As part of the cost cutting, shared platforms proliferate with 80% of models launched between 2014-2016 based on designs shared with a partner.

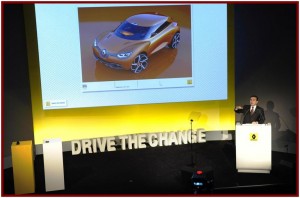

Carlos Ghosn, CEO of the Renault Group (RNO.FR), unveiled a five-year plan this morning in Paris that he said would accomplish two goals – growth and cash flow.

“We are aiming for sales of over 3 million vehicles in 2013,” Ghosn said, while talking about Renault’s first long term plan since he rescinded a previous one in 2008 as global markets collapsed and Renault went into survival mode during a near death experience.

The plan is heavily dependent on cost cutting, growth in emerging markets, and success of electric vehicles. In a statement that disappointed analysts, and sent the stock price down, Ghosn dismissed out of hand a merger with Nissan, claiming it was culturally impossible.

Coming off 2010 final results that saw Renault returning to profitability of €3.4 billion, with an operating margin at 2.8% of revenues, better than the -1.2% loss in 2009, Ghosn said that over the next three years he is aiming for an accumulated operational free cash flow of €2 billion – with a target of €3 billion. This excludes dividends from Nissan, where Renault holds a 44% stake, as well as its 7% interest in Swedish truck maker AB Volvo, and 1.5% piece of Daimler.

Nonetheless, Ghosn said that as the result of alliances the cost of Renault’s vehicles will fall by at least 4% annually, even accounting for improvements and regulations. This means a 12% decline by 2013, with a goal of 15%. Caveat here – this excludes raw material price changes, which in theory all makers face to roughly the same degree.

As part of the cost cutting, shared platforms will proliferate. A new C/D platform will be shared with Nissan for mid- and upper-range models, leading to the production of 1.5 million vehicles a year. Renault and Daimler will share a small A platform to build future Twingo and Smart models. Renault’s light commercial vehicle platforms will use components or processes from Nissan and Daimler.

The upshot is 80% of the models launched between 2014 and 2016 will be based on a platform shared with a partner.

To grow, Renault is also adjusting its industrial base and putting €5.7 billion ($7.9 b) investment into plants by 2013, largely in emerging markets. The impending investment shift is the latest blow to ailing European economies.

Renault said that there will be a lasting slump in the European market; in 2010 vehicle sales of 15.3 million were 20% lower than in 2007. Renault forecasts that by 2016 the market will remain below the pre-financial crisis levels of 2007.

Instead, automobile growth will be driven by markets outside of Europe:

• Sales in the BRIC countries (Brazil, Russia, India and China) have increased four-fold in the past ten years and now account for 1/3 of car sales worldwide.

• In 1990, 82% of new cars were sold in the United States, Europe or Japan. In 2007, the percentage was 62% and today, it is less than 50%.

• The non-European market is expected to expand by nearly 50% from 2010 to 2016.

Renault and rival French automaker Peugeot-Citroen, number three and two European automakers respectively, received loans of €3 billion from the French taxpayers in 2008 when global financial markets were frozen and vehicle sales collapsed. Each has since repaid €1 billion.

Renault said some more of the loan will be repaid this year and that it intends to surpass Peugeot as the Number two European automaker behind Volkswagen.