In a matter of just three months, five trillion dollars of Americans' household wealth evaporated during the waning months of the Bush Administration. Economic activity and trade around the world ground toward a halt. We are still feeling the negative effects.

The final results for the fiscal year (FY) 2011 budget shows that the budget deficit remained large at $1.299 trillion – about the same as last year, a $4 billion or 0.3% increase. This was slightly lower than predicted last February, but because of ongoing effects of the financial crisis in 2008 and 2009, which have put a persistent strain on Federal revenues and outlays, the budget deficit remains, after unemployment, a major U.S. problem. As a percentage of gross domestic product (GDP), the budget deficit was 8.7% of GDP, down from 9.0% of GDP in FY 2010.

U.S. Treasury Secretary Tim Geithner and Office of Management and Budget (OMB) Director Jacob Lew – both already in full Presidential campaign mode – said the Obama Administration is committed to enacting budget deficit reduction that puts “Federal finances back on a sustainable path while providing near-term support for jobs and economic growth.”

Last August, President Obama signed into law the Budget Control Act of 2011 (BCA). The BCA cuts discretionary Government spending by nearly $1 trillion over the next 10 years. It also charges a Joint Select Committee on Deficit Reduction with finding an additional $1.5 trillion in savings.

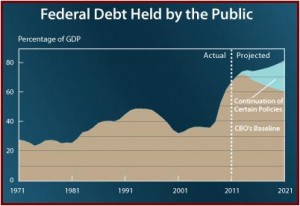

Federal borrowing from the public, net of financial assets, increased by $1.299 trillion during FY 2011 to $9.302 trillion, 62.2% of GDP.

This so-called Super Committee is already gridlocked over how to decrease the budget deficit, and that very likely means nothing will be done about the deficit until after the 2012 elections as both parties in a dysfunctional Washington maneuver for advantages – perceived or real – that can be used to sway voters. Nothing is being done to help create jobs and the tax revenues that go with them by either party.

“Congress has an opportunity now to pass reforms to reduce future budget deficits and strengthen economic growth,” said Geithner, as he released the results. “I urge Congress to act on the President’s proposals.”

Summary of Fiscal Year 2011 Budget Results

In a statement, Geithner said the economy has begun to recover with the aid of efforts including the American Recovery and Reinvestment Act (Recovery Act), financial market interventions, and further fiscal support enacted last December. The recession was deeper than originally reported, and the return to economic growth has been further slowed by higher energy prices, the earthquake and tsunami in Japan, and a broader global economic slowdown.

|

Total Receipts, Outlays, Deficit in $ Billions |

|||

| Receipts | Outlays | Deficit | |

| FY 2010 Actual | 2,162 | 3,456 | -1,294 |

| % GDP | 15.1% | 24.1% | 9.0% |

| FY 2011 Estimates: | |||

| 2012 Budget | 2,174 | 3,819 | -1,645 |

| 2012 Mid-Session | 2,314 | 3,630 | -1,316 |

| FY 2011 Actual | 2,302 | 3,601 | -1,299 |

| % GDP | 15.4% | 24.1% | 8.7% |

Government receipts totaled $2.302 trillion in FY 2011- $141 billion higher than in FY 2010, an increase of 6.5%. Even with the extension of tax provisions in the December 2010 Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act, FY 2011 collections were significantly higher for individual income tax receipts. Collections also increased for excise tax receipts, customs duties and deposits of earnings from the Federal Reserve. These increases were offset by decreases in social insurance and retirement receipts (because of the payroll tax relief enacted in December), corporation income tax receipts, and estate and gift tax receipts. As percentage of GDP, receipts equaled 15.4%, slightly higher than the 15.1% of GDP last year.

Outlays for FY 2011 were $145 billion above those in FY 2010, an increase of 4.2%. As percentage of GDP, total outlays were 24.1%, unchanged from last year. Outlays for annually appropriated programs as a whole changed very little from the prior year because they were operating under a series of continuing resolutions culminating in the passage of the Department of Defense and Full-Year Continuing Appropriations Act in April. Higher spending for interest on the public debt, Medicare, and Social Security accounted for $110 billion of the $145 billion increase in outlays relative to FY 2010. Notably, spending for unemployment benefits decreased by $30 billion from FY 2010. Outlays were $218 billion less than estimated in the President’s FY 2012 Budget.

