Click to enlarge.

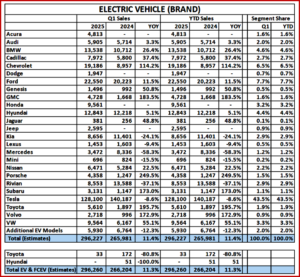

Almost 300,000 new electric vehicles (EVs) were sold during Q1 of 2025 in the U.S., according to the latest report from Kelley Blue Book* (excludes super exotics). This is an increase of 11.4% year over year. Despite mad King Trump’s many hindrances electric-vehicle sales continue to grow in the U.S. market. Roughly 7.5% of total new-vehicle sales in the first quarter were electric vehicles, an increase from 7% a year-over-year.

“The latest numbers show that growth in the EV market is anything but uniform. New models from Acura, Audi, Chevrolet, Honda and Porsche, to name some, are helping with higher sales.** At the same time, established products declined noticeably, as automakers shift market strategy. Goodbye, Chevy Bolt. Hello, Chevy Equinox EV,” said Cox Automotive.

“General Motors sold a lot of EVs in Q1 of 2025. While GM suffered through painful and slow product launches in 2023 and 2024, the long-promised EVs are starting to flow. More than 30,000 EVs from General Motors brands were sold last quarter, nearly doubling the volume from a year ago and passing both Ford Motor Company and Hyundai Group along the way. And worth noting, Honda and Acura added more than 14,000 EVs to the U.S. market last quarter as well, up from zero a year ago, all courtesy of a short-lived partnership with GM. Stellantis got in the EV game in Q1, with new products from Dodge, Jeep and Fiat. It’s a start.” said Cox Automotive.

However the EV story continues to revolve around the threatened market leader Tesla, which saw sales fall further in Q1, down ~9% YoY. As Cox has noted before, without a significant shift in product strategy, Tesla will continue to shrink in the U.S. market. A refreshed Model Y is launching in the U.S. right now. How that model will affect sales is yet to be seen.

Cox Automotive Analyst Stephanie Valdez Streaty noted during the Q1 Cox Automotive forecast call late last month that Tesla’s sales peaked in the U.S. in the spring of 2023 when it placed more than 173,000 EVs onto the roads, and its share of the total U.S. auto market hit 5%. In Q1 2025, sales of 128,000 were down 26% from their peak and with a market share closer to 3%.

“The rest of 2025 will likely be a volatile one for EV sales in the U.S., despite the introduction of new product and healthy incentives. If the new auto tariffs hold, they will pose a monumental challenge for many automakers, particularly due to the tariffs on steel and, importantly for EVs, aluminum. Roughly two-thirds of the EVs sold in the U.S. last year were assembled in the U.S., but like all modern automobiles, the parts and components are globally sourced.

“The current, full-blown trade war with China, the world’s leading supplier of EV battery materials, will distort the market even more. Add to that the heavy speculation that the new administration will reverse Biden-era EV sales incentives, and the story for EV sales in Q2 and beyond is murky at best,” COX said.

“The year certainly started strong, but the road ahead will be anything but smooth,” said Valdez Streaty.

*Cox Automotive

Cox Automotive says it is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, automakers, dealers, retailers, lenders, and fleet owners. The company has 25,000-plus employees on five continents and a family of trusted brands that includes Autotrader®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital™, and vAuto®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $22 billion in annual revenue.

**AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Q1 2025 U.S. EV Sales Up 10%. Tesla Down

Click to enlarge.

Almost 300,000 new electric vehicles (EVs) were sold during Q1 of 2025 in the U.S., according to the latest report from Kelley Blue Book* (excludes super exotics). This is an increase of 11.4% year over year. Despite mad King Trump’s many hindrances electric-vehicle sales continue to grow in the U.S. market. Roughly 7.5% of total new-vehicle sales in the first quarter were electric vehicles, an increase from 7% a year-over-year.

“The latest numbers show that growth in the EV market is anything but uniform. New models from Acura, Audi, Chevrolet, Honda and Porsche, to name some, are helping with higher sales.** At the same time, established products declined noticeably, as automakers shift market strategy. Goodbye, Chevy Bolt. Hello, Chevy Equinox EV,” said Cox Automotive.

“General Motors sold a lot of EVs in Q1 of 2025. While GM suffered through painful and slow product launches in 2023 and 2024, the long-promised EVs are starting to flow. More than 30,000 EVs from General Motors brands were sold last quarter, nearly doubling the volume from a year ago and passing both Ford Motor Company and Hyundai Group along the way. And worth noting, Honda and Acura added more than 14,000 EVs to the U.S. market last quarter as well, up from zero a year ago, all courtesy of a short-lived partnership with GM. Stellantis got in the EV game in Q1, with new products from Dodge, Jeep and Fiat. It’s a start.” said Cox Automotive.

However the EV story continues to revolve around the threatened market leader Tesla, which saw sales fall further in Q1, down ~9% YoY. As Cox has noted before, without a significant shift in product strategy, Tesla will continue to shrink in the U.S. market. A refreshed Model Y is launching in the U.S. right now. How that model will affect sales is yet to be seen.

Cox Automotive Analyst Stephanie Valdez Streaty noted during the Q1 Cox Automotive forecast call late last month that Tesla’s sales peaked in the U.S. in the spring of 2023 when it placed more than 173,000 EVs onto the roads, and its share of the total U.S. auto market hit 5%. In Q1 2025, sales of 128,000 were down 26% from their peak and with a market share closer to 3%.

“The rest of 2025 will likely be a volatile one for EV sales in the U.S., despite the introduction of new product and healthy incentives. If the new auto tariffs hold, they will pose a monumental challenge for many automakers, particularly due to the tariffs on steel and, importantly for EVs, aluminum. Roughly two-thirds of the EVs sold in the U.S. last year were assembled in the U.S., but like all modern automobiles, the parts and components are globally sourced.

“The current, full-blown trade war with China, the world’s leading supplier of EV battery materials, will distort the market even more. Add to that the heavy speculation that the new administration will reverse Biden-era EV sales incentives, and the story for EV sales in Q2 and beyond is murky at best,” COX said.

“The year certainly started strong, but the road ahead will be anything but smooth,” said Valdez Streaty.

*Cox Automotive

Cox Automotive says it is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, automakers, dealers, retailers, lenders, and fleet owners. The company has 25,000-plus employees on five continents and a family of trusted brands that includes Autotrader®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital™, and vAuto®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $22 billion in annual revenue.

**AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.