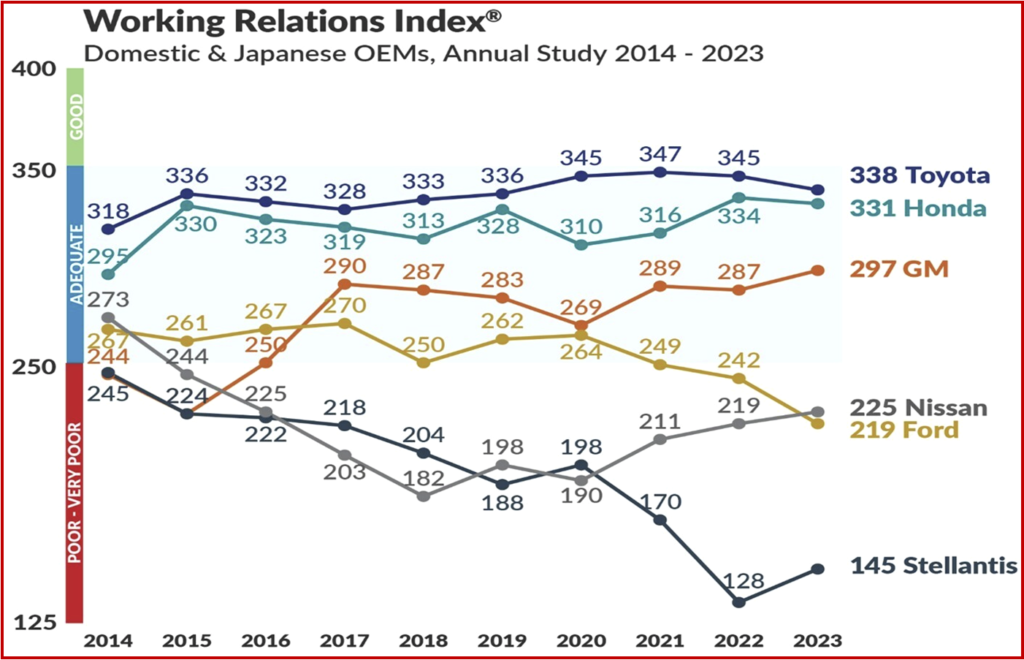

Toyota, Honda and GM finished at the top of the 23rd annual North American Automotive OEM – Supplier Working Relations Index® Study* that evaluates the relations between US automakers and their suppliers by mega- consultancy Plante Moran. GM, Nissan and Stellantis improved their scores. However, Toyota and Honda dropped slightly, and Ford, with a troubled supplier history, fell significantly. Stellantis showed the greatest improvement at +17 points, followed by GM (10) and Nissan (6). Nissan took over fourth place from Ford which dropped 23 points – the largest drop by an automaker this year. Toyota lost 7 points and Honda declined by 3 points.

“The industry continues to face unprecedented challenges in the shift to EVs that unless effectively addressed will only get worse,” said David Andrea, Principal in Plante Moran’s Strategy and Automotive & Mobility Consulting Practice, which conducts the annual Study. “During Covid, a ‘war room’ approach was adopted to quickly resolve critical issues. That approach is what auto manufacturers need to maintain during the transition to EV technologies. The industry needs that level of collaboration, even without the pressure of a crisis.”

Click for more data.

Suppliers cited several common issues critical to OEM success in Plante Moran’s view:

- There cannot be a disconnect between OEM senior management’s words and front-line buyers’ actions.

- OEMs need to ensure purchasing staffs have the experience and training to understand new EV technologies, and internal relationships to engage with engineering and manufacturing as the OEMs conduct staff reductions and reorganizations.

- OEM’s product plans and technology requirements need to be articulated and communicated to suppliers for suppliers to know where they and their products fit into long-term strategies.

- OEM decision-making locations need to be located near and reinforce where supplier sourcing and manufacturing occurs.

Plante Moran’s Lessons

- OEMs have improved their supplier relations by incorporating the Working Relations Index findings in their personnel performance metrics, corporate strategic planning processes, and communication strategies allowing them to better leverage their suppliers.

- Strong supplier working relations are more than external relations with suppliers. An improving WRI reflects improved automaker cross-functional internal relations and indicates how well purchasing, engineering, and manufacturing are working together – a critical need to achieve faster product development.