The Federal Government primarily finances deficits by borrowing. Borrowing from the public is also affected by other factors, such as changes in the Treasury operating cash balance. The U.S. Government also holds significant financial assets. Federal borrowing from the public, net of financial assets, increased by $1.299 trillion during FY 2011 to $9.302 trillion, or 62.2% of GDP. (This measure of net borrowing, as reported in the Monthly Treasury Statement, excludes the Federal Government’s holdings of Fannie Mae and Freddie Mac preferred stock. If those stock holdings were included, net borrowing as a percentage of GDP would be smaller by roughly 1 %.)

Fiscal Year 2011 Receipts

Total receipts for FY 2011 were $2.302 trillion; $12 billion lower than the previous MSR (mid-session review) estimate of $2.314 trillion. This net decrease in receipts was attributable in large part to lower-than-estimated collections of corporation income taxes and miscellaneous receipts, which were only partially offset by higher-than-estimated collections of individual income taxes, social insurance and retirement receipts, and excise taxes.

Individual income taxes were $1,091 billion, $2 billion higher than the old estimate. Lower-than-expected refunds increased individual income tax collections by $5 billion relative to the MSR. This increase was partially offset by lower-than-estimated withholding and lower-than-estimated non-withheld payments of individual income tax liability, which were both $1 billion below the MSR estimate.

- Corporation income taxes were $181 billion, $13 billion lower than the MSR estimate. This decrease reflected lower-than-expected payments of 2011 corporation income tax liability, attributable in large part to slower economic growth relative to what was assumed for the MSR. Delays in certain filing and payment deadlines granted by the Internal Revenue Service in response to recent natural disasters may have also contributed to the shortfall in this source of receipts.

- Social insurance and retirement receipts were $819 billion, $3 billion higher than the MSR estimate. Higher-than-estimated collections of Social Security and Medicare payroll taxes increased this source of receipts by $2 billion relative to the MSR. Higher-than-expected unemployment insurance receipts, attributable to higher-than-estimated deposits by States to the unemployment insurance trust fund to replenish depleted balances, increased this source of receipts by an additional $2 billion relative to the MSR estimate.

- Excise taxes were $72 billion, $2 billion higher than the MSR estimate of $70 billion. This increase was attributable to higher-than-expected demand for taxed goods.

- Estate and gift taxes were $7 billion, the same as the MSR estimate.

- Customs duties were $30 billion, the same as the MSR estimate.

- Miscellaneous receipts were $102 billion; $6 billion lower than the MSR estimate. Lower-than-expected deposits of earnings by the Federal Reserve System, attributable in large part to lower-than-expected returns on the Federal Reserve’s investment portfolio, accounted for $4 billion of the decrease in miscellaneous receipts relative to the MSR estimate.

Fiscal Year 2011 Outlays

Total outlays were $3.601 trillion for FY 2011, $29 billion below the MSR estimate.

- Department of Agriculture — Outlays for the Department of Agriculture were $139.4 billion, $4.3 billion lower than the MSR estimate.

- About half of the difference was due to lower-than-expected outlays in the Supplemental Nutrition Assistance Program (SNAP) and Child Nutrition programs. For SNAP, outlays were $77.6 billion; $1.4 billion lower than the MSR estimate because State administrative expenses and the average cost per participant were slightly lower than expected. However, the Department anticipates States will submit upward adjustments as they reconcile payments for disaster SNAP benefits issued at the end of FY 2011. Outlays for Child Nutrition programs were $17.3 billion, $1.1 billion lower than the MSR estimate. This difference was primarily driven by slower-than-expected growth in the number of school meals, and differences in the percentage served at free, reduced price, and paid rates.

- Outlays for farm programs administered by the Farm Service Agency (FSA) were $1.5 billion less than the MSR estimate. Roughly $1 billion of that difference was due to lower-than-anticipated outlays for commodity programs and commodity loans as a result of higher-than-anticipated crop prices and about $0.4 billion of the difference was due to lower-than-estimated outlays for mandatory crop disaster assistance for the 2009 crop year.

- Crop insurance outlays were $1.3 billion more than projected in the MSR because claims for 2011 crop indemnities were significantly higher than anticipated due to a wet spring in the Midwest, drought in Texas and Oklahoma, and flooding from Hurricane Irene.

