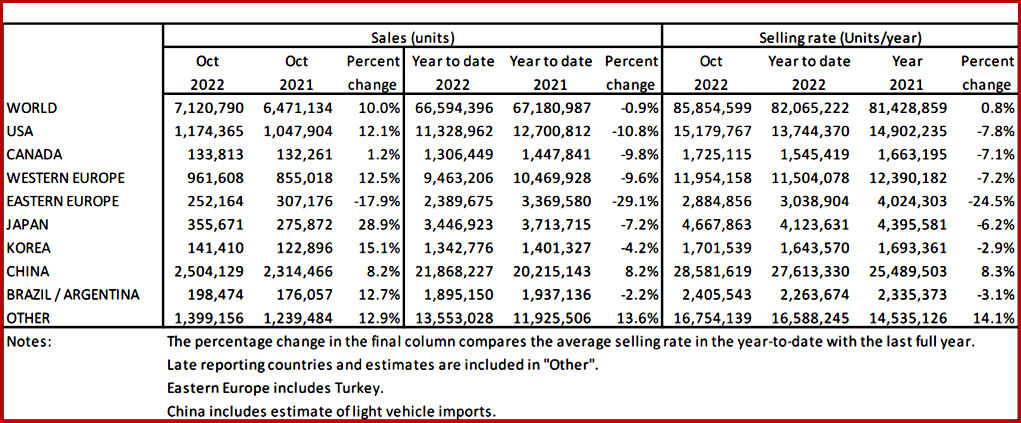

At 86 million units annually, October’s Global Light Vehicle (LV) selling rate was consistent with July, according to data just released by the respected LMC Automotive* consultancy. October’s meager sales of 7.1 million units was nonetheless an improvement of 10% YoY (year‐on‐year).

Year-to-date (YTD) sales are off ~1% compared to the weak covid-afflicted base of the 2021 plague. “Despite China experiencing a third consecutive month of slowing selling rates, YTD sales were up 8%. However, North America and Europe continue to struggle YTD as supply constraints hamper performances ahead of worsening macroeconomic conditions,” LMC observed.

Click for more information.

North America

US Light Vehicle sales grew by 12.1% YoY in October, to 1.2 million units. This was the third consecutive month of YoY gains. Once again the mathematics are helped by a weak H2 2021, which was the start of the ongoing chip shortage. “In volume terms, October saw the highest sales since April. Additionally, the selling rate climbed to 15.2 million units/year, the strongest so far this year. Inventory levels increased by 7.8% from last month, although those vehicles are more expensive as average transaction prices increased by 1.1% MoM to $46,120.” LMC said.

Canadian LV sales grew by ~1.2% YoY in October, to 134k units. The selling rate per LMC is thought to have increased to 1.7 million units/year, the highest since January. “Selling rates should be treated with caution in a limited supply environment,” LMC said.

Mexican sales were up by 19.1% YoY to 90.6k units, while the selling rate was 1.11 million units/year. “The market continues to surprise to the upside despite economic headwinds,” said LMC.

Europe

The West European selling rate was fixed from September to October at 12.0 million units/year and ensured that the selling rate YTD improved slightly. In raw monthly sales terms, October was up over 12% YoY to just over 960k units, though this still leaves the YTD sum down ~10%. “It remains clear that supply constraints continue to hold back market results, even accounting for the deteriorating macroeconomic situation.

East European selling rates were “broadly in line with the previous month, at 2.9 million units/year, though October’s raw sales were still down 29% YTD. The war in Ukraine continues to restrict supplies, and with Russia’s sales being crushed by sanctions, both are hampering the region’s sales activity,” LMC said.

China

According to preliminary data in the opaque Chinese market, it continued to lose force after rebounding strongly in June and July, following the reopening of Shanghai. The October selling rate of 28.6 million units/year was 7.6% lower than September’s, the third consecutive month of MoM decline. The YTD average selling rate reached a strong 27.6 million units/year. In YoY terms, raw sales increased by only 8.2% in October (due partially to a high base effect), compared to about 30% YoY growth in each of the previous four months.

“Apparently, sales were somewhat affected by sporadic COVID‐19 outbreaks and lock-downs in multiple regions in the country. It has been reported that OEMs reduced production in October from September levels. Nonetheless, NEV sales (new electric vehicle) remained robust. Sales of BEVs and PHEVs expanded by 67% YoY and 150% YoY, respectively, in October. Total EV and PHEV sales reached almost 5.3 million units in the first ten months of this year,” said LMC.

Elsewhere in Asia

Japanese sales rebounded strongly after a sharp slowdown. The October selling rate reached 4.7 million units/year, up ~17% from a weak September. On a YoY basis, sales increased by double digits for the second consecutive month in October with the easing of global supply‐chain disruptions. “EV sales, however, slowed, as the Japanese government’s budget for the EV subsidies is running out,” said LMC.

Korean sales “remained robust in October, as the supply situation continued to improve, and OEMs ramped up production before the temporary excise tax cut on Passenger Vehicles expires at the end of this year. The October selling rate of 1.7 million units/year was slightly lower than September’s 1.74 million units/year, but that was a good result. It appears that all Korean OEMs managed to normalize production at their domestic plants in October, getting out of the procurement crisis.” LMC noted.

South America

Brazilian LV sales grew by 11.8% YoY in October, to 168k units, while the selling rate decelerated to 2.01 million units/year, from 2.10 million units/year in September. The results were somewhat disappointing: YoY growth has been much stronger in recent months, even though the market was weak in October 2021, providing a low base. “The presidential run‐off election may have distracted consumers, particularly towards the end of the month, when sales slowed,” LMC said.

