Chairman of the Managing Board of Groupe PSA Carlos Tavares and FCA CEO Mike Manley handshake after signing a historic combination agreement that will lead to the creation of the world’s fourth-largest global OEM in terms of annual sales (8.7 million vehicles).

Fiat Chrysler Automobiles N.V. (“FCA”) (NYSE: FCAU / MTA: FCA) and Peugeot S.A. (“Groupe PSA”) have today signed a binding agreement providing for a 50%/50% merger of their businesses, which will create the 4th largest global automotive OEM by volume, and 3rd largest by revenue. The new group’s Dutch-domiciled parent company will be listed on Euronext (Paris), the Borsa Italiana (Milan) and the New York Stock Exchange and have a strong business in France, Italy and the US.

AutoInformed readers likely realized that such mergers are difficult, and the road – looking backward – is littered with abandoned or failed promises of synergies and sales from such ventures. (FCA + PSA = Massive Job Losses, FCA-PSA Merger – Surviving Platforms and Powertrains)

For enthusiasts as well a workers there are other threats. How about a spin-off FCA’s expensive low-return Alfa Romeo/Maserati operations? Simple math here: It would provide funds for the new FCA-PSA group while improving its utilization rate.

Makes sense on paper…

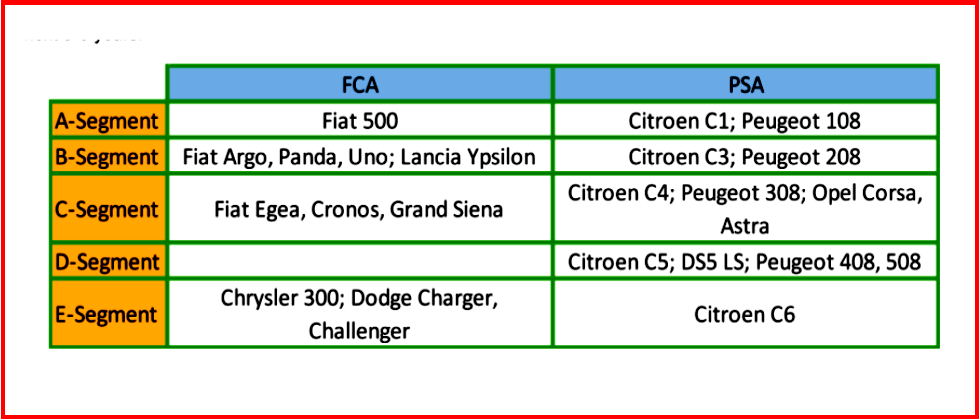

The proposed combination has the capability to be an industry leader with “the management, capabilities, resources and scale to successfully capitalize on the opportunities presented by the new era in sustainable mobility.” More than two-thirds of run rate volumes will be concentrated on 2 platforms, with approximately 3 million cars per year on each of the small platform and the compact/mid-size platform.

The exorbitantly expensive world of developing clean vehicles is on view at FCA-PSA. The business case is simply put as a way to spread costs as a consolation would result in FCA-PSA group emerging as the fourth-largest Global Automaker. It could compete with the current Global Big Three – Volkswagen Group, Toyota and Renault-Nissan-Mitsubishi.

Consultancy LMC observes that the high Research & Development expenditure involving platform creation and merging, electrification, as well as other safety, emission and autonomous driving technologies, “is expected to remain a drag on industry profitability over the course of the next decade, and further consolidation is likely.”

This was the rational, of course, for the failed FCA-Renault affiliation with Nissan included in the mix. (AutoInformed: Renault’s Board of Directors to Study with FCA the Merger, Renault’s Board of Directors Continue FCA Merger Study, FCA Balks at French Government In-Laws. Renault Marriage Off )

“The gains in efficiency derived from larger volumes, as well as the benefits of uniting the two companies’ strengths and core competencies, will ensure the combined business can offer all its customers best-in-class products, technologies and services and respond with increased agility to the shift taking place in this highly demanding sector,” the two European-heritage companies claimed.

The combined company will have annual unit sales of 8.7 million vehicles, with revenues of nearly €170 billion, recurring operating profit of over €11 billion and an operating profit margin of 6.6%, all on a simple aggregated basis of 2018 results. The strong combined balance sheet provides significant financial flexibility and ample headroom both to execute strategic plans and invest in new technologies throughout the cycle, it’s claimed. expect trouble from competitors here – Lawsuits, Competition Commission of the EU where VW, BMW, and Daimler have some clout, and who knows where else. This could be a long slog.