- Forest Service outlays were $0.6 billion less than estimated in the MSR due to slower-than-expected grant spending and intense efforts in firefighting, which reduced other program activities and spending.

- Department of Education — Outlays for the Department of Education were $64.3 billion, $5.0 billion lower than the MSR estimate. Outlays for the Accelerating Achievement and Ensuring Equity account and the State Fiscal Stabilization Fund were each $1.5 billion below the MSR estimate. The lower-than-expected spending in both accounts is mainly due to an influx of Recovery Act-related Federal funds and a conservative approach adopted by States anticipating possible funding shortfalls in coming years. Additionally, one program in the former account, School Improvement Grants, awarded funds later in the year due to changes in the program. Outlays for the Federal Student Loan Reserve Fund, which represents the value of Federal assets held by State guaranty agencies for the student loan programs, were $1.1 billion below the MSR estimate. This difference is a result of higher-than-expected values of assets held by those accounts, including defaulted student loan assets.

- Department of Energy — Outlays for the Department of Energy (DOE) were $31.4 billion, $1.5 billion lower than the MSR estimate. Outlays for the Office of Energy Efficiency and Renewable Energy (EERE) were $1.4 billion below the MSR estimate. Over three-quarters of the estimated outlays were for Recovery Act projects that were part of the “reinvestment” portion of the American Recovery and Reinvestment Act. Many of these projects, as well as activities in the Weatherization Assistance and State Energy Programs portion of the office, experienced delays in working with State and local government partners and other awardees. Outlays for the Title 17 loan guarantee program were $0.3 billion, $1.0 billion less than the MSR estimate. A large part of this difference is due to lower-than-expected spending under the section 1705 portion of the program. Several loans closed later in the year than expected, resulting in later construction starts and lower outlays in FY 2011. Outlays for the Office of Electricity Delivery and Energy Reliability were $0.4 billion less than the MSR estimate, as a result of revised recipient execution plans primarily in the Recovery Act Smart Grid Investment Grant program. These plans were affected by State regulatory, technical, and supply chain requirements.

- Department of Health and Human Services— Outlays for the Department of Health and Human Services (HHS) were $891.2 billion, $7.0 billion lower than the MSR estimate.

- Gross outlays for Medicare were $3.5 billion lower than the MSR estimate. Medicare Hospital Insurance (Part A) outlays were $3.9 billion lower than in the MSR, due to fewer hospital admissions than projected. The lower Part A outlays were partially offset by slightly higher outlays for Supplementary Medical Insurance (Part B) and the Prescription Drug Account (Part D).

- Medicaid outlays were $1.8 billion higher than the MSR estimate. The difference was likely due to higher-than-anticipated benefits spending, primarily the result of State efforts to take advantage of expiring temporary Federal matching rate increases, partially offset by lower-than-anticipated administrative spending, likely due to stronger efforts by States to control spending.

- Outlays for the Public Health and Social Services Emergency Fund were $1.7 billion, $2 billion below the MSR estimate. This was due to a slower than anticipated rate of obligation of funds for the pandemic flu account and the BioShield Special Reserve Fund account, primarily because of the limitations of predicting timing for contracts to support the development of medical countermeasures.

- Outlays for the Administration for Children and Families were $1.3 billion below the MSR estimate. Outlays for both Low Income Home Energy Assistance and the Children and Families Services account, which includes Head Start and Early Head Start, were lower than expected due primarily to the late enactment of FY 2011 appropriations. Downward adjustments in the MSR to account for the delay in appropriations turned out to be insufficient.

- Department of Homeland Security— Outlays for the Department of Homeland Security were $45.7 billion, $2.3 billion higher than the MSR estimate.

- Federal Emergency Management Agency (FEMA) outlays were $9.6 billion, $1.5 billion more than the MSR estimate because of FEMA’s faster spending of grant funds within the State and Local Programs account, accompanied by unexpected disaster relief costs associated with Hurricane Irene and Tropical Storm Lee.

- Transportation Security Administration outlays were $0.7 billion higher than the MSR estimate because of higher-than-anticipated spend-out of prior year funding.

