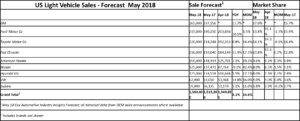

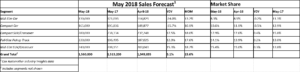

Forecasts for U.S. vehicle sales predict flat May numbers year-over-year. New light-vehicle sales are projected to reach 1.56 million units, with a seasonally adjusted annual rate – SAAR – of 16.6 million, down a tad from last year.

If accurate the SAAR will be its lowest level since August 2017 and down from the 17.1 million trend the market has been averaging in 2018.

“This month’s sales volume is expected to rise over last year, but May 2018 has one additional selling day,” said Charles Chesbrough, senior economist at Cox Automotive. “The selling rate, however, would mark the first month below 17 million SAAR since last August, when Hurricane Harvey disrupted the market.”

May 2018 Stats and Facts

- In May, new light-vehicle sales, including fleet, are forecast to reach 1,560,000 units, up 3.1% or 47,000 units compared to May 2017, and up more than 15 % from last month.

- The SAAR in May 2018 is estimated to be 16.6 million, down slightly from last year’s 16.7 million pace, down from April’s 17.1 million level and well below the 17.1 million average for 2018.

- A record SAAR in May is possible, but with the seasonal adjustments a huge Memorial Day Weekend would be required to reach a volume of 100,000 above current forecasts.

Increases for Most Makers?

Cox Automotive expects most automakers will report higher year-over-year sales in May 2018. With one additional selling day, increases are predicted even in a flat market. The Jeep and VW brands should continue to perform well. However, Nissan, which had a significant decline last month, is expected to post lower sales again, as they pull back on fleet and incentives.

Autotrader Executive Analyst Michelle Krebs says, “the entire industry will be watching Nissan this month after the surprise in April. Nissan has been making strategic decisions about its sales approach, working to reduce incentive spend and fleet sales, focusing more on quality sales and less on absolute market share.”

A trend noted by AutoInformed for a long time continues. Car sales are expected to decline yet again. May 2018 will see double-digit declines. Truck and SUV/CUVs share growth will continue.

“Gas prices continue to be in the news,” said Rebecca Lindland, executive analyst at Kelley Blue Book. “Our survey shows that $4 a gallon is when consumers start thinking about a more fuel-efficient vehicle. I would encourage consumers to look at the most fuel-efficient version of a vehicle they already want to buy, particularly if it comes in a hybrid. This will ensure long-term satisfaction with the vehicle, regardless of peaks and valleys in gas prices.”

Although the sales pace is expected to moderate, the U.S. vehicle market remains on sound footing. Economic conditions are strong with robust consumer confidence levels and decades lows unemployment rates. The recent passage of tax reform has likely led to additional strength in the vehicle market in 2018. There is strong underlying support for a high 16-million vehicle market even with interest rates rising modestly.

Cox Automotive expects 2018 to finish near 16.7 million, down slightly from the 17.1 million units in 2017, a top five all-time finish. However, overall economic conditions and strong sales in the spring may lead Cox Automotive to make an upward revision to its current forecast at the end of Q2.