Toyota Motor – the world’s largest automaker – posted impressive operating results for Q1 of the 2024 Japanese fiscal year with an operating profit margin of ~11% up from ~7% a year ago.

“We faced many challenges, including those posed by COVID-19 and production restrictions due to tight semiconductor supplies, but the results showed the efforts of each front-line employee, including those of our suppliers and dealers, each recognized what they needed to do and acted accordingly, and a management structure and profit structure that was built to be resilient to crises,” said Koji Sato, president. (AutoInformed: New Toyota Motor President Koji Sato on Evolution)

Click to enlarge.

Sales volume increased in all regions due to productivity improvements inside TMC and with its suppliers. Consolidated vehicle sales Q1 was 2,326,000 units, at 115.5% of consolidated vehicle sales for the same period of the previous fiscal year. Toyota and Lexus vehicle sales was at 2,538,000 thousand units, at 108.4% of such sales for the same period of the previous fiscal year. This coincided with the better supply of semiconductors, which is still delaying delivery, particularly on new models. Notably, electrified vehicles were 34% of total sales.

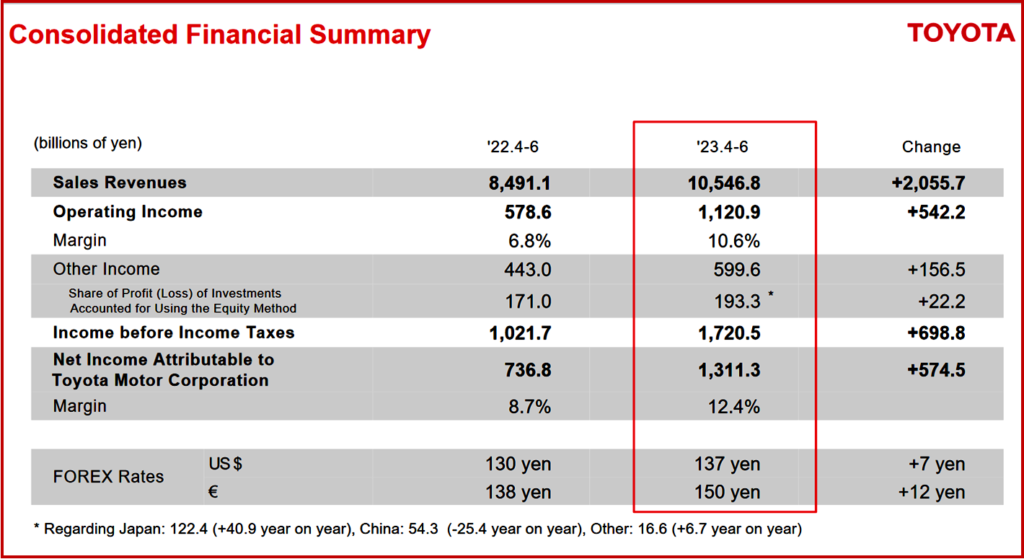

Consolidated financial results Q1 Japanese FY 2024

- Sales revenue of 10 trillion 546.8 billion yen.

- Operating income of 1 trillion 120.9 billion yen.

- Income before income taxes of 1 trillion 720.5 billion yen.

- Net income of 311 trillion yen ($9.22 billion).

Toyota is maintaining its previously announced full-year forecast. Toyota forecasts group vehicle sales with subsidiaries Daihatsu Motor and Hino Motors at 11.4 million units. Toyota projects that revenue will increase 2.3% to ¥38.000 trillion and net profit to rise 5.2% to ¥2.580 trillion.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Toyota Posts Strong FY 2024 Q1 Results – $9.2 Billion Net

Toyota Motor – the world’s largest automaker – posted impressive operating results for Q1 of the 2024 Japanese fiscal year with an operating profit margin of ~11% up from ~7% a year ago.

“We faced many challenges, including those posed by COVID-19 and production restrictions due to tight semiconductor supplies, but the results showed the efforts of each front-line employee, including those of our suppliers and dealers, each recognized what they needed to do and acted accordingly, and a management structure and profit structure that was built to be resilient to crises,” said Koji Sato, president. (AutoInformed: New Toyota Motor President Koji Sato on Evolution)

Click to enlarge.

Sales volume increased in all regions due to productivity improvements inside TMC and with its suppliers. Consolidated vehicle sales Q1 was 2,326,000 units, at 115.5% of consolidated vehicle sales for the same period of the previous fiscal year. Toyota and Lexus vehicle sales was at 2,538,000 thousand units, at 108.4% of such sales for the same period of the previous fiscal year. This coincided with the better supply of semiconductors, which is still delaying delivery, particularly on new models. Notably, electrified vehicles were 34% of total sales.

Consolidated financial results Q1 Japanese FY 2024

Toyota is maintaining its previously announced full-year forecast. Toyota forecasts group vehicle sales with subsidiaries Daihatsu Motor and Hino Motors at 11.4 million units. Toyota projects that revenue will increase 2.3% to ¥38.000 trillion and net profit to rise 5.2% to ¥2.580 trillion.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.