The results of the 24th annual North American Automotive OEM-supplier Working Relations Index® [WRI®] Study appraising relations between U.S. automakers and their suppliers by Plante Moran shows five of the six OEMs improved overall relationships while managing continued frictions over cost recovery issues related to materials and tooling, and the overall fairness of supplier-commercial relations in general. The Working Relations Index® measures the total commercial relationship, which is a function of perceived trust, timely communication, mutual profit opportunity, assistance, and a reduction in conflict in dealings with automakers. (AutoInformed on Toyota, Honda, GM Lead in Supplier Relations)

The two big issues – cost and fairness – have been created and compounded by changing electric vehicle (EV) demand that sees automakers switching to hybrid configurations, or canceling EV programs and again ramping up conventional powertrain production. These are occurring while rising costs are squeezing automaker’s suppliers.

Click to enlarge.

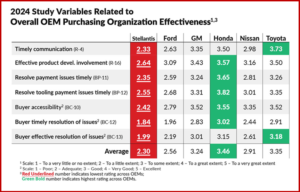

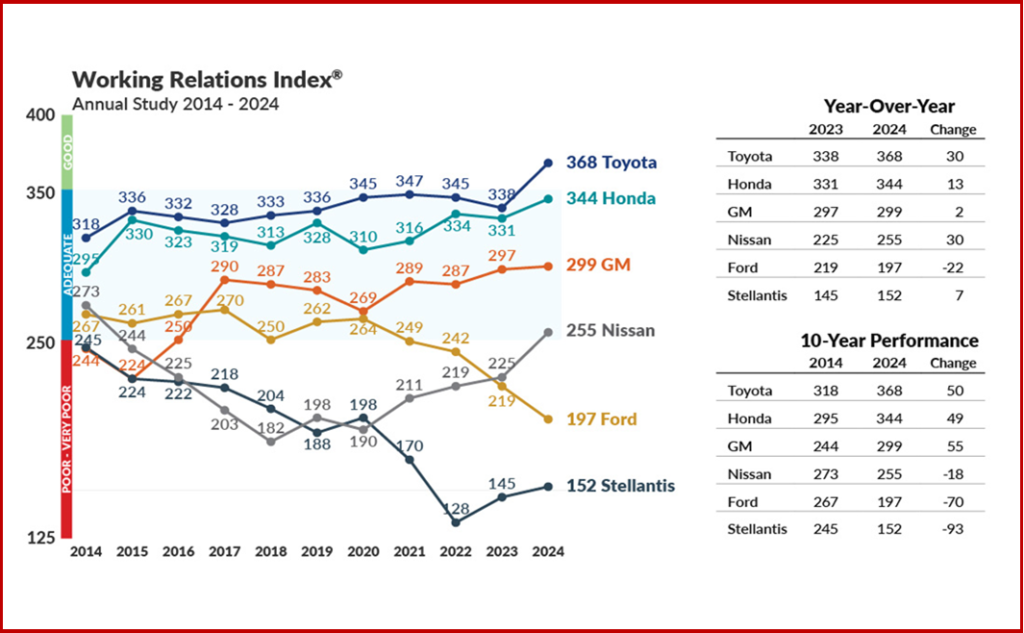

In this year’s study, the WRI® scores show Toyota, Honda, and General Motors finishing 1-2-3, followed by Nissan, Ford, and Stellantis in last place. Toyota jumped 30 points to 368 that puts the automaker alone in the upper good-very good category and is its highest score in the WRI since 2007 when Toyota topped out at 415. Nissan also gained 30 points. Honda gained 13 points and scored 344. Ford dropped 22 points year-over-year, putting the company in fifth place, or two places and 70 points lower since 2016. Stellantis gained seven points but remains in last place at 152. Between Toyota and Stellantis is a gap of 216 points.

“With all the challenges and conflicts facing suppliers this past year, it’s not surprising that some automakers dropped even further in their scores. But what might be surprising to some is that several automakers improved their scores significantly during the past year. This shows that piece price economics alone is not what drives the automakers’ WRI score but that the score also reflects the tangible and intangible costs to serve the OEMs,” said Dave Andrea, principal in Plante Moran’s automotive and mobility strategy consulting practice.