Argentinian sales are estimated to have grown by 18.4% YoY in October, to 30k units, while the selling rate increased to 396k units/year, from 338k units/year in September. “Although this was a more robust result than September’s, the underlying conditions remain challenging. High inflation, rising interest rates and import restrictions are keeping the market well below its historical levels,” said LMC.

*LMC Automotive

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s client base from around the globe includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group. LMC is the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

The Global Light Vehicle Sales Forecast is published in association with Jato Dynamics Ltd. It uses macro-economic forecasts generated by LMC’s partner, the distinguished Oxford Economics, which, combined with an examination of demographics, fiscal and regulatory influences by LMC’s own specialist automotive research team, presents twelve-year forecasts at a global, regional and country level for Light Vehicle demand in 137 countries.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

October Global Light Vehicle Sales at 7.1M Units

At 86 million units annually, October’s Global Light Vehicle (LV) selling rate was consistent with July, according to data just released by the respected LMC Automotive* consultancy. October’s meager sales of 7.1 million units was nonetheless an improvement of 10% YoY (year‐on‐year).

Year-to-date (YTD) sales are off ~1% compared to the weak covid-afflicted base of the 2021 plague. “Despite China experiencing a third consecutive month of slowing selling rates, YTD sales were up 8%. However, North America and Europe continue to struggle YTD as supply constraints hamper performances ahead of worsening macroeconomic conditions,” LMC observed.

Click for more information.

North America

US Light Vehicle sales grew by 12.1% YoY in October, to 1.2 million units. This was the third consecutive month of YoY gains. Once again the mathematics are helped by a weak H2 2021, which was the start of the ongoing chip shortage. “In volume terms, October saw the highest sales since April. Additionally, the selling rate climbed to 15.2 million units/year, the strongest so far this year. Inventory levels increased by 7.8% from last month, although those vehicles are more expensive as average transaction prices increased by 1.1% MoM to $46,120.” LMC said.

Canadian LV sales grew by ~1.2% YoY in October, to 134k units. The selling rate per LMC is thought to have increased to 1.7 million units/year, the highest since January. “Selling rates should be treated with caution in a limited supply environment,” LMC said.

Mexican sales were up by 19.1% YoY to 90.6k units, while the selling rate was 1.11 million units/year. “The market continues to surprise to the upside despite economic headwinds,” said LMC.

Europe

The West European selling rate was fixed from September to October at 12.0 million units/year and ensured that the selling rate YTD improved slightly. In raw monthly sales terms, October was up over 12% YoY to just over 960k units, though this still leaves the YTD sum down ~10%. “It remains clear that supply constraints continue to hold back market results, even accounting for the deteriorating macroeconomic situation.

East European selling rates were “broadly in line with the previous month, at 2.9 million units/year, though October’s raw sales were still down 29% YTD. The war in Ukraine continues to restrict supplies, and with Russia’s sales being crushed by sanctions, both are hampering the region’s sales activity,” LMC said.

China

According to preliminary data in the opaque Chinese market, it continued to lose force after rebounding strongly in June and July, following the reopening of Shanghai. The October selling rate of 28.6 million units/year was 7.6% lower than September’s, the third consecutive month of MoM decline. The YTD average selling rate reached a strong 27.6 million units/year. In YoY terms, raw sales increased by only 8.2% in October (due partially to a high base effect), compared to about 30% YoY growth in each of the previous four months.

“Apparently, sales were somewhat affected by sporadic COVID‐19 outbreaks and lock-downs in multiple regions in the country. It has been reported that OEMs reduced production in October from September levels. Nonetheless, NEV sales (new electric vehicle) remained robust. Sales of BEVs and PHEVs expanded by 67% YoY and 150% YoY, respectively, in October. Total EV and PHEV sales reached almost 5.3 million units in the first ten months of this year,” said LMC.

Elsewhere in Asia

Japanese sales rebounded strongly after a sharp slowdown. The October selling rate reached 4.7 million units/year, up ~17% from a weak September. On a YoY basis, sales increased by double digits for the second consecutive month in October with the easing of global supply‐chain disruptions. “EV sales, however, slowed, as the Japanese government’s budget for the EV subsidies is running out,” said LMC.

Korean sales “remained robust in October, as the supply situation continued to improve, and OEMs ramped up production before the temporary excise tax cut on Passenger Vehicles expires at the end of this year. The October selling rate of 1.7 million units/year was slightly lower than September’s 1.74 million units/year, but that was a good result. It appears that all Korean OEMs managed to normalize production at their domestic plants in October, getting out of the procurement crisis.” LMC noted.

South America

Brazilian LV sales grew by 11.8% YoY in October, to 168k units, while the selling rate decelerated to 2.01 million units/year, from 2.10 million units/year in September. The results were somewhat disappointing: YoY growth has been much stronger in recent months, even though the market was weak in October 2021, providing a low base. “The presidential run‐off election may have distracted consumers, particularly towards the end of the month, when sales slowed,” LMC said.

Argentinian sales are estimated to have grown by 18.4% YoY in October, to 30k units, while the selling rate increased to 396k units/year, from 338k units/year in September. “Although this was a more robust result than September’s, the underlying conditions remain challenging. High inflation, rising interest rates and import restrictions are keeping the market well below its historical levels,” said LMC.

*LMC Automotive

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s client base from around the globe includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group. LMC is the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

The Global Light Vehicle Sales Forecast is published in association with Jato Dynamics Ltd. It uses macro-economic forecasts generated by LMC’s partner, the distinguished Oxford Economics, which, combined with an examination of demographics, fiscal and regulatory influences by LMC’s own specialist automotive research team, presents twelve-year forecasts at a global, regional and country level for Light Vehicle demand in 137 countries.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.