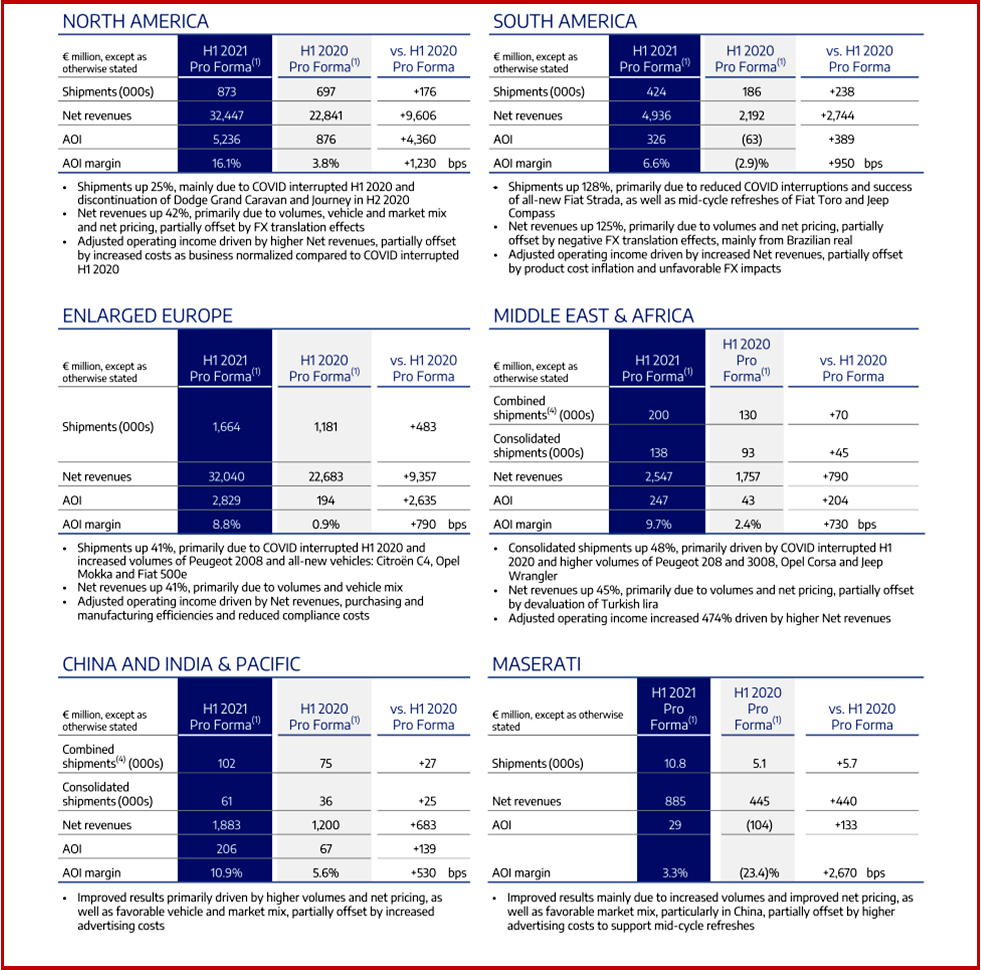

Stellantis today posted record H1 Pro Forma(1) Results with an 11.4% Margin. The conglomerate created in January by the merger of Fiat-Chrysler and Peugeot Group showed that all segments were making money. All segments were also profitable so full-year guidance was raised to ~10% of adjusted operating income(2) margin.

“While delivering this strong operational performance the Company also made significant progress on strategic matters related to electrification acceleration and software, which are fundamental pillars of our strategy,” claimed Carlos Tavares, CEO.

Stellantis also claimed that it is “Full speed ahead with the launch of 11 BEVs and 10 PHEVs over the next 24 months; fully-electrified LCV range in Europe, along with hydrogen fuel cell medium vans, by end of 2021; a third ‘giga-factory’ announced for Termoli (Italy); and the transformation of Ellesmere Port (UK) plant into the Company’s first purely BEV factory from late 2022.