The primary driver behind the largest WRI® point gains is sharing risk and cost in an equitable manner while relentlessly pursuing cost reduction,” says Andrea. “This will enhance the mutual long-term financial and innovative capability of the customer and the supplier. OEMs doing this best integrate the suppliers into their corporate strategy and keep WRI-related principles front and center in their dealings.”

Click for more.

WRI Study – Quick Takes

- Automakers need to revise outdated contract terms and conditions and purchasing practices built over decades for the new realities of the EV transition and beyond.

- There must be more flexibility. OEMs can’t simply say, “no material cost recovery” when suppliers are dealing with unused capacity due to delayed programs.

- Contract structures need to be updated to deal fairly with the risks inherent in transitioning into EVs, adopting new safety and infotainment technologies, sourcing scarce new materials, and increasing competition from China.

- In uncertain, high-risk times there needs to be more trust, transparency, and flexibility, not less. Fixed terms and conditions must be restructured to deal with new market conditions.

- Corporate leadership beyond purchasing – especially finance and engineering – need to cooperate in managing supplier cost and risk reduction requests.

- The best OEMs know fast responses, new cost recovery formulas, and the like are needed if they expect suppliers’ best efforts on their behalf.

- Suppliers have a choice as to who they work with and can make decisions to manage down business with specific OEMs.

- Annual price reduction “productivity” demands by OEMs must incorporate the cost of the total supplier relationship. Suppliers and OEMs must look for annual cost reductions through true productivity gains – getting more output with fewer input resources. This takes investment which comes from adequate returns on investment for suppliers.

- Faster, more flexible cost-reduction suggestions made by suppliers can be adopted by OEMs if design, engineering, and purchasing are working together. This would expedite re-validation of parts using lower-priced materials; reduce complexity; and lower parts count by part consolidation. Better cost estimating and target pricing by OEMs and suppliers would help correct this.

The key to mutual success is trust. Trust is based on three factors: having the OEM customer set realistic expectations; delivering on commitments; and sharing information,” said Andrea.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Supplier Relations Study – Toyota Ascending, Ford Slumping

The results of the 24th annual North American Automotive OEM-supplier Working Relations Index® [WRI®] Study appraising relations between U.S. automakers and their suppliers by Plante Moran shows five of the six OEMs improved overall relationships while managing continued frictions over cost recovery issues related to materials and tooling, and the overall fairness of supplier-commercial relations in general. The Working Relations Index® measures the total commercial relationship, which is a function of perceived trust, timely communication, mutual profit opportunity, assistance, and a reduction in conflict in dealings with automakers. (AutoInformed on Toyota, Honda, GM Lead in Supplier Relations)

The two big issues – cost and fairness – have been created and compounded by changing electric vehicle (EV) demand that sees automakers switching to hybrid configurations, or canceling EV programs and again ramping up conventional powertrain production. These are occurring while rising costs are squeezing automaker’s suppliers.

Click to enlarge.

In this year’s study, the WRI® scores show Toyota, Honda, and General Motors finishing 1-2-3, followed by Nissan, Ford, and Stellantis in last place. Toyota jumped 30 points to 368 that puts the automaker alone in the upper good-very good category and is its highest score in the WRI since 2007 when Toyota topped out at 415. Nissan also gained 30 points. Honda gained 13 points and scored 344. Ford dropped 22 points year-over-year, putting the company in fifth place, or two places and 70 points lower since 2016. Stellantis gained seven points but remains in last place at 152. Between Toyota and Stellantis is a gap of 216 points.

“With all the challenges and conflicts facing suppliers this past year, it’s not surprising that some automakers dropped even further in their scores. But what might be surprising to some is that several automakers improved their scores significantly during the past year. This shows that piece price economics alone is not what drives the automakers’ WRI score but that the score also reflects the tangible and intangible costs to serve the OEMs,” said Dave Andrea, principal in Plante Moran’s automotive and mobility strategy consulting practice.

The primary driver behind the largest WRI® point gains is sharing risk and cost in an equitable manner while relentlessly pursuing cost reduction,” says Andrea. “This will enhance the mutual long-term financial and innovative capability of the customer and the supplier. OEMs doing this best integrate the suppliers into their corporate strategy and keep WRI-related principles front and center in their dealings.”

Click for more.

WRI Study – Quick Takes

The key to mutual success is trust. Trust is based on three factors: having the OEM customer set realistic expectations; delivering on commitments; and sharing information,” said Andrea.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.