Click for more.

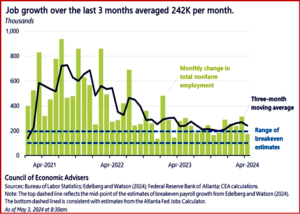

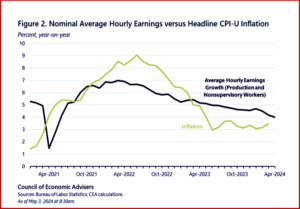

The U.S. labor market added 175,000 jobs in April, the White House said today via its Council of Economic Advisors. More than 60% of private-sector industries added jobs. The unemployment rate ticked up slightly to 3.9% – it went from 3.83% to 3.86% – and the labor force participation rate held steady at 62.7%. AutoInformed sees nothing in the report that is practically worrisome to the auto industry.* What will be telling is if the companies can adjust supply and pricing to demand without incurring losses. Wage gains continue to outpace inflation. See Figure 2 chart after page the break. (Read AutoInformed on: April 2024 US Vehicle Sales Drop Slightly)

“At the same time, as economic expansions progress, we expect GDP and job growth to slow to a steadier and more stable pace than the breakneck growth pace coming out of the trough of the pandemic-induced recession,” CEA said. “Economists have referred to this as normalization or sometimes, as economic cooling.”

Click to enlarge.

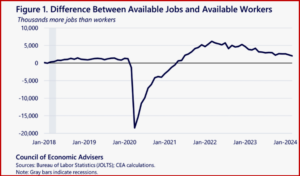

“We learned at least two things this morning about the U.S. labor market. First, most importantly, we learned that employers continue to hire at a strong pace, helping to generate record spells of both low unemployment and high women’s LFPRs. Second, we learned that as the pandemic continues to fade into the rear-view mirror, some key economic misalignments are realigning in a manner consistent with steady, stable, sustainable growth,” CEA said.

Wage gains continue to outpace inflation. Click to enlarge.

Adarsh Jain, CFA, Director of Financial Markets at GlobalData put it thus: “2024 started strong with labor market witnessing an unprecedented three consecutive months (Jan-March) of 15%+ month-on-month growth in job postings, signaling robust jobs demand. It is natural to anticipate a pullback from this rapid pace as companies adjust their demand, given that job postings, indicating hiring intentions, experience their first double-digit decline in four months in April, with a 12% month-on-month decrease.”

“In terms of sector trends, consumer driven sectors like retail, automotive and consumer have been strong, despite persistent inflation, whereas tech sectors like telecom and IT have exhibited weakness. It will not be surprising if advances in AI continue to have a dampening [damping in auto speak- editor] effect on the demand for labor in these sectors,” Jain said.

* “New light-vehicle inventory started April at just under 2.58 million units and increased 3.5% to 2.67 million units by the end of the month. We expect that inventory will but will decline slightly in May, as May is typically a high-volume sales month. For 2024 as a whole, we believe that new light-vehicle sales will total 15.9 million units,” said Patrick Manzi, National Automobile Dealers Association Chief Economist.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

The April 2024 U.S. Jobs Report – is Stable Good?

Click for more.

The U.S. labor market added 175,000 jobs in April, the White House said today via its Council of Economic Advisors. More than 60% of private-sector industries added jobs. The unemployment rate ticked up slightly to 3.9% – it went from 3.83% to 3.86% – and the labor force participation rate held steady at 62.7%. AutoInformed sees nothing in the report that is practically worrisome to the auto industry.* What will be telling is if the companies can adjust supply and pricing to demand without incurring losses. Wage gains continue to outpace inflation. See Figure 2 chart after page the break. (Read AutoInformed on: April 2024 US Vehicle Sales Drop Slightly)

“At the same time, as economic expansions progress, we expect GDP and job growth to slow to a steadier and more stable pace than the breakneck growth pace coming out of the trough of the pandemic-induced recession,” CEA said. “Economists have referred to this as normalization or sometimes, as economic cooling.”

Click to enlarge.

“We learned at least two things this morning about the U.S. labor market. First, most importantly, we learned that employers continue to hire at a strong pace, helping to generate record spells of both low unemployment and high women’s LFPRs. Second, we learned that as the pandemic continues to fade into the rear-view mirror, some key economic misalignments are realigning in a manner consistent with steady, stable, sustainable growth,” CEA said.

Wage gains continue to outpace inflation. Click to enlarge.

Adarsh Jain, CFA, Director of Financial Markets at GlobalData put it thus: “2024 started strong with labor market witnessing an unprecedented three consecutive months (Jan-March) of 15%+ month-on-month growth in job postings, signaling robust jobs demand. It is natural to anticipate a pullback from this rapid pace as companies adjust their demand, given that job postings, indicating hiring intentions, experience their first double-digit decline in four months in April, with a 12% month-on-month decrease.”

“In terms of sector trends, consumer driven sectors like retail, automotive and consumer have been strong, despite persistent inflation, whereas tech sectors like telecom and IT have exhibited weakness. It will not be surprising if advances in AI continue to have a dampening [damping in auto speak- editor] effect on the demand for labor in these sectors,” Jain said.

* “New light-vehicle inventory started April at just under 2.58 million units and increased 3.5% to 2.67 million units by the end of the month. We expect that inventory will but will decline slightly in May, as May is typically a high-volume sales month. For 2024 as a whole, we believe that new light-vehicle sales will total 15.9 million units,” said Patrick Manzi, National Automobile Dealers Association Chief Economist.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.