North American sales volume is finally approaching the 15 million-unit level for the first time since 2007.

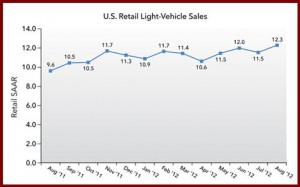

August new-vehicle retail sales are projected to come in at 1,066,200 units for a seasonally adjusted annualized rate or SAAR of 12.3 million units. Total light-vehicle sales are relatively soft, with August volume expected to come in at 1,285,300 units, a 16% increase from August 2011. Fleet sales represent 17% of total light-vehicle sales, which is lower than the 21% year-to-date average, so an argument can be made that the modest recovery is continuing.

Nevertheless, LMC Automotive has revised the outlook for total light-vehicle sales in the United States downward to 14.3 million units from 14.5 million units, with retail auto sales at 11.4 million units, down from 11.5 million units. Weaker U.S. economic growth and concerns with the deepening Eurozone crisis are cited as factors for slower growth during the second half of the year. The U.S. auto industry is still projected at a 15-million-unit level in 2013, but the outlook has been cut from 15.2 million units, as the risks in could carry over into next year.

“The strength in August light-vehicle sales takes some of the pressure off expectations for the balance of the year, but a high level of risk lingers,” said Jeff Schuster, senior vice president of forecasting at LMC Automotive. “We expect the current seesawing in auto sales to continue for the foreseeable future, but the overall picture in 2012 remains positive.”

North American light-vehicle can you buy cialis online production volume has increased by 23% through the first seven months this year, compared with the same period in 2011. The increase of nearly 1.7 million additional vehicles points to the industry’s slow recovery from the challenging production environment in 2011, 2010, 2009 and 2008.

Production for Honda and Toyota in the first seven months of 2012 is up 79% and 65%, respectively, as natural disasters in Asia are no longer factors. U.S. manufacturing growth is outpacing the rest of the North American region, with a 27% year-to-date increase as newly added capacity comes on line. Production in Mexico has increased 14%, with further growth expected as new key models such as the Imported Ford Fusion ramp up. Canadian manufacturing has increased 20% year to date, but the level of future volume is at risk, as the domestic manufacturers and CAW begin labor negotiations.

Vehicle inventory in early August declined slightly to a 54-day supply, compared with 58 days in July. Car inventory remains at a below-normal level with a 47-day supply, down from 49 days in July. Truck inventory is at normal levels with a 61-day supply, down from 67 days in July.

“With the robust production activity outpacing the increases in demand, North American volume is approaching the 15.0-million-unit level for the first time since 2007,” said Schuster. “However, given that inventory has normalized and growth in demand is expected to slow, LMC Automotive is holding the forecast for 2012 at 14.9 million units for the year.”