Click to Enlarge.

Affordability and supply problems dropped US September light vehicle sales to their lowest point during Covid-plagued 2021. They were, in fact, at their lowest level for the month of September since 2010, according to LMC Automotive, a respected independent automotive global forecasting and market intelligence company.

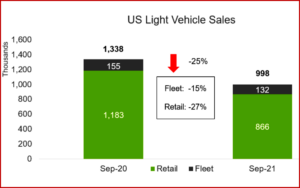

Automakers sold just under 1 million during September, down by -25% YoY. The annualized rate fell to 12 million units, the same level registered in May 2020 and 1 million units under the August Seasonally Adjusted Annualized Rate, aka SAAR. During Q3 light vehicle sales totaled 3.36 million units, down by -14% YoY and the lowest Q3 since 2011 as volumes plunged -22% from the pre-pandemic level in Q3 2019. (GM Q3 US Sales Drop -33% as Semiconductor Shortage Bites)

Click to Enlarge.

September had the same 25 selling days from a year ago, and the typically strong selling Labor Day weekend failed to help volume. Retail sales of 866,000 units were the decline in the month, while fleet sales are estimated to have fallen by -15% YoY.

Worse, average transaction prices broke the +$42,000 threshold for the first time and incentives remained below the US$2,000/unit. Dealers are paying premiums for trade-in vehicles, but affordability problematic to sales “as rising prices may not be offset by higher trade-in values, pushing some consumers out of the new vehicle market,” observes LMC.

During Q3 light vehicle sales totaled 3.36 million units, down by -14% YoY and the lowest Q3 sinc 2011 as volumes plunged -22% from the pre-pandemic level in Q3 2019.

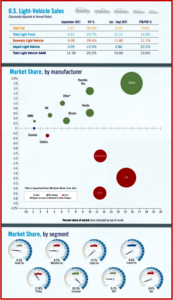

“The quarter ended with some important changes in sales ranking. Toyota outsold General Motors by 123,000 units. September was such a weak month for GM that four other OEMs had stronger volume performance, with Hyundai topping GM for the first time ever. Stellantis ended the quarter ahead of Ford, and Hyundai outsold Honda,” said Augusto Amorim, Senior Manager, Americas Vehicle Sales Forecasts, LMC.

“The Ford F-150 was the only model to sell more than 100,000 units in Q3, followed by the Toyota RAV4 and Chevrolet Silverado. The surprise was that the Jeep Grand Cherokee and Toyota Camry were also among the bestselling top 5 models. As the Detroit 3 have been hit particularly hard by the parts shortages, imported vehicles have gained ground in the US. They accounted for 25% of sales so far this year, up by 2 percentage points from a year ago,” Amorim observed.

Once again LMC cut its forecast. The recovery in production is not expected to start replenishing inventory levels until late 2022 or early 2023. The 2021 outlook has been cut by -700,000 units to just under 15.0 million units and only 500,000 units higher than 2020. Retail sales account for most of the reduction, and the LMC forecast is now at 13.0 million units, down from 13.7 million. Fleet sales were cut by 4% to 1.9 million units, 13% of total Light Vehicles. This is LMC’s lowest fleet share since LMC started tracking the retail and fleet split 15 years ago.

Still, LMC is carefully optimistic.

“While some assembly plants are slated to come back online, other plants have had downtime extended and new stoppages have been added, creating a chaotic environment in manufacturing in North America and globally. Risk remains elevated well into 2022 given the short supply of semiconductors and other parts. While the recovery, in terms of volume and time-frame, has been downgraded several times over the past three months, volumes are projected to gradually improve over the next 12-18 months, and the market may finally be closing in on the peak lows,” said Jeff Schuster, President, Americas Operations and Global Vehicle Forecasts, LMC Automotive.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

September US Auto Sales at 2021 Low Point

Click to Enlarge.

Affordability and supply problems dropped US September light vehicle sales to their lowest point during Covid-plagued 2021. They were, in fact, at their lowest level for the month of September since 2010, according to LMC Automotive, a respected independent automotive global forecasting and market intelligence company.

Automakers sold just under 1 million during September, down by -25% YoY. The annualized rate fell to 12 million units, the same level registered in May 2020 and 1 million units under the August Seasonally Adjusted Annualized Rate, aka SAAR. During Q3 light vehicle sales totaled 3.36 million units, down by -14% YoY and the lowest Q3 since 2011 as volumes plunged -22% from the pre-pandemic level in Q3 2019. (GM Q3 US Sales Drop -33% as Semiconductor Shortage Bites)

Click to Enlarge.

September had the same 25 selling days from a year ago, and the typically strong selling Labor Day weekend failed to help volume. Retail sales of 866,000 units were the decline in the month, while fleet sales are estimated to have fallen by -15% YoY.

Worse, average transaction prices broke the +$42,000 threshold for the first time and incentives remained below the US$2,000/unit. Dealers are paying premiums for trade-in vehicles, but affordability problematic to sales “as rising prices may not be offset by higher trade-in values, pushing some consumers out of the new vehicle market,” observes LMC.

During Q3 light vehicle sales totaled 3.36 million units, down by -14% YoY and the lowest Q3 sinc 2011 as volumes plunged -22% from the pre-pandemic level in Q3 2019.

“The quarter ended with some important changes in sales ranking. Toyota outsold General Motors by 123,000 units. September was such a weak month for GM that four other OEMs had stronger volume performance, with Hyundai topping GM for the first time ever. Stellantis ended the quarter ahead of Ford, and Hyundai outsold Honda,” said Augusto Amorim, Senior Manager, Americas Vehicle Sales Forecasts, LMC.

“The Ford F-150 was the only model to sell more than 100,000 units in Q3, followed by the Toyota RAV4 and Chevrolet Silverado. The surprise was that the Jeep Grand Cherokee and Toyota Camry were also among the bestselling top 5 models. As the Detroit 3 have been hit particularly hard by the parts shortages, imported vehicles have gained ground in the US. They accounted for 25% of sales so far this year, up by 2 percentage points from a year ago,” Amorim observed.

Once again LMC cut its forecast. The recovery in production is not expected to start replenishing inventory levels until late 2022 or early 2023. The 2021 outlook has been cut by -700,000 units to just under 15.0 million units and only 500,000 units higher than 2020. Retail sales account for most of the reduction, and the LMC forecast is now at 13.0 million units, down from 13.7 million. Fleet sales were cut by 4% to 1.9 million units, 13% of total Light Vehicles. This is LMC’s lowest fleet share since LMC started tracking the retail and fleet split 15 years ago.

Still, LMC is carefully optimistic.

“While some assembly plants are slated to come back online, other plants have had downtime extended and new stoppages have been added, creating a chaotic environment in manufacturing in North America and globally. Risk remains elevated well into 2022 given the short supply of semiconductors and other parts. While the recovery, in terms of volume and time-frame, has been downgraded several times over the past three months, volumes are projected to gradually improve over the next 12-18 months, and the market may finally be closing in on the peak lows,” said Jeff Schuster, President, Americas Operations and Global Vehicle Forecasts, LMC Automotive.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.