Penske Automotive Group, Inc. (NYSE:PAG) today said there were “improvements in automotive retail business conditions” when compared to March and April.

All US automotive retail dealership sales and service operations are open. As shelter in place orders impacted operations in April, new and used unit sales declined approximately 50% and service and parts gross profit declined by 52% when compared to April last year.

In May 2020, business conditions began improving. New and used unit sales declined approximately 25% when compared to May last year and increased 60% from April to May 2020. Service and parts gross profit declined 39% in May when compared to the same-period last year but increased 28% from April to May 2020.

The company’s North American commercial truck dealership sales and service operations have remained open. In April 2020, new and used unit sales were flat year-over-year. In May 2020, new and used unit sales declined 20% when compared to May last year. On a same-store basis, new and used units declined 39% as compared to April last year and declined 19% from April to May 2020. Service and parts gross profit remain “strong with May fixed absorption- a measure of how they contribute to overall operating expenses – remaining above 120% and repair orders per day increased 7% sequentially from April to May 2020.

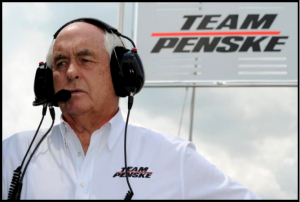

“Since the COVID-19 pandemic began impacting operations in the second half of March, we took actions to reduce costs and preserve our liquidity position. Based on these actions, I expect further improvements to our operating results in June and into the second half of the year as the economy continues to recover,” said Penske Automotive Group CEO Roger Penske.

United Kingdom

All dealerships had closed on March 24th in accordance with government order. Service and parts operations resumed during the middle of May while dealership showrooms re-opened on June 1, 2020, for most of the U.K. Despite the dealerships being closed, dealerships remotely delivered approximately 2,500 vehicles in May. Further, through e-commerce efforts, our U.K. dealership operations had more than 4,000 vehicles sold and awaiting delivery at the beginning of June. Since re-opening June 1, sales have been strong and increased approximately 50% during the first week of June 2020 when compared to the same period last year.

Europe

All dealerships and service operations in Germany, Italy and Spain are now open. As restrictions are lifted in each country, operations are improving from week to week.

Australia

All operations are open and restrictions in the market are being gradually lifted. The mining, transportation, defense and power generation sectors remain “resilient” and service revenue increased 8% sequentially from April to May 2020.

Penske Transportation Solutions

The company has a 28.9% ownership interest in Penske Transportation Solutions (“PTS”). As an integral part of the supply chain and transportation infrastructure, PTS has a strong recurring revenue base that is derived from 17,000 contract customers across a wide range of industries. About 70% of its business is generated from multi-year contracts from these customers through full-service leasing, contract maintenance and logistics services.

Each part of the business experienced positive results in May. New contracts for full-service leases were equal to the same-period last year. Commercial rental utilization improved sequentially from April 2020 to May, and Penske Logistics had continued strong activity in the grocery and home improvement sectors, as well as increased revenues in the automotive sector as OEMs began to restart production. PTS earnings more than tripled sequentially from April to May 2020 and were down only 17% from May last year.

Penske Automotive Group, Inc., (NYSE:PAG) a diversified international transportation services company, today 4 August announced that it intends to offer $550 million aggregate principal amount of fixed rate Senior Subordinated Notes due 2025 (the “2025 Notes”), subject to market and other customary closing conditions, pursuant to an effective shelf registration statement filed with the Securities and Exchange Commission (“SEC”).

The company intends to use the net proceeds of this offering to redeem its $550 million 5.75% Senior Subordinated Notes due 2022 on October 1, 2020. In the interim, we intend to repay amounts outstanding under our U.S. credit agreement, to repay various floor plan debt, and for general corporate purposes.