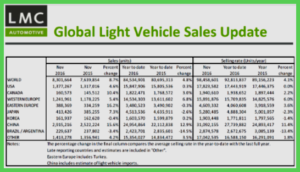

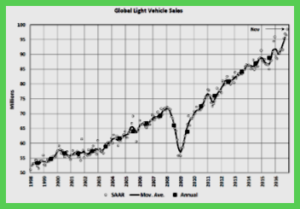

Initial estimates for Global Light Vehicle Sales in November show it coming in at a breathtaking 98.5 million units on an annualized selling rate.

Initial estimates for Global Light Vehicle Sales in November show it coming in at a breathtaking 98.5 million units on an annualized selling rate.

“Explosive sales in China were the primary factor, though there were solid results in the US and Western Europe, together with slightly less bad results in Brazil and Russia,” per consultancy LMC Automotive. This is its strongest ever monthly market result.

North America

November US Light Vehicle sales totaled 1.38 million units, representing a selling rate of 17.8 million units/year and a near‐5% increase in year‐on‐year terms. In addition to having two more selling days than last year, November 2016 sales were stimulated by increased incentive spending, which was up 17% YoY. Furthermore, following the removal of uncertainty from the presidential election, consumer confidence rebounded by more than 6% from October. Sales in the combined Pickup and SUV segments experienced incremental year‐on‐year gains outweighing losses in the combined Car segments.

Canadian Light Vehicle sales for November Totaled 161,000 units, a 10.4% increase from last year’s record November, with sales on track for another annual record in 2016.

Western Europe

Year‐on‐year growth in Light Vehicle sales resumed in November in Western Europe after a flat October result. The selling rate edged up towards 15.9 million units/year, bringing the expectation for 2016 in total to be a little under 15.8 million units. Note, this is below the region’s highest ever level by around 1 million units, or 6%, so full recovery from the Great Recession, and the subsequent Eurozone crisis, is now not far off. Brexit effects have yet to be felt, with UK demand holding up well, but some softening in that market appears likely next year and beyond.

For the first time in many months, sales in Russia surprised on the upside, with sales marginally up in year on‐ year terms – the first such gain since late 2014. The selling rate also increased to 1.6 million units/year, comparing favorably with an average of just 1.4 million units/year in the first ten months of 2016. Activity may be being spurred by consumer fears of an end to interest rate and leasing incentives, though the government has tried to allay such fears by announcing that the stimulus will continue into 2017 and may be supplemented by other incentives.

China

With only a few weeks left before the planned expiration of the temporary tax cut, Chinese consumers continued to rush to dealerships in November. While there is strong speculation that the government will extend the tax cut, there has been no official announcement so far, so buyers have acted as if the incentive will end. Preliminary data indicates that the November selling rate reached 31 million units/year, a touch above October’s record high. On a year‐on‐year basis, sales increased by around 16% in November.

In the economy, capital outflows from China have accelerated since Donald Trump’s election in the US and the strengthening of the US dollar. China’s economic outlook, and thus sales outlook, is increasingly uncertain, as Mr. Trump’s campaign rhetoric implies a more hardline approach, citing China’s currency manipulation and trade policy – but it remains to be seen how campaign sentiment will translate into policy.

Other Asia

Sales in Japan made a surprise upswing, with the November selling rate reaching 5.3 million units/year, a near two‐year high. Recently launched new models boosted sales, even though Donald Trump’s election in the US has increased uncertainty over Japan’s economic outlook.

Defying the slowing economy and an ongoing political crisis, the selling rate in South Korea surged to a robust 1.9 million units/year in November, up 11% from an already strong October. Record‐low interest rates and heavy discounting by OEMs and dealerships are helping to boost sales after a temporary tax cut expired in June.

South America

In Brazil, the selling rate rebounded to just above 2 million units/year in November, up nearly 16% from a weak October, as the supply issue at VW Brazil has started to dissipate. Yet, ongoing fiscal austerity measures and the still‐deteriorating job market continue to lead to depressed spending on new vehicles.

In the notoriously volatile Argentine market, the selling rate jumped to a 3.5‐year high of 815,000 units/year in November. While such a robust rate is unlikely to be sustainable, easing credit conditions and an improving job market are expected to support sales over the next year.