 1,093,601 |

| Total Sales | 1,465,100 +8% ‘12 | 1,190,707 | 1,402,503 |

| Retail SAAR | 12.1 million | 12.1 million | 11.4 million |

| Total SAAR | 15.3 million | 15.3 million | 14.1 million |

Vehicle production in North America is up 3% through February 2013, compared with the same period in 2012. Production of models in the compact segment is outpacing the total market, up 7% thus far in 2013. LMC Automotive’s forecast for North American production remains at 15.9 million units for 2013, an increase of 3% from 2012.

Production of vehicles in the mid-size and large segments have increased 1% and likely will hold in a slower growth position as General Motors readies the ramp-up of its redesigned large pickups and gasoline prices remain high. Production of compact cars and compact premium crossovers are up 15% in the first two months of 2013, partially from the addition of the Dodge Dart, Nissan Leaf and the redesigned Acura RDX.

Vehicle inventory levels in early March increased to a 64-day supply, compared with 74 days in February. There are nearly 3.2 million units currently available on dealer lots or in transit—an increase of approximately 600,000 units from March 2012. Both car and truck inventories have dropped approximately 10 days from last month. Cars began March with a 61-day supply and trucks with a 68-day supply, both healthy by industry standards.