Click to enlarge.

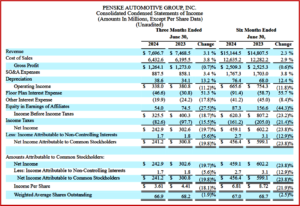

Penske Automotive Group (NYSE: PAG) today posted $7.7 Billion in revenue during Q2 2024, a quarterly record. Q2 included a 10% increase in quarterly retail automotive service and parts revenue to $753 million, which is also a quarterly record. However, net income attributable to common stockholders was $241.2 million compared to $300.8 million in the prior year period, and related earnings per share was $3.61 compared to $4.41 for the same period in 2023. Foreign currency exchange negatively impacted revenue by $0.8 million, net income attributable to common stockholders by $0.4 million, but had no negative effect on earnings per share.

“I am pleased to see that our service and parts business remains strong and contributed to our record total quarterly revenue of $7.7 billion. In addition, our focus on efficiency and controlling costs drove a sequential decline in selling, general, and administrative expenses as a percentage of gross profit by 50 basis points to 70.2%,” said Chair and CEO Roger Penske, which is more or less what he said about Q1 results.

For the six months ended 30 June 2024, revenue increased 2% to $15.1 billion. Net income attributable to common stockholders was $456.4 million compared to $599.1 million in the prior year period, and related earnings per share was $6.81 compared to $8.72 for the same period in 2023. Foreign currency exchange positively impacted revenue by $97.3 million, net income attributable to common stockholders by $1.0 million, and earnings per share by $0.01. (read AutoInformed on; Penske Automotive Group 2024 Q1 Earnings Drop; UAW Strikes Again – This Time at Penske Logistics in El Paso)

Second Quarter 2024 Operating Results Compared to Second Quarter 2023

- Total new and used units delivered increased 2% to 126,653, and total retail automotive revenue increased 3% to $6.6 billion.

- New Vehicle +4%; Used Vehicle flat.

- Retail Automotive Same-Store Revenue – decreased 1%.

- New Vehicle +2%; Used Vehicle -6%; Finance & Insurance -4%; Service & Parts +5%.

- Retail Automotive Same-Store Gross Profit – decreased 5%.

- New Vehicle -15%; Used Vehicle -7%; Finance & Insurance -4%; Service & Parts +4%.

- New and Used Retail Commercial Truck Units – flat.

- New Vehicle -1%; Used Vehicle +9%.

- Retail Commercial Truck Same-Store Revenue – decreased 7%. Revenue was $892.3 million compared to $919.2 million in the same period last year. Earnings before taxes was $51.7 million compared to $55.5 million in the same period in 2023.

- New Vehicle -4%; Used Vehicle -10%; Finance & Insurance -22%; Service & Parts -9%.

- Retail Commercial Truck Same-Store Gross Profit – decreased 5%. New Vehicle flat; Used Vehicle -5%; Finance & Insurance -22%; Service & Parts -5%.

Penske Transportation Solutions

Penske Transportation Solutions (“PTS”) is a provider of full-service truck leasing, truck rental, contract maintenance, and logistics services. PTS operates a managed fleet with more than 446,000 trucks, tractors, and trailers under lease, rental and/or maintenance contracts. Penske Automotive Group has a 28.9% ownership interest in PTS and accounts for its ownership interest using the equity method of accounting. For the three and six months ended June 30, 2024, the Company recorded $52.9 million and $85.4 million in earnings compared to $73.3 million and $154.1 million for the same periods in 2023. Equity earnings increased by 63% sequentially as full-service leasing continued to perform well and rental utilization improved when compared to the three months ended March 31, 2024.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Penske Automotive Group Posts Lukewarm Q2 Results

Click to enlarge.

Penske Automotive Group (NYSE: PAG) today posted $7.7 Billion in revenue during Q2 2024, a quarterly record. Q2 included a 10% increase in quarterly retail automotive service and parts revenue to $753 million, which is also a quarterly record. However, net income attributable to common stockholders was $241.2 million compared to $300.8 million in the prior year period, and related earnings per share was $3.61 compared to $4.41 for the same period in 2023. Foreign currency exchange negatively impacted revenue by $0.8 million, net income attributable to common stockholders by $0.4 million, but had no negative effect on earnings per share.

“I am pleased to see that our service and parts business remains strong and contributed to our record total quarterly revenue of $7.7 billion. In addition, our focus on efficiency and controlling costs drove a sequential decline in selling, general, and administrative expenses as a percentage of gross profit by 50 basis points to 70.2%,” said Chair and CEO Roger Penske, which is more or less what he said about Q1 results.

For the six months ended 30 June 2024, revenue increased 2% to $15.1 billion. Net income attributable to common stockholders was $456.4 million compared to $599.1 million in the prior year period, and related earnings per share was $6.81 compared to $8.72 for the same period in 2023. Foreign currency exchange positively impacted revenue by $97.3 million, net income attributable to common stockholders by $1.0 million, and earnings per share by $0.01. (read AutoInformed on; Penske Automotive Group 2024 Q1 Earnings Drop; UAW Strikes Again – This Time at Penske Logistics in El Paso)

Second Quarter 2024 Operating Results Compared to Second Quarter 2023

Penske Transportation Solutions

Penske Transportation Solutions (“PTS”) is a provider of full-service truck leasing, truck rental, contract maintenance, and logistics services. PTS operates a managed fleet with more than 446,000 trucks, tractors, and trailers under lease, rental and/or maintenance contracts. Penske Automotive Group has a 28.9% ownership interest in PTS and accounts for its ownership interest using the equity method of accounting. For the three and six months ended June 30, 2024, the Company recorded $52.9 million and $85.4 million in earnings compared to $73.3 million and $154.1 million for the same periods in 2023. Equity earnings increased by 63% sequentially as full-service leasing continued to perform well and rental utilization improved when compared to the three months ended March 31, 2024.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.