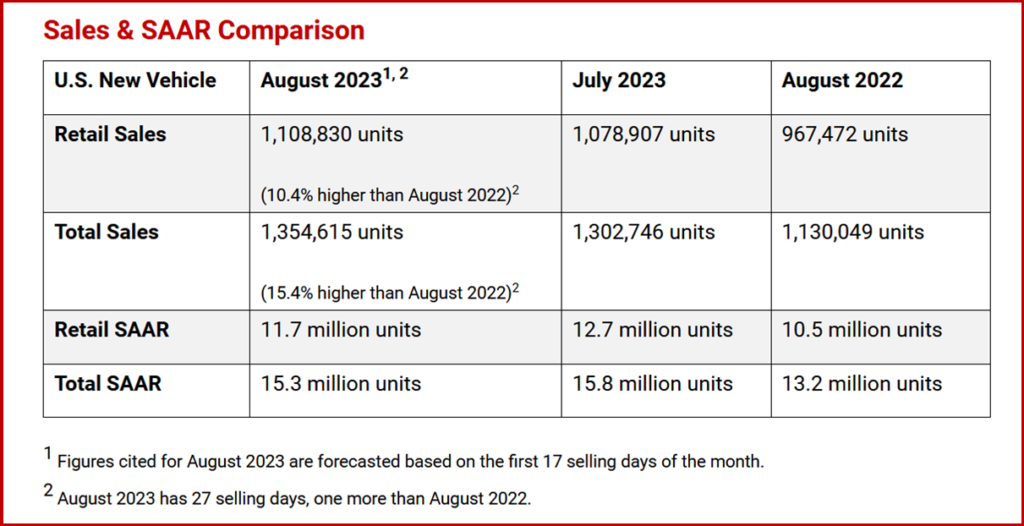

Total US new-vehicle sales for August 2023, including retail and non-retail transactions, are forecast to reach 1,354,600 units, a 15.4% increase from August 2022, according to a joint release from J.D. Power and GlobalData made public today.* August 2023 has 27 selling days, one more than August 2022. Comparing the same sales volume without adjusting for the number of selling days translates to an increase of 19.9% from a year ago. The seasonally adjusted annualized rate (SAAR) for total new-vehicle sales is expected to be 15.3 million units, up 2.1 million units from August 2022. (AutoInformed: US July Vehicle Sales Forecast Up Significantly Again)

“August feels like another rinse-and-repeat month as the industry continues its pace of double-digit sales growth for a fifth consecutive month. This is facilitated by incremental increases in vehicle production and leveraging continued strong demand from fleet customers,” said Thomas King, president of the data and analytics division at J.D. Power.

Bidenomics is clearly working in AutoInformed’s point of view. The latest data show a continuing trend that started after President Biden was elected and began a recovery from the economic reverses and job losses from the Trump Administration. Trump was the first president since Herbert Hoover who left office having presided over an the Great Depression economic disaster and with far fewer jobs than existed at the outset.

Year-to-date total sales through August will be slightly more than 10.3 million units – an increase of 14.4% from a year ago – but still below pre-pandemic sales levels, which were north of 11.4 million,” King said.

Significant Data

- The average new-vehicle retail transaction price in August is expected to reach $45,537, down $566 from August 2022. The previous high for any month,$47,362, was set in December 2022.

- Average incentive spending per unit in August is expected to reach $1902, up from $953 in August 2022. Spending as a percentage of the average MSRP is expected to increase to 4%, up 1.9 percentage points from August 2022.

- Average incentive spending per unit on trucks/SUVs in August is expected to be $1813, up $831 from a year ago, while the average spending on cars is expected to be $1483, up $638 from a year ago.

- Retail buyers are forecast to spend $47.8 billion on new vehicles, up $5 billion from August 2022.

- Truck/SUVs are on pace to comprise 78.6% of new-vehicle retail sales in August.

- Fleet sales are expected to total 245,785 units in August, up 45.6% from August 2022 on a selling day adjusted basis. Fleet volume is expected to account for 18.1% of total light-vehicle sales, up from 14.4% a year ago.

- Average interest rates for new-vehicle loans are expected to increase to 7.3%, 182 basis points higher than a year ago.

*GlobalData

J.D. Power is part of GlobalData. GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.”

The average price Americans paid for a new vehicle in August 2023 was virtually flat year over year due to higher inventory levels and increased incentives. Kelley Blue Book reports that the average transaction price (ATP) of a new vehicle in August was $48,451, up only $42 from one year ago. Prices increased slightly by 0.6% ($286) compared to July’s revised ATP of $48,165. Since the start of the year, transaction prices are down 2.4%, or $1,212, the largest decrease in the past decade. In August, manufacturers’ incentives averaged $2,365, reaching the highest point in a year. This increase brought incentives to 4.9% of ATP, which is still historically low.

Electric vehicle (EV) prices continue to fall, with Tesla leading the way. In August, the average price paid for an EV was $53,376, lower than the previous month and significantly less than a year ago when an EV cost more than $65,000. Incentives for EVs in August were 8.1% of the average transaction price, or $4,298.