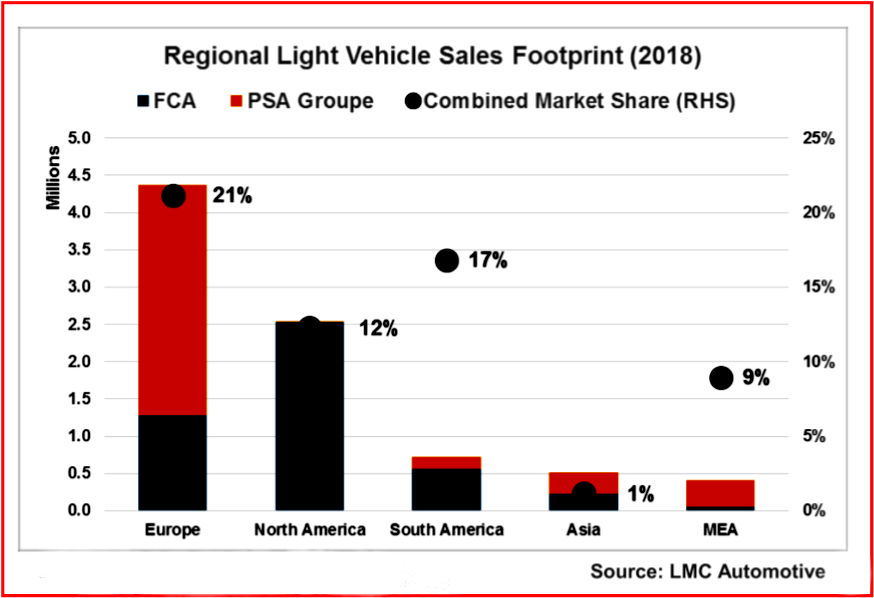

The combined entity – it’s claimed – will have a balanced and profitable global presence with a highly complementary and iconic brand portfolio covering all key vehicle segments from luxury, premium, and mainstream passenger cars through to SUVs and trucks & light commercial vehicles. This will be underpinned by FCA’s Jeep and Dodge truck strength in North America and Latin America and Groupe PSA’s solid position in Europe. The new Group will have much greater geographic balance with 46% of revenues derived from Europe and 43% from North America, based on total 2018 figures of each company. The combination will bring the opportunity for the new company to reshape the strategy in other regions.

Some detailed assembly and execution required…

The efficiencies that will be gained from optimizing investments in vehicle platforms, engine families and new technologies while leveraging increased scale will enable the business to, hopefully, be profitable while surviving the massive restructuring of the auto industry that is under way.

These technology, product and platform-related savings “are expected to account for approximately 40% of the total €3.7 billion in annual run-rate synergies, while purchasing – benefiting principally from scale and best price alignment – will represent a further estimated 40% of the synergies. Other areas, including marketing, IT, G&A and logistics, will account for the remaining 20%.”

“These synergy estimates are not based on any plant closures resulting from the transaction,” the companies claimed.

Unusually, they also claimed: “It is projected that the estimated synergies will be net cash flow positive from year 1 and that approximately 80% of the synergies will be achieved by year 4. The total one-time cost of achieving the synergies is estimated at €2.8 billion.”

Each company intends to distribute a €1.1 billion ordinary dividend in 2020 related to fiscal year 2019, subject to approval by each company’s Board of Directors and shareholders. At closing, Groupe PSA shareholders will receive 1.742 shares of the new combined company for each share of Groupe PSA, while FCA shareholders will have 1 share of the new combined company for each share of FCA.

Completion of the proposed combination is expected to take place in 12-15 months, subject to customary closing conditions, including approval by both companies’ shareholders at their respective Extraordinary General Meetings and the satisfaction of antitrust and other regulatory requirements.

Carlos Tavares, Chairman of the Managing Board of Groupe PSA, said: “Our merger is a huge opportunity to take a stronger position in the auto industry as we seek to master the transition to a world of clean, safe and sustainable mobility and to provide our customers with world-class products, technology and services. I have every confidence that with their immense talent and their collaborative mindset, our teams will succeed in delivering maximized performance with vigor and enthusiasm.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Mobility Roll of the Die – FCA and PSA Merger

Chairman of the Managing Board of Groupe PSA Carlos Tavares and FCA CEO Mike Manley handshake after signing a historic combination agreement that will lead to the creation of the world’s fourth-largest global OEM in terms of annual sales (8.7 million vehicles).

Fiat Chrysler Automobiles N.V. (“FCA”) (NYSE: FCAU / MTA: FCA) and Peugeot S.A. (“Groupe PSA”) have today signed a binding agreement providing for a 50%/50% merger of their businesses, which will create the 4th largest global automotive OEM by volume, and 3rd largest by revenue. The new group’s Dutch-domiciled parent company will be listed on Euronext (Paris), the Borsa Italiana (Milan) and the New York Stock Exchange and have a strong business in France, Italy and the US.