- New market conditions, such as supply chain disruptions and new technologies that change product plans and manufacturing strategies, require short- and long-term forecasts and production schedules to be more accurate and to be communicated timelier with suppliers.

- Cost recovery mechanisms should not be judged in isolation. Inflation-driven cost increases and adjustments need to be addressed in a timely manner that is consistent, tested, and institutionalized and supported by automaker and supplier cost reduction efforts.

*Working Relations Index® Study

The 2023 North American Automotive OEM-Tier 1 Supplier Working Relations Index® Study now in its 23rd year was conducted by Plante Moran from mid-February to mid-April. Respondents are executives from Tier-1 suppliers serving Ford, General Motors, Honda, Nissan and Stellantis, and Toyota. The annual Study tracks supplier perceptions of working relations with their automaker customers in which they rate them across the eight major purchasing areas broken down into 20 commodity areas. The results of the Study are used to calculate the WRI® which can then be used to calculate the economic value of working relations based on a proprietary economic model.

The respondents to the survey were 715 salespersons from 459 Tier-1 suppliers, representing about 50% of the six OEM’s annual purchases. The sales personnel provided data on 2301 buying situations (e.g., supplying brake systems to Ford, tires to Toyota, and seats to GM). Demographically, the supplier respondents represent 38 of the Top 50 North American suppliers and 69 of the Top 100 NA suppliers.

The Study was founded in 2001 by Dr. John Henke, CEO of Planning Perspectives, Inc., and acquired by Plante Moran in 2019. The automakers use the Study – says Plante Moran – “because the attributes measured by the Working Relations Index® (WRI®) are highly correlated to the benefits OEMs receive from their suppliers, including competitive pricing, investment in innovation and technology, and better program launch support. These benefits contribute to the OEM’s operating profit and competitive strength.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Toyota, Honda, GM Lead in Supplier Relations

Toyota, Honda and GM finished at the top of the 23rd annual North American Automotive OEM – Supplier Working Relations Index® Study* that evaluates the relations between US automakers and their suppliers by mega- consultancy Plante Moran. GM, Nissan and Stellantis improved their scores. However, Toyota and Honda dropped slightly, and Ford, with a troubled supplier history, fell significantly. Stellantis showed the greatest improvement at +17 points, followed by GM (10) and Nissan (6). Nissan took over fourth place from Ford which dropped 23 points – the largest drop by an automaker this year. Toyota lost 7 points and Honda declined by 3 points.

“The industry continues to face unprecedented challenges in the shift to EVs that unless effectively addressed will only get worse,” said David Andrea, Principal in Plante Moran’s Strategy and Automotive & Mobility Consulting Practice, which conducts the annual Study. “During Covid, a ‘war room’ approach was adopted to quickly resolve critical issues. That approach is what auto manufacturers need to maintain during the transition to EV technologies. The industry needs that level of collaboration, even without the pressure of a crisis.”

Click for more data.

Suppliers cited several common issues critical to OEM success in Plante Moran’s view:

Plante Moran’s Lessons

*Working Relations Index® Study

The 2023 North American Automotive OEM-Tier 1 Supplier Working Relations Index® Study now in its 23rd year was conducted by Plante Moran from mid-February to mid-April. Respondents are executives from Tier-1 suppliers serving Ford, General Motors, Honda, Nissan and Stellantis, and Toyota. The annual Study tracks supplier perceptions of working relations with their automaker customers in which they rate them across the eight major purchasing areas broken down into 20 commodity areas. The results of the Study are used to calculate the WRI® which can then be used to calculate the economic value of working relations based on a proprietary economic model.

The respondents to the survey were 715 salespersons from 459 Tier-1 suppliers, representing about 50% of the six OEM’s annual purchases. The sales personnel provided data on 2301 buying situations (e.g., supplying brake systems to Ford, tires to Toyota, and seats to GM). Demographically, the supplier respondents represent 38 of the Top 50 North American suppliers and 69 of the Top 100 NA suppliers.

The Study was founded in 2001 by Dr. John Henke, CEO of Planning Perspectives, Inc., and acquired by Plante Moran in 2019. The automakers use the Study – says Plante Moran – “because the attributes measured by the Working Relations Index® (WRI®) are highly correlated to the benefits OEMs receive from their suppliers, including competitive pricing, investment in innovation and technology, and better program launch support. These benefits contribute to the OEM’s operating profit and competitive strength.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.