The percentage of consumers deciding to purchase their new vehicle during the test drive has notably increased year over year and has become a key factor, according to the J.D. Power 2022 China Sales Satisfaction Index* (SSI) StudySM. However, the size of the auto market in China has significantly slowed to micro-growth levels in the Covid-Pandemic world.

The study also finds that although the core value of a test drive is offering product experience, the quality of the salesperson’s introduction to the product also influences the purchase decision. The percentage of consumers who say they had an excellent introduction during the test drive is 4% higher than among those who say they did not have an excellent introduction.

Click to Enlarge.

The 2022 study finds that the percentage of consumers deciding to purchase during the test drive has increased to 21% from 15% in 2021. The percentages of consumers deciding to purchase during other steps in the purchase process have decreased. Among the top 15 reasons for rejection of a vehicle, the largest increase is the number of consumers who indicate that the driving experience during the test drive is not as good as expected, which Power maintains “confirms the importance of the test drive during the sales process.”

“Currently, consumers in China who visit a dealership spend a lot of time experiencing and verifying products by themselves instead of receiving information from salespeople,” said Ann Xie, digital retail consulting practice at J.D. Power China.

“Faced with this challenge, improving the service capabilities during the whole process of the test drive is very important. Brands need to change based on the needs of their customers, including the upgrade of the existing test drive, as well as improving the process and experience of scheduling a test drive online, which will effectively help brands to drive sales,” Xie said.

The China SSI Study measures customer satisfaction with the purchase experience among new-vehicle buyers and includes rejecters, defined as those who seriously consider a brand but ultimately buy another brand.

Highlights of the 2022 study

Sales satisfaction with luxury brands leads the market again this year: Sales satisfaction in the luxury segment (759 on a 1,000-point scale) is nine points higher than in the mass market segment. Among the measures that comprise the study, the highest score for luxury brands is the test drive while for mass market brands it is the delivery process. Furthermore, for luxury brands and mass market brands, the lowest score is for the online experience.

Consumers whose purchase decision is based on the brand decide faster: The percentage of those who purchase within one week of visiting the dealership (42.9%) is the highest percentage among consumers whose primary purchase reason is related to the brand.

The profile of those who buy an additional or replacement vehicle is different than that of first-time customers: The percentage of customers who purchase an additional or replacement vehicle has grown to 30% of all purchasers. Customers in this group have higher spending power and stronger willingness to recommend their vehicle or brand. Compared with first-time customers, they make purchase decisions earlier; care more about the brand; are more dependent on the official online channels including apps and websites; pay more attention to the quality of service; place more focus on the honesty and objectivity of the product introduction; are more concerned with the problems of new vehicle condition; and are less agreeable to non-negotiable prices.

Rankings

Porsche ranks highest among luxury brands with a score of 768. Audi (765) ranks second. BMW and Cadillac rank third in a tie, each with a score of 759.

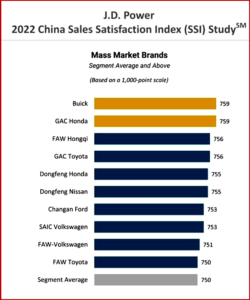

Buick and GAC Honda rank highest in a tie among mass market brands, each with a score of 759. FAW Hongqi and GAC Toyota rank third in a tie, each with a score of 756.

FAW Hongqi (756) also ranks highest among Chinese domestic brands. CHANGAN, Chery and GAC Trumpchi rank second in a tie, each with a score of 749.

*The 2022 China Sales Satisfaction Index (SSI) Study measures sales satisfaction among new-vehicle buyers and rejecters.

Buyer satisfaction is based on seven measures:

- online experience (12%);

- communication before visit (9%);

- reception (14%);

- showroom visit (14%);

- test drive (10%);

- deal (17%)

- and delivery process (23%).

Rejecter satisfaction is based on six measures:

- online experience (23%);

- communication before visit (20%);

- reception (21%);

- showroom visit (16%);

- test drive (10%);

- and negotiation (10%).

