Total new-vehicle sales for March 2023, including retail and non-retail transactions, are forecast at 1,330,700, a 6.2% increase from March 2022, according to data just released from J.D. Power and LMC Automotive*. New-vehicle total sales for Q1 2023 are projected to reach 3,526,700 units, a 7.3% increase from Q1 2022 when adjusted for selling days. New-vehicle transaction prices continue to rise, with the average price reaching a March record of $45,818.

“March is shaping up to be yet another positive month for the industry. With retail sales forecasted to be up nearly 2%, along with average transaction prices tracking up 3.5%, consumers are on pace to spend nearly $50 billion this month, an increase of 5.5% from what they spent on new vehicles a year ago,” said Thomas King, president of the data and analytics division at J.D. Power.

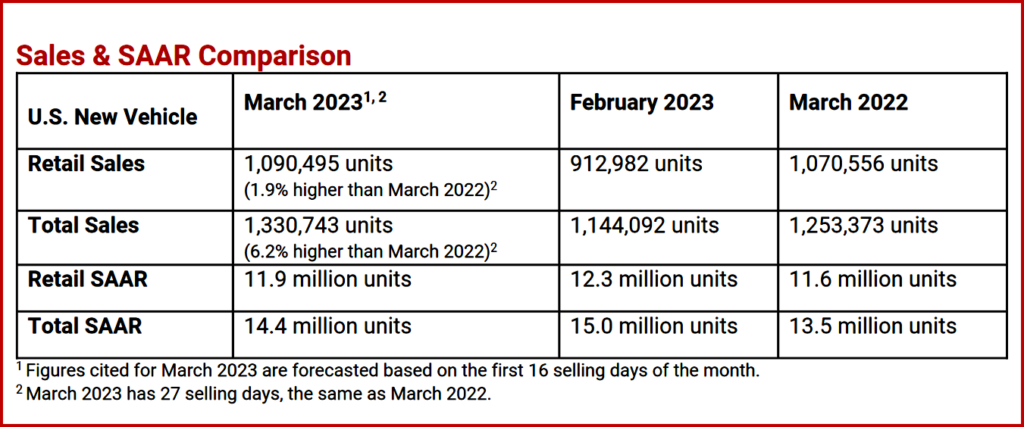

Click to enlarge.

“Retail demand for vehicles remains strong, due primarily to considerable pent-up demand” said King. “The availability of new vehicles in inventory at retailers is improving, resulting in a softening of dealer margins and increased manufacturer incentive spending. But, overall, the industry remains supply constrained, and profitability is well above historical norms.”

Even with high transaction prices notwithstanding increased production levels, automakers are focusing on sales to fleet customers. “Rather than allocate incremental production to retailers, manufacturers are selling more vehicles to fleet buyers. Sales to fleet buyers are expected to increase 31% from a year ago,” said King.

Other Power data show that automaker discounts are up slightly from a month ago and up significantly from a year ago, but remain historically low.

- The average incentive spend per vehicle is tracking toward $1,558, a 45.2% increase from a year ago.

- Incentive spending per vehicle expressed as a percentage of the average vehicle MSRP is trending at 3.3%, down 0.9 percentage points from March 2022.

- One of the factors contributing to the low level of spending is the absence of discounts on vehicles that are leased.

- This month, leasing accounts for just 20% of retail sales. In March 2019, leases accounted for 31% of all new-vehicle retail sales.

- After breaking the $700 level for the first time ever in July 2022, the average monthly finance payment in March is on pace to be $711, up $46 from March 2022. That translates to a 6.8% increase in monthly payments from a year ago.

- The average interest rate for new-vehicle loans is expected to be 6.7%, an increase of 228 basis points from a year ago.

Electric Vehicles

“As EV market share reaches 8.5%, the J.D. Power EV Index, which tracks the transition from ICE to EV, increased 2 points in February, and now stands at 49. EV market dynamics are as volatile as ever,” said Elizabeth Krear, vice president, electric vehicle practice at J.D. Power. “Some EV Index factors are improving, such as Interest; Availability; and Affordability, while Infrastructure and Experience factors are sliding.

“Affordability has increased 6.6 points since December, closing February with a score of 87.4. This is driven primarily by the lifting of volume caps for key players Tesla and General Motors.

“Interest remains strong for EVs in the mass market segment, with Ford F-150 Lightning coming in as the most considered model, followed by Toyota bZ4X. Interest in premium brands follows pricing fluctuations, with the Cadillac LYRIQ seeing the highest gain in 2023. The EV landscape is changing quickly. Newer models are bringing in more mainstream, first-time buyers who expect build quality and dependability to be on par with ICE vehicles,” said Krear.

