The slow sales recovery continues. Automakers without adequate car production - GM and Ford are good bets- will likely lose share in May.

Total light-vehicle sales in May are predicted at 1,384,000 units, a 21% percent increase from auto sales in May 2011. However, fleet volume as a percentage of total light-vehicle sales is expected to remain high in May at 22%.

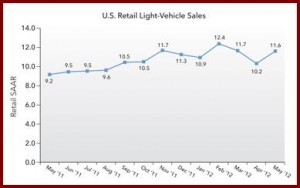

May new-vehicle retail sales are projected at 1,087,000 units, which represents a seasonally adjusted annualized rate or SAAR of 11.6 million units. Volume is expected to increase 20% compared with May 2011, after adjusting for the two additional selling days this month. Retail transactions are the most accurate measurement of true underlying consumer demand for new vehicles, according to J.D. Power and Associates the source of the data.

|

May 2012 |

April 2012 |

May 2011 |

|

| Retail Sales |

1,087,000 (+20% May 2011) |

908,685 |

833,847 |

| Total Sales |

1,384,000 units (+21% May 2011) |

1,182,230 |

1,059,505 |

| Retail SAAR |

11.6 million |

10.3 million |

9.2 million |

| Total SAAR |

14.3 million |

14.4 million |

11.7 million |

“This is the largest year-over-year gain since February 2011, when sales increased 27%, compared with February 2010,” said John Humphrey of Power.

With the continuation of higher fleet volume, LMC Automotive, Power’s owner, is raising the light-vehicle sales forecast for 2012. The current forecast is now at 14.5 million units total light-vehicle sales, up from the previous forecast of 14.3 million units, and 11.6 million units retail light-vehicle sales, up from 11.5 million units.

North American light-vehicle production through April this year increased nearly 22%, compared with 2011, as almost 1 million additional vehicles were built in the first four months of 2012 than in the same period last year. Growth in U.S. manufacturing leads the overall North America region with a 25% year-to-date increase. Production in Mexico is up 19% and Canadian manufacturing is 14% higher.

North American production in the second quarter is anticipated to increase by more than 20% from 2011, with more than 3.8 million units expected to be built. Several manufacturers have limited normal summer shutdowns this year in order to keep pace with vehicle demand and stabilize inventory throughout the summer selling season.

Vehicle inventory at the beginning of May remains sat a 55-days supply, a slight increase from a 54-days supply in April. Car inventory remains at a below-normal level, with a 45-days supply in early May, up from 44 days in April, as demand for cars has increased due to higher fuel prices. Truck inventory levels are also stable in May at a 67-days supply, up from a 66-days supply in April.