Click to Enlarge.

Stellantis Highlights

- North America: Record profitability, with record H1 Ram Global and U.S. retail sales. Jeep Wrangler 4xe was the best-selling PHEV in the U.S for Q2 2021, following its launch in March 2021. Jeep is expanding market coverage with the forthcoming premium Grand Wagoneer and Wagoneer.

- Enlarged Europe: Standalone CO2 compliance, H1 EU30 market share increased to 23.1%, with LCV leadership at 34.4% share. Peugeot #2 in EU30 with 7.1% H1 market share. Opel Corsa H1 segment leader in Germany and UK; Fiat H1 market leader in Italy, with 500e the #1 electric city car in ten countries.

- Other Regions: H1 market leader in South America, with 23.6% share and Fiat Strada is Brazil’s top selling vehicle; H1 Middle East & Africa market share up 30 basis points to 11.9%.

- Maserati: Back in the black with H1 Adjusted operating income(1) of €29 million and H1 market share up in all key markets.

AutoInformed on Stellantis

- Stellantis New Credit Line €12B Tops PSA and FCA Combined

- New Stellantis Opel CEO Hochgeschurtz From Renault

- Stellantis Ups Electrification Strategy by $35.54 Billion

- Stellantis – Diesel Emissions Probes for Consumer Fraud

- Stellantis First Ever Q1 Shows Revenue, Sales Increases

- Stellantis 2021 Annual Meeting Yeas €1 Billion Cash Payout

- Stellantis Reports Legacy FCA, PSA 2020 Financial Results

Stellantis Basis of Preparation

“H1 2021” and “H1 2020” represent results as reportable under IFRS, which include FCA from January 17, 2021, following the closure of the Merger; “H1 2021 Pro Forma” and “H1 2020 Pro Forma” are presented as if the Merger had occurred January 1, 2020. Refer to the section “Notes” and “Unaudited Pro Forma Condensed Consolidated Financial Information” for additional detail. Reference should be made to the section “Safe Harbor Statement” included elsewhere within this document.

*Reconciliation of Net profit/(loss) to Pro Forma Adjusted Net profit and of Pro Forma Diluted EPS to Pro Forma Adjusted diluted EPS are included on pages 6-7 Guidance includes impacts from purchase accounting and changes in accounting policies as required by IFRS in connection with the Merger. Guidance refers to Pro Forma results, which include results of FCA for the period January 1 – 16, 2021.

Footnotes

Completed merger of Peugeot S.A. (“PSA”) with and into Fiat Chrysler Automobiles N.V. (“FCA”) on January 16, 2021 (“Merger”). On January 17, 2021, combined company was renamed Stellantis N.V. PSA was determined to be the acquirer for accounting purposes, therefore, the historical financial statements of Stellantis represent the continuing operations of PSA, which also reflect the loss of control and the classification of Faurecia S.E. (Faurecia) as a discontinued operation as of January 1, 2021 with the restatement of comparative periods.

Acquisition date of business combination was January 17, 2021, therefore, results of FCA for the period January 1 -16, 2021 are excluded from H1 2021 results unless otherwise stated. H1 2021 Pro Forma results are presented as if the Merger had occurred on January 1, 2020 and include results of FCA for the period January 1 -16, 2021. H1 2020 represents results of the continuing operations of PSA only and are not directly comparable to previously reported results of PSA and reflect accounting policies and reporting classifications of the Group.

- H1 2020 Pro Forma results are presented as if the Merger had occurred on January 1, 2020. The fair values assigned to the assets acquired and liabilities assumed are preliminary and will be finalized during the one-year measurement period from the acquisition date, as provided for by IFRS 3.