AutoInformed readers likely realized that such mergers are difficult, and the road – looking backward – is littered with abandoned or failed promises of synergies and sales from such ventures. (FCA + PSA = Massive Job Losses, FCA-PSA Merger – Surviving Platforms and Powertrains)

For enthusiasts as well a workers there are other threats. How about a spin-off FCA’s expensive low-return Alfa Romeo/Maserati operations? Simple math here: It would provide funds for the new FCA-PSA group while improving its utilization rate.

Makes sense on paper…

The proposed combination has the capability to be an industry leader with “the management, capabilities, resources and scale to successfully capitalize on the opportunities presented by the new era in sustainable mobility.” More than two-thirds of run rate volumes will be concentrated on 2 platforms, with approximately 3 million cars per year on each of the small platform and the compact/mid-size platform.

The exorbitantly expensive world of developing clean vehicles is on view at FCA-PSA. The business case is simply put as a way to spread costs as a consolation would result in FCA-PSA group emerging as the fourth-largest Global Automaker. It could compete with the current Global Big Three – Volkswagen Group, Toyota and Renault-Nissan-Mitsubishi.

Consultancy LMC observes that the high Research & Development expenditure involving platform creation and merging, electrification, as well as other safety, emission and autonomous driving technologies, “is expected to remain a drag on industry profitability over the course of the next decade, and further consolidation is likely.”

This was the rational, of course, for the failed FCA-Renault affiliation with Nissan included in the mix. (AutoInformed: Renault’s Board of Directors to Study with FCA the Merger, Renault’s Board of Directors Continue FCA Merger Study, FCA Balks at French Government In-Laws. Renault Marriage Off )

“The gains in efficiency derived from larger volumes, as well as the benefits of uniting the two companies’ strengths and core competencies, will ensure the combined business can offer all its customers best-in-class products, technologies and services and respond with increased agility to the shift taking place in this highly demanding sector,” the two European-heritage companies claimed.

The combined company will have annual unit sales of 8.7 million vehicles, with revenues of nearly €170 billion, recurring operating profit of over €11 billion and an operating profit margin of 6.6%, all on a simple aggregated basis of 2018 results. The strong combined balance sheet provides significant financial flexibility and ample headroom both to execute strategic plans and invest in new technologies throughout the cycle, it’s claimed. expect trouble from competitors here – Lawsuits, Competition Commission of the EU where VW, BMW, and Daimler have some clout, and who knows where else. This could be a long slog.

The combined entity – it’s claimed – will have a balanced and profitable global presence with a highly complementary and iconic brand portfolio covering all key vehicle segments from luxury, premium, and mainstream passenger cars through to SUVs and trucks & light commercial vehicles. This will be underpinned by FCA’s Jeep and Dodge truck strength in North America and Latin America and Groupe PSA’s solid position in Europe. The new Group will have much greater geographic balance with 46% of revenues derived from Europe and 43% from North America, based on total 2018 figures of each company. The combination will bring the opportunity for the new company to reshape the strategy in other regions.

Some detailed assembly and execution required…

The efficiencies that will be gained from optimizing investments in vehicle platforms, engine families and new technologies while leveraging increased scale will enable the business to, hopefully, be profitable while surviving the massive restructuring of the auto industry that is under way.

These technology, product and platform-related savings “are expected to account for approximately 40% of the total €3.7 billion in annual run-rate synergies, while purchasing – benefiting principally from scale and best price alignment – will represent a further estimated 40% of the synergies. Other areas, including marketing, IT, G&A and logistics, will account for the remaining 20%.”

“These synergy estimates are not based on any plant closures resulting from the transaction,” the companies claimed.

Unusually, they also claimed: “It is projected that the estimated synergies will be net cash flow positive from year 1 and that approximately 80% of the synergies will be achieved by year 4. The total one-time cost of achieving the synergies is estimated at €2.8 billion.”

Each company intends to distribute a €1.1 billion ordinary dividend in 2020 related to fiscal year 2019, subject to approval by each company’s Board of Directors and shareholders. At closing, Groupe PSA shareholders will receive 1.742 shares of the new combined company for each share of Groupe PSA, while FCA shareholders will have 1 share of the new combined company for each share of FCA.

Completion of the proposed combination is expected to take place in 12-15 months, subject to customary closing conditions, including approval by both companies’ shareholders at their respective Extraordinary General Meetings and the satisfaction of antitrust and other regulatory requirements.

Carlos Tavares, Chairman of the Managing Board of Groupe PSA, said: “Our merger is a huge opportunity to take a stronger position in the auto industry as we seek to master the transition to a world of clean, safe and sustainable mobility and to provide our customers with world-class products, technology and services. I have every confidence that with their immense talent and their collaborative mindset, our teams will succeed in delivering maximized performance with vigor and enthusiasm.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.