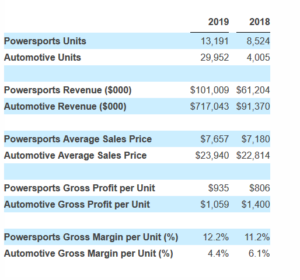

Click to Enlarge. Losses are below.

RumbleOn, Inc. (NASDAQ:RMBL), an e-commerce company, today announced operating results for the year ending 31 December 2019. The Company also provided a business update in response to the impact of the COVID-19 pandemic. Furthermore, given the uncertainty resulting from the COVID-19 pandemic, RumbleOn is withdrawing its prior 2020 financial guidance. It’s currently trading at $0.26 a share down from a 52-week high of $5.69. At 26 cents it’s overvalued in AutoInformed’s view.

Theories in business and science are often elegant, but they are subject to correction or questioning by data. The e-commerce RumbleOn touts using innovative technology to simplify how dealers and consumers buy, sell, trade or finance pre-owned vehicles. As such, it’s one of a growing number of companies that are catching analysts’ enthusiasm because they are “disruptive” to the ruling business order. Well, so is COVID-19, which is ideologically atheistic about class, party, economic theories and Wall Street.

RumbleOn Results

- Operating loss for the year was $(37.8) million, or (4.5)% of revenue.

- Net Loss was $(45.2) million, or (5.4)% of revenue.

- Adjusted EBITDA loss of $(26.4) million.

- Net loss per share was $(2.03) based on 22,294,268 basic and fully diluted Class B shares.

“There is no playbook for running a company during a pandemic, but we are committed to prudent management of our financial resources as we navigate this environment and are taking certain actions to protect our business. As many OEMs have suspended production, we’ve likewise temporarily halted inventory acquisition,” said RumbleOn CEO Marshall Chesrown.

Executive summary from AutoInformed: RumbleOn has ambitious plans with more than $840 million in revenue in 2019, but what is arguably a national brand is facing the ongoing contraction (collapse?) of the U.S. economy.

Preliminary 2019 Financial Results (Unaudited)

All results are for the year ending December 31, 2019. RumbleOn’s operating results are as follows:

- Total vehicle unit sales in 2019 was 43,143 units. Consistent with its previously communicated plan, the company held back units in Q4 in order to build inventory for the historically strong first half of the year.

- Total unit sales to consumers was 3,747, 8.7% of total units sold.

- Total revenue was $840.6 million.

- Total gross profit was $50.6 million, for a total gross margin of 6.0%.

- Total vehicle gross profit per unit was $1,021.

- Sales, General and Administrative Expenses with depreciation were $86.6 million.

- Advertising and Marketing expense was $18.2 million.

- Technology development expenses were $2.4 million.

- General and Administrative expense was $29.9 million.

- Compensation and related costs were $33.5 million.

- Professional fees were $2.6 million.

- Operating loss for the year was $(37.8) million, or (4.5)% of revenue.

- Net Loss was $(45.2) million, or (5.4)% of revenue.

- Adjusted EBITDA loss of $(26.4) million.

- Net loss per share was $(2.03) based on 22,294,268 basic and fully diluted Class B shares.

- Adjusted EBITDA is a non-GAAP financial measure. A reconciliation of adjusted EBITDA is provided in the attached financial tables.

Outlook

“RumbleOn’s operations and business have experienced disruption due to the unprecedented conditions surrounding the COVID-19 pandemic spreading throughout the United States. In response to the COVID-19 pandemic, federal, state and local governments are considering placing, or have placed, restrictions on conducting or operating business activities. The Company has been and will continue to be impacted by those restrictions, including the closures of certain offices. Given that the type, degree and length of such restrictions are not known at this time, the Company cannot predict the overall impact of such restrictions on the Company, its customers, its regional business partners, and others that the Company works with or the overall economic environment. As such, the impact these restrictions may have on the Company’s financial position, operating results and liquidity cannot be reasonably estimated at this time. Also, the Company and its insurance carriers continue the assessment of the costs and damages sustained by the Company’s Nashville facilities and inventory from the tornadoes on March 3, 2020. ”

Annual Report

The Company is delaying the filing of its Annual Report for the year ended December 31, 2019 (the “Annual Report”) by up to 45 days in accordance with the U.S. Securities and Exchange Commission’s (“SEC”) March 25, 2020 Order (which extended and superseded a prior order issued on March 4, 2020), pursuant to Section 36 of the Exchange Act (Release No. 34-88465) (the “Order”), which allows for the delay of certain filings required under the Exchange Act. In reliance upon the Order, the Company expects to file its Annual Report no later than May 14, 2020, which is 45 days after the original due date of the Annual Report. If the Annual Report is filed by May 14, 2020, it will be deemed timely filed by the SEC.