The 2022 study is based on responses from 25,154 vehicle owners in 70 major cities who purchased their new vehicle between June 2021 and February 2022. The study was fielded from December 2021 through April 2022.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Test Drives Key to Chinese Sales Satisfaction

The percentage of consumers deciding to purchase their new vehicle during the test drive has notably increased year over year and has become a key factor, according to the J.D. Power 2022 China Sales Satisfaction Index* (SSI) StudySM. However, the size of the auto market in China has significantly slowed to micro-growth levels in the Covid-Pandemic world.

The study also finds that although the core value of a test drive is offering product experience, the quality of the salesperson’s introduction to the product also influences the purchase decision. The percentage of consumers who say they had an excellent introduction during the test drive is 4% higher than among those who say they did not have an excellent introduction.

Click to Enlarge.

The 2022 study finds that the percentage of consumers deciding to purchase during the test drive has increased to 21% from 15% in 2021. The percentages of consumers deciding to purchase during other steps in the purchase process have decreased. Among the top 15 reasons for rejection of a vehicle, the largest increase is the number of consumers who indicate that the driving experience during the test drive is not as good as expected, which Power maintains “confirms the importance of the test drive during the sales process.”

“Currently, consumers in China who visit a dealership spend a lot of time experiencing and verifying products by themselves instead of receiving information from salespeople,” said Ann Xie, digital retail consulting practice at J.D. Power China.

“Faced with this challenge, improving the service capabilities during the whole process of the test drive is very important. Brands need to change based on the needs of their customers, including the upgrade of the existing test drive, as well as improving the process and experience of scheduling a test drive online, which will effectively help brands to drive sales,” Xie said.

The China SSI Study measures customer satisfaction with the purchase experience among new-vehicle buyers and includes rejecters, defined as those who seriously consider a brand but ultimately buy another brand.

Highlights of the 2022 study

Sales satisfaction with luxury brands leads the market again this year: Sales satisfaction in the luxury segment (759 on a 1,000-point scale) is nine points higher than in the mass market segment. Among the measures that comprise the study, the highest score for luxury brands is the test drive while for mass market brands it is the delivery process. Furthermore, for luxury brands and mass market brands, the lowest score is for the online experience.

Consumers whose purchase decision is based on the brand decide faster: The percentage of those who purchase within one week of visiting the dealership (42.9%) is the highest percentage among consumers whose primary purchase reason is related to the brand.

The profile of those who buy an additional or replacement vehicle is different than that of first-time customers: The percentage of customers who purchase an additional or replacement vehicle has grown to 30% of all purchasers. Customers in this group have higher spending power and stronger willingness to recommend their vehicle or brand. Compared with first-time customers, they make purchase decisions earlier; care more about the brand; are more dependent on the official online channels including apps and websites; pay more attention to the quality of service; place more focus on the honesty and objectivity of the product introduction; are more concerned with the problems of new vehicle condition; and are less agreeable to non-negotiable prices.

Rankings

Porsche ranks highest among luxury brands with a score of 768. Audi (765) ranks second. BMW and Cadillac rank third in a tie, each with a score of 759.

Buick and GAC Honda rank highest in a tie among mass market brands, each with a score of 759. FAW Hongqi and GAC Toyota rank third in a tie, each with a score of 756.

FAW Hongqi (756) also ranks highest among Chinese domestic brands. CHANGAN, Chery and GAC Trumpchi rank second in a tie, each with a score of 749.

*The 2022 China Sales Satisfaction Index (SSI) Study measures sales satisfaction among new-vehicle buyers and rejecters.

Buyer satisfaction is based on seven measures:

Rejecter satisfaction is based on six measures:

The 2022 study is based on responses from 25,154 vehicle owners in 70 major cities who purchased their new vehicle between June 2021 and February 2022. The study was fielded from December 2021 through April 2022.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.