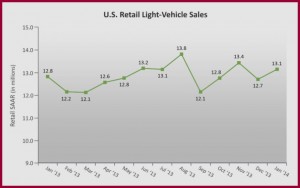

Retail sales of new vehicles in the U.S. during January 2014 are projected at 847,400, a 3% gain when compared to January 2013. The seasonally adjusted annualized rate, aka SAAR, of 13.1 million, is an increase of 400,000 units from December and 300,000 vehicles ahead of the rate one year ago as the jobless recovery in the U.S. economy continues at an agonizingly slow pace.

Total light-vehicle sales are projected at 1.1 million, a meager 1% increase from January 2013. Fleet sales are expected to remain below the level of a year ago and representing less than 20% of total light-vehicle sales for the month.

During calendar year 2013, total light-vehicle sales were 15.6 million units. Consultancy LMC Automotive is holding its forecast for 2014 at a modest increase of 600,000 units from 2013 to 16.2 million units for the total light-vehicle market. Retail light-vehicle sales are expected to reach 13.3 million units in 2014.

The sales recovery – such as it is – has not stopped automakers from cutting incentives. Retail transaction prices in January likely will exceed $29,500, up nearly $300 from January a year ago.

All manufacturers posted a decline in supply levels in January. However, the Detroit Three are collectively running with a higher supply than the other manufacturers with 77 days compared to an industry average of 63 days.

“All systems are a go for a strong and stable U.S. auto market in 2014, with risk of not achieving modest growth diminished,” says Jeff Schuster, of LMC Automotive, the source of the forecast.

“We look for economic growth, a robust level of lease maturities, 70% more new model launches and an increase in consumers’ willingness to spend to be the major drivers of growth in 2014,”says Schuster.

Production in North America is expected to continue to increase in 2014, but with a slowdown in the rate of growth. LMC Automotive is maintaining the current forecast of 16.6 million units for the year, a 4% increase from 2013. First-quarter 2014 production is expected to grow to grow to 4.2 million units, the highest level for a first quarter since 2000.