About RumbleOn

RumbleOn (NASDAQ: RMBL) says it is “an e-commerce company that uses innovative technology to simplify how dealers and customers buy, sell, trade, or finance pre-owned vehicles through RumbleOn’s 100% online marketplace. Leveraging its capital-light network of 17 regional partnerships and innovative technological solutions, RumbleOn is disrupting the old-school pre-owned vehicle supply chain by providing users with the most efficient, timely and transparent transaction experience.” For more information, see http://www.rumbleon.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

RumbleOn Posts 2019 Loss. Cancels Guidance

Click to Enlarge. Losses are below.

RumbleOn, Inc. (NASDAQ:RMBL), an e-commerce company, today announced operating results for the year ending 31 December 2019. The Company also provided a business update in response to the impact of the COVID-19 pandemic. Furthermore, given the uncertainty resulting from the COVID-19 pandemic, RumbleOn is withdrawing its prior 2020 financial guidance. It’s currently trading at $0.26 a share down from a 52-week high of $5.69. At 26 cents it’s overvalued in AutoInformed’s view.

Theories in business and science are often elegant, but they are subject to correction or questioning by data. The e-commerce RumbleOn touts using innovative technology to simplify how dealers and consumers buy, sell, trade or finance pre-owned vehicles. As such, it’s one of a growing number of companies that are catching analysts’ enthusiasm because they are “disruptive” to the ruling business order. Well, so is COVID-19, which is ideologically atheistic about class, party, economic theories and Wall Street.

RumbleOn Results

“There is no playbook for running a company during a pandemic, but we are committed to prudent management of our financial resources as we navigate this environment and are taking certain actions to protect our business. As many OEMs have suspended production, we’ve likewise temporarily halted inventory acquisition,” said RumbleOn CEO Marshall Chesrown.

Executive summary from AutoInformed: RumbleOn has ambitious plans with more than $840 million in revenue in 2019, but what is arguably a national brand is facing the ongoing contraction (collapse?) of the U.S. economy.

Preliminary 2019 Financial Results (Unaudited)

All results are for the year ending December 31, 2019. RumbleOn’s operating results are as follows:

Outlook

“RumbleOn’s operations and business have experienced disruption due to the unprecedented conditions surrounding the COVID-19 pandemic spreading throughout the United States. In response to the COVID-19 pandemic, federal, state and local governments are considering placing, or have placed, restrictions on conducting or operating business activities. The Company has been and will continue to be impacted by those restrictions, including the closures of certain offices. Given that the type, degree and length of such restrictions are not known at this time, the Company cannot predict the overall impact of such restrictions on the Company, its customers, its regional business partners, and others that the Company works with or the overall economic environment. As such, the impact these restrictions may have on the Company’s financial position, operating results and liquidity cannot be reasonably estimated at this time. Also, the Company and its insurance carriers continue the assessment of the costs and damages sustained by the Company’s Nashville facilities and inventory from the tornadoes on March 3, 2020. ”

Annual Report

The Company is delaying the filing of its Annual Report for the year ended December 31, 2019 (the “Annual Report”) by up to 45 days in accordance with the U.S. Securities and Exchange Commission’s (“SEC”) March 25, 2020 Order (which extended and superseded a prior order issued on March 4, 2020), pursuant to Section 36 of the Exchange Act (Release No. 34-88465) (the “Order”), which allows for the delay of certain filings required under the Exchange Act. In reliance upon the Order, the Company expects to file its Annual Report no later than May 14, 2020, which is 45 days after the original due date of the Annual Report. If the Annual Report is filed by May 14, 2020, it will be deemed timely filed by the SEC.

About RumbleOn

RumbleOn (NASDAQ: RMBL) says it is “an e-commerce company that uses innovative technology to simplify how dealers and customers buy, sell, trade, or finance pre-owned vehicles through RumbleOn’s 100% online marketplace. Leveraging its capital-light network of 17 regional partnerships and innovative technological solutions, RumbleOn is disrupting the old-school pre-owned vehicle supply chain by providing users with the most efficient, timely and transparent transaction experience.” For more information, see http://www.rumbleon.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.