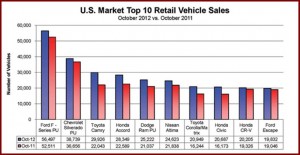

Not one Detroit Three car in the Top Ten sales list. Accord leads all Honda vehicles with sales of 28,349, +25% compared to 2011, as production of the new 2013 Accord has ramped up. Civic gained 27% with sales of 20,687 units. Toyota Camry and Corolla also were strong sellers.

While Hurricane Sandy swept up the East Coast at the end of October shutting dealerships, offshore automakers held their own in U.S. October auto sales results, even though the Northeast is traditionally a strong region for import brand sales. Sales for all offshore brands were up 6.9% from October 2011 and 13.8% year-over-year, according to AutoData corporation, which estimated the Seasonally Adjusted Annual Selling rate or SAAR for light vehicles at 14.3 million vehicles.

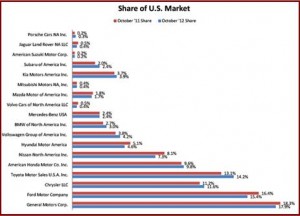

Offshore brands took 55.4% of the U.S. market in October with auto sales of 606,029 vehicles. This is decrease from September – when offshore brands held 56.1% of the market and sold 666,301 vehicles – is attributable to delayed purchases by Hurricane Sandy harassed customers.

Asian automakers captured 44.1% of the market, down from the 46.1% held in September. Overall auto sales for the month were 485,384 compared to 547,703 vehicles last month. Asian brands are currently up 8% compared to last October and 18.9% year-to-date in a market that grew by 14%.

European automakers gained share in October, moving from a 10% of the market in September to 11% in October. Volkswagen led the way with sales of more than 46,000 vehicles for a 20% increase, with its best October since 1972. European brands sold 120,645 vehicles, and were up 15.1% month-over-month. For the year-to-date, European makes have posed a 19.4% increase, slightly outpacing the U.S. market as their home markets contract because of the extended Eurozone crisis.

The Detroit Three closed the month with 44.5% of the market and sales of 466,944 vehicles, up 4.1% over last October. In September, the Detroit Three sold 522,564 units and held 45.3% of the market. Year-to-date, Detroit brands are up 8.9%, but given their strong pickup truck lineups, they stand to benefit disproportionately from the stimulus that post Sandy rebuilding will create.

If there is any weakness in the Detroit Three, it remains passenger cars. Not one Chrysler, Ford or GM car occupied a spot on the Top Ten Selling list. This, once again, shows how entrenched Japanese automakers are in the small- and mid-size car segments, which now comprise 73% of the car market, good for total sales of more than 402,000 cars in October of 2012.

Sales for the Toyota’s four Prius hybrid models, including a plug-in hybrid, rose 52% from a year ago to almost 17,000 units, on the verge of breaking into the Ten List.