- Coast Guard outlays were $10.5 billion, $0.5 billion more than the MSR estimate. This was mainly due to higher-than-estimated spending in mandatory accounts, including Retired Pay and Maritime Oil Spill Programs, with the latter increase reflecting faster-than-expected reimbursement of costs associated with the 2010 Deepwater Horizon oil spill response work.

- National Protection and Programs Directorate outlays were $1.7 billion, $0.8 billion higher than the MSR estimate in part because of an effort to accelerate contract awards to procure technologies to enhance the security of the Federal civilian network from a cyber attack.

- Immigration and Customs Enforcement (ICE) outlays were $5.8 billion in FY 2011, $0.3 billion more than the MSR estimate, because of faster outlays of prior-year supplemental appropriations and concerted efforts by ICE to liquidate prior-year obligations.

- Department of State — Outlays for the Department of State were $24.3 billion, $1.1 billion lower than the MSR estimate. The difference was largely due to the Global Health and Child Survival account, outlays for which were $1.1 billion less than projected because of the late enactment of appropriations and delays in the Congressional notification process. This was particularly challenging for the President’s Emergency Plan for AIDS Relief, whose transfers to the implementing agencies were delayed resulting in a smaller-than-usual end-of-year acceleration in outlays.

- Department of Transportation — Outlays for the Department of Transportation were $77.3 billion, $3.5 billion lower than the MSR estimate. The largest difference was in the Federal Transit Administration, where outlays for the formula grant programs were $1.1 billion below MSR projections. The economic downturn has forced State departments of transportation and local transit authorities to delay capital reinvestment and maintenance projects and focus local resources on core operations, thereby slowing the pace of transit capital investment. Federal Railroad Administration outlays were $0.8 billion below the MSR projection, including $0.6 billion in the High Speed Rail program. Outlays for the Federal Aviation Administration were $0.8 billion below MSR projections. The Department’s aviation programs were affected by the uncertainty of multiple short-term extensions and a two-week lapse in trust fund expenditure authority near the end of the fiscal year.

- Department of the Treasury— Outlays for the Department of the Treasury were $536.7 billion, $5.7 billion above the MSR estimate. The increase in outlays resulted from higher net outlays for transactions with credit financing accounts, partly offset by lower outlays in a number of other Treasury programs.

- Among the programs whose outlays were below the MSR estimate, the Claims, Judgments, and Relief Acts account was $2.9 billion lower due to a settlement appeal that was not assumed in the MSR. In addition, IRS outlays were $1.5 billion less than estimated in the MSR due to several factors including lower outlays for IRS refundable tax credit outlay accounts, such as the First-Time Homebuyer Tax Credit through amended tax returns and the American Opportunity Tax Credit. Interest paid by the IRS on income tax refunds was also $0.2 billion below the MSR estimate.

- Offsetting these reductions, net interest outlays for transactions to and from non-budgetary credit financing accounts were $11.2 billion higher than MSR estimates. While outlays for interest paid by Treasury on balances in financing accounts was $14.8 billion lower than in the MSR, interest received from these accounts on their Treasury borrowing (reported under Treasury’s aggregate offsetting receipts) was $26.0 billion below the MSR estimate. In particular, interest received from the financing accounts for the Troubled Asset Relief Program (TARP) was $16.1 billion lower than in the MSR. This difference was primarily due to the TARP statutory requirement to use market risk-adjusted discount and interest rates for budget formulation, while lower, actual Treasury rates are used for budget execution in TARP financing account interest transactions, including interest payable to Treasury.

- On a technical note, outlays for the TARP Equity Purchase Program account were nearly $17 billion above the MSR estimate; however, this increase was fully offset by a corresponding $17 billion downward re-estimate of TARP subsidy costs (reported under Treasury offsetting receipts), reflecting a technical change in accounting and resulting in no net impact on the deficit.

- Department of Veterans Affairs — Outlays for the Department of Veterans Affairs were $126.9 billion, $3.8 billion lower than the MSR estimate. The Compensation and Pensions program accounted for $3.2 billion of that difference, mainly due to longer-than-expected times to process payments associated with new eligibility for Vietnam-era Agent Orange exposure claims for disability compensation. In addition, outlays for Readjustment Benefits were $1.0 billion less than the MSR estimate mainly because of lower-than-expected education benefit levels paid to beneficiaries for the beginning of the 2011 academic year.