Global Sales Forecast

“The global light-vehicle selling rate fell in February to 81 million units from 83 million units in January. On a year-over-year basis, volume was up 10% to 6.5 million units, as drag from global supply constraints remain a factor in the month’s performance. Individual markets continue to vary in the recovery path, though there was some consistency in February. Japan and Korea led mature markets, with volume up 21% and 20%, respectively. North America, Western Europe, China and India were all up approximately 10% from February 2022,” said Jeff Schuster, group head and executive vice president, automotive at GlobalData, parent of LMC Automotive:

“As March ends, we expect global light-vehicle sales to finish at 7.7 million units, up nearly 5% from March 2022. The selling rate is expected to slip to 79.1 million units, which is still an increase from 76.7 million units in March 2022. Of the major markets, China is expected to pull down sales in March with volume projected to be 2% lower year-over-year,” said Schuster

“The automotive environment in 2023 remains challenging and while there are some warning signs in the banking industry and with the general economy, the outlook for global vehicle sales has been increased by 200,000 from a month ago to 86.1 million units, up 6.2% from 2022. Supply disruption is expected to continue to ease, shifting the level of recovery over to the consumer to decide,” Schuster concluded.

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s global clients include car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

March US Auto Sales Forecast Up. Q1 to Set Spending Record

Total new-vehicle sales for March 2023, including retail and non-retail transactions, are forecast at 1,330,700, a 6.2% increase from March 2022, according to data just released from J.D. Power and LMC Automotive*. New-vehicle total sales for Q1 2023 are projected to reach 3,526,700 units, a 7.3% increase from Q1 2022 when adjusted for selling days. New-vehicle transaction prices continue to rise, with the average price reaching a March record of $45,818.

“March is shaping up to be yet another positive month for the industry. With retail sales forecasted to be up nearly 2%, along with average transaction prices tracking up 3.5%, consumers are on pace to spend nearly $50 billion this month, an increase of 5.5% from what they spent on new vehicles a year ago,” said Thomas King, president of the data and analytics division at J.D. Power.

Click to enlarge.

“Retail demand for vehicles remains strong, due primarily to considerable pent-up demand” said King. “The availability of new vehicles in inventory at retailers is improving, resulting in a softening of dealer margins and increased manufacturer incentive spending. But, overall, the industry remains supply constrained, and profitability is well above historical norms.”

Even with high transaction prices notwithstanding increased production levels, automakers are focusing on sales to fleet customers. “Rather than allocate incremental production to retailers, manufacturers are selling more vehicles to fleet buyers. Sales to fleet buyers are expected to increase 31% from a year ago,” said King.

Other Power data show that automaker discounts are up slightly from a month ago and up significantly from a year ago, but remain historically low.

Electric Vehicles

“As EV market share reaches 8.5%, the J.D. Power EV Index, which tracks the transition from ICE to EV, increased 2 points in February, and now stands at 49. EV market dynamics are as volatile as ever,” said Elizabeth Krear, vice president, electric vehicle practice at J.D. Power. “Some EV Index factors are improving, such as Interest; Availability; and Affordability, while Infrastructure and Experience factors are sliding.

“Affordability has increased 6.6 points since December, closing February with a score of 87.4. This is driven primarily by the lifting of volume caps for key players Tesla and General Motors.

“Interest remains strong for EVs in the mass market segment, with Ford F-150 Lightning coming in as the most considered model, followed by Toyota bZ4X. Interest in premium brands follows pricing fluctuations, with the Cadillac LYRIQ seeing the highest gain in 2023. The EV landscape is changing quickly. Newer models are bringing in more mainstream, first-time buyers who expect build quality and dependability to be on par with ICE vehicles,” said Krear.

Global Sales Forecast

“The global light-vehicle selling rate fell in February to 81 million units from 83 million units in January. On a year-over-year basis, volume was up 10% to 6.5 million units, as drag from global supply constraints remain a factor in the month’s performance. Individual markets continue to vary in the recovery path, though there was some consistency in February. Japan and Korea led mature markets, with volume up 21% and 20%, respectively. North America, Western Europe, China and India were all up approximately 10% from February 2022,” said Jeff Schuster, group head and executive vice president, automotive at GlobalData, parent of LMC Automotive:

“As March ends, we expect global light-vehicle sales to finish at 7.7 million units, up nearly 5% from March 2022. The selling rate is expected to slip to 79.1 million units, which is still an increase from 76.7 million units in March 2022. Of the major markets, China is expected to pull down sales in March with volume projected to be 2% lower year-over-year,” said Schuster

“The automotive environment in 2023 remains challenging and while there are some warning signs in the banking industry and with the general economy, the outlook for global vehicle sales has been increased by 200,000 from a month ago to 86.1 million units, up 6.2% from 2022. Supply disruption is expected to continue to ease, shifting the level of recovery over to the consumer to decide,” Schuster concluded.

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s global clients include car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.