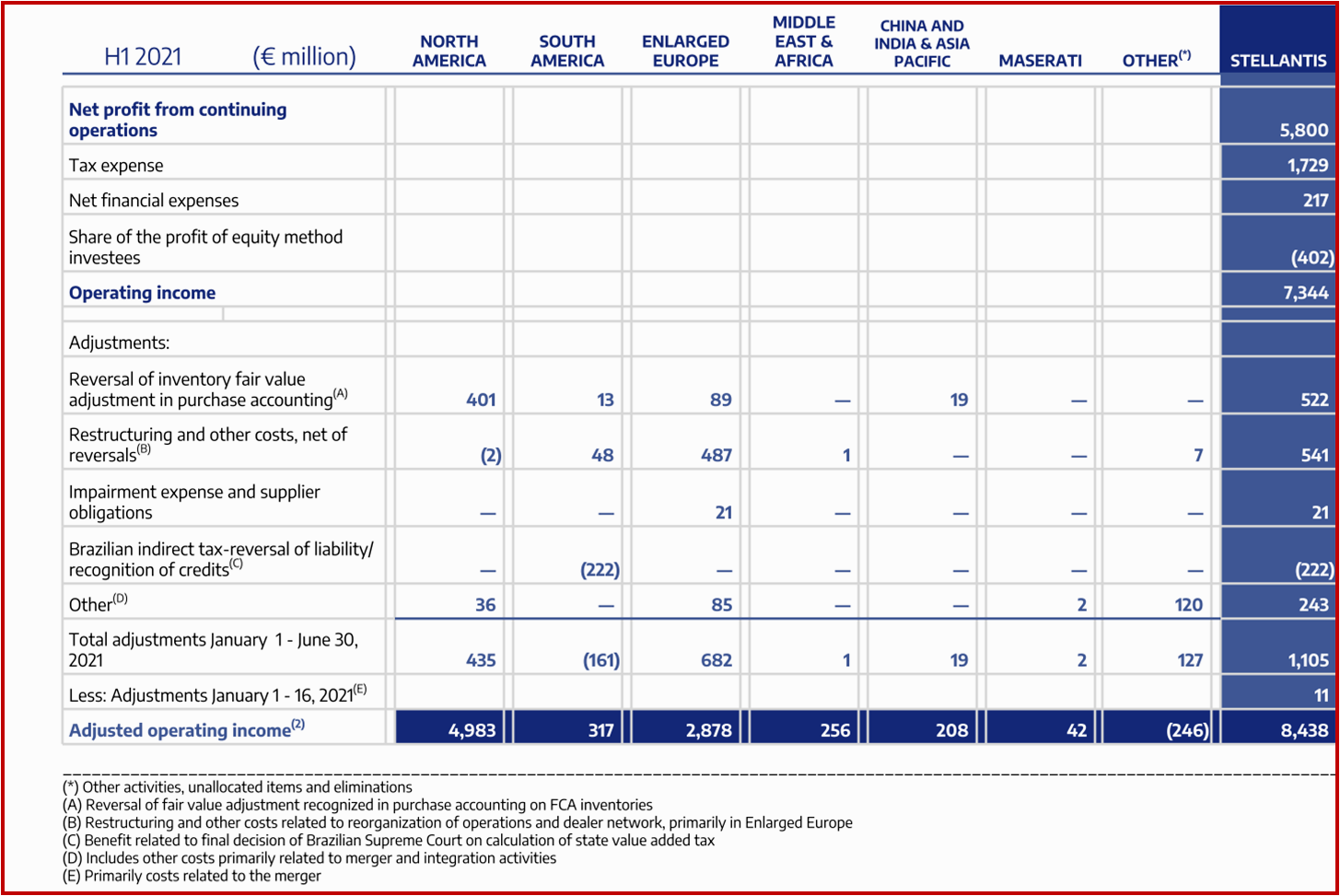

Adjusted operating income/(loss) excludes from Net profit/(loss) from continuing operations adjustments comprising restructuring, impairments, asset write-offs, disposals of investments and unusual operating income/(expense) that are considered rare or discrete events and are infrequent in nature, as inclusion of such items is not considered to be indicative of the Group’s ongoing operating performance, and also excludes Net financial expenses/(income), Tax expense/(benefit) and Share of the profit of equity method investees.

