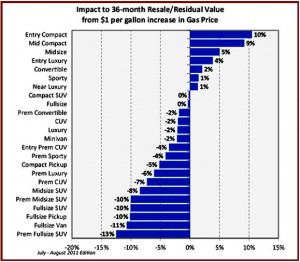

Entry Compacts and Mid Compacts receive largest positive effect on 36-month resale values when gas prices increase. Click to enlarge.

As fuel prices rise so does the trade-in or resale value of smaller vehicles. Most of this is common sense, but it is also backed by historical data.

The consultancy ALG has modeled the effect of a 1$ per gallon change in regular gas price on 36-month resale values or residual lease values. To no one’s surprise, lest of all ALG, which is expert in the area, so called Entry Compacts and Mid Compacts receive the largest positive impact on 36-month resale/residual values when gas prices increase. When the price of regular gas increases by $1 per gallon as it has, Entry Compacts and Mid Compacts experience an increase in used values of 10% and 9%, respectively.

Then there’s the other unhappy side of the gas price effect. Resale or residual values from the same $1 per gallon increase result in a -13% impact on Premium Full size SUVs. Convertible, Premium Convertible and Sporty vehicles are affected less by gas prices since they are not typically used as commuter cars in the U.S where 80% of those employed drive to work.

Full Size, CUV (crossover) and Minivan segments have also been found to be less sensitive to fuel prices. These segments have performed well in spite of volatility in gas prices due to their functionality. ALG notes that while Minivans and Full Size vehicles were historically the vehicle of choice for families, the rising popularity of CUVs has resulted in weakened demand for those segments with Ford and General Motors having surrendered the volume to the Japanese.

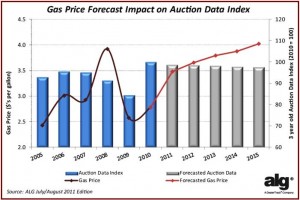

Relationship between gas prices and auto industry 3-year old auction values, showing where auction data will trend based on ALG’s current gas price forecast. Click to enlarge.

ALG projects the impact that its gas price forecast will have on auction values (indexed to 2010 values). Holding all other factors constant, ALG anticipates that auction data for the overall industry will decline slightly from 2010 current values, and remain flat through 2015.

However, as gas prices are forecasted to increase from 2010 through 2015, ALG expects that resale/residual values will continue to improve for fuel efficient segments, while demand for SUVs will decline from current levels.