- Corp of Engineers — Outlays for the Corps of Engineers (Corps) were $10.1 billion, $1.1 billion lower than the MSR estimate. The difference was due primarily to a combination of contractors on Corps projects completing project work more slowly than expected and invoicing more slowly than anticipated for completed work.

- Other Defense Civil Programs — Outlays for Other Defense Civil Programs were $54.8 billion, $2.1 billion less than the MSR estimate. Outlays for retiree health care were $1.8 billion less than the MSR estimate. Almost half of this difference was due to lower-than-expected medical care costs in the TRICARE-for-Life program due to lower usage rates and lower intensity of medical services. The remainder of the difference was because of higher earnings on investments held by the Defense Medicare Eligible Retiree Health Care Fund.

- National Science Foundation — Outlays for the National Science Foundation were $7.1 billion in FY 2011, $1.3 billion less than the MSR estimate. This difference is attributable to lower-than-expected outlays of Recovery Act obligations in the fourth quarter of the fiscal year, later-than-expected passage of the final FY 2011 appropriation, and a time lag between grantee drawdown and Treasury reporting.

- Office of Personnel Management — Outlays for the Office of Personnel Management (OPM) were $74.1 billion, $1.7 billion more than the MSR estimate. This was mostly due to legislative postponement of a $5.5 billion payment from the Postal Service to OPM for the pre-funding of retired Postal Service employee health insurance. The Continuing Appropriations Resolution for FY 2012 deferred this required end-of-year payment until November 18, 2011, which lowered OPM collections and therefore increased net outlays. These higher outlays were partly offset by $2.1 billion in lower-than-expected outlays in the Employees and Retired Employees Health Benefits Fund due to larger-than-expected declines in payments to experience-rated insurance carriers, and $1.2 billion lower-than-expected retirement benefits paid by the Civil Service Retirement and Disability Fund due to fewer retirees being added to the annuity rolls than anticipated and a lower-than-expected value of annuity payments.

- Federal Deposit Insurance Corporation — Net outlays for the Federal Deposit Insurance Corporation (FDIC) were $1.4 billion, $1.8 billion less than the MSR estimate. The majority of the difference was attributable to lower-than-expected payments related to FDIC’s guarantee of bank and bank holding company debt under the Temporary Liquidity Guarantee Program, which was established in October 2008 to promote liquidity in the banking sector during the financial crisis. Payments under this program were lower than forecasted due to improved conditions in the banking sector and lower default rates on bank and bank holding company debt. Approximately 30 percent of the difference was attributable to lower-than-expected payments related to FDIC’s resolution of failed insured depository institutions, which was partially a result of improved capital positions in the banking sector.

- United States Postal Service — The United States Postal Service (USPS) had net outlays of $0.9 billion, $3.0 billion lower than the MSR estimate. This difference for FY 2011 was primarily due to the legislated postponement of the $5.5 billion statutorily mandated USPS end-of-year payment to the Office of Personnel Management for retiree health benefit liabilities. The remainder of the change is due to USPS’ worsening financial position, in which the decline in postal revenues is currently outpacing USPS’ ability to reduce operating costs.

- Tennessee Valley Authority — Outlays for the Tennessee Valley Authority (TVA) were $1.0 billion, $1.1 billion lower than the MSR estimate, due to higher-than-estimated collections.

- Undistributed Offsetting Receipts — Undistributed offsetting receipts were $274.5 billion, $1.9 billion less than the MSR estimate. Federal agency payments for the employer share of employee retirement and rents and royalties on the Outer Continental Shelf land were both $0.6 billion higher than estimated in the MSR. Offsetting these increased receipts, interest received by trust funds was $1.3 billion lower than the MSR estimate, due primarily to lower-than-projected interest earnings of the military retirement fund. This intergovernmental interest is paid out of the Department of the Treasury account for interest on the public debt and has no net impact on total Federal Government outlays. In addition, other undistributed offsetting receipts were $1.6 billion lower because revenue from asset sales was less than assumed in the MSR.

- Department of Commerce — Outlays for the Department of Commerce were $9.9 billion, $1.2 billion lower than the MSR estimate. Almost all of the difference is due to lower-than-expected outlays for grants for construction projects in the Broadband Technologies Opportunity Program, reflecting longer-than-anticipated lead times to begin construction for certain projects.