Unusual operating income/(expense) are impacts from strategic decisions as well as events considered rare or discrete and infrequent in nature, as inclusion of such items is not considered to be indicative of the Group’s ongoing operating performance.

Unusual operating income/(expense) includes but may not be limited to impacts from strategic decisions to rationalize Stellantis’ core operations; facility-related costs stemming from Stellantis’ plans to match production capacity and cost structure to market demand, and; convergence and integration costs directly related to significant acquisitions or mergers.

For the six months ended June 30, 2021, Pro Forma Adjusted operating income includes the Adjusted operating income of FCA for the period January 1 – January 16, 2021. For the six months ended June 30, 2020, Pro Forma Adjusted operating income includes the Adjusted operating income result of FCA for the period January 1 – June 30, 2020.

2. Industrial free cash flows is calculated as Cash flows from operating activities less: cash flows from operating activities from discontinued operations; cash flows from operating activities related to financial services, net of eliminations; investments in property, plant and equipment and intangible assets for industrial activities; contributions of equity to joint ventures and minor acquisitions of consolidated subsidiaries and equity method investments; adjusted for: net inter-company payments between continuing operations and discontinued operations; proceeds from disposal of assets and contributions to defined benefit pension plans, net of tax. For the six months ended June 30, 2021, Pro Forma Industrial free cash flows includes the Industrial free cash flows of FCA for the period January 1 – January 16, 2021.The timing of Industrial free cash flows may be affected by the timing of monetization of receivables and the payment of accounts payables, as well as changes in other components of working capital, which can vary from period to period due to, among other things, cash management initiatives and other factors, some of which may be outside of the Group’s control.

3. Combined shipments include shipments by the Group’s consolidated subsidiaries and unconsolidated joint ventures, whereas Consolidated shipments only include shipments by the Group’s consolidated subsidiaries.

4. Adjusted net profit/(loss) is calculated as Net profit/(loss) from continuing operations excluding post-tax impacts of the same items excluded from Adjusted operating income, as well as financial income/(expenses) and tax income/(expenses) considered rare or discrete events that are infrequent in nature. For the six months ended June 30, 2021, Pro Forma Adjusted net profit includes the Adjusted net profit of FCA for the period January 1 – January 16, 2021. For the six months ended June 30, 2020, Pro Forma Adjusted net profit includes the Adjusted net profit of FCA for the period January 1 – June 30, 2020.

5. Adjusted diluted EPS is calculated by adjusting Diluted EPS from continuing operations for the impact per share of the same items excluded from Adjusted net profit/(loss). For the six months ended June 30, 2021, the calculation of Pro Forma Adjusted diluted EPS includes the Net profit of FCA for the period January 1 – January 16, 2021. For the six months ended June 30, 2020, the calculation of Pro Forma Adjusted diluted EPS includes the Net profit of FCA for the period January 1 – June 30, 2020.

6. Source: IHS Global Insight, Wards, China Passenger Car Association and Group estimates.

7. Industrial net financial position is calculated as Debt plus derivative financial liabilities related to industrial activities less (i) cash and cash equivalents, (ii) financial securities that are considered liquid, (iii) current financial receivables from the Group or its jointly controlled financial services entities and (iv) derivative financial assets and collateral deposits; therefore, debt, cash and cash equivalents and other financial assets/ liabilities pertaining to Stellantis’ financial services entities are excluded from the computation of the Industrial net financial position. Industrial net financial position includes the Industrial net financial position classified as held for sale.

Pingback: Stellantis Claims Record First Year with €13.4B Net Profit | AutoInformed