Click to Enlarge.

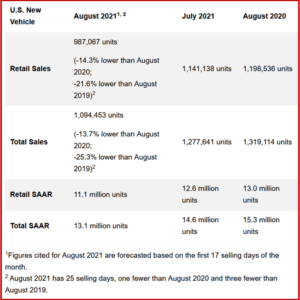

New-vehicle retail and fleet sales for the month of August are expected to decline from August 2020 and decline from August 2019, according to a joint forecast from J.D. Power and LMC Automotive. August 2021 has one fewer selling day than August 2020 and three fewer selling days than August 2019. Comparing the same retail sales volume without adjusting for the number of selling days translates to a decrease of 17.6% from 2020 and a decrease of 30.0% from 2019.

Overall new-vehicle sales for August 2021, including retail and non-retail transactions, are projected to reach 1,094,500 units, a 13.7% decrease from August 2020 and a 25.3% decrease from August 2019. Comparing the same sales volume without adjusting for the number of selling days translates to a decrease of 17.0% from 2020 and a decrease of 33.3% from 2019. The seasonally adjusted annualized rate (SAAR) for total new-vehicle sales is expected to be 13.1 million units, down 2.1 million units from 2020 and down 4.0 million units from 2019.

“The month of August is historically a peak selling month as manufacturers launch promotional events to clear inventories of outgoing model-year vehicles and begin sales of the new model year,” said Thomas King, president of the data and analytics division at J.D. Power. “This year, however, the industry has insufficient inventory at dealerships to meet strong consumer demand. The consequence is that the retail sales pace is depressed, but transaction prices are elevated.”

Things aren’t much better in the UK where car manufacturing output fell -37.6% in July, the first fall since February, with just 53,438 units made, according to the latest figures released today by the Society of Motor Manufacturers and Traders (SMMT). It represented the worst July performance since 1956 (51,4720 as manufacturers struggled with the global shortage of semiconductors and staff absence resulting from the ‘pingdemic,’ with some altering summer shutdown timings to help manage the situation.

AutoInformed.com on

Dealers have approximately 942,000 vehicles in inventory now available for retail sale, compared with roughly 3.0 million in inventory two years ago. Current automaker shipments are just replacing the vehicles being sold, “preventing dealers from increasing inventories to a level necessary to support a higher sales pace. This means the sales pace is being dictated by production levels rather than actual consumer demand,” according to Power.

For August 2021, average transaction prices are expected reach an all-time high of $41,378. This is the first time above $41,000. Average transaction prices are trending to be more than 16% higher in August 2021 than they were in August 2020.

“This is partially due to the continued retraction in manufacturer incentives. The average manufacturer incentive per vehicle is on pace to be $1,823, a decrease of $2,132 from a year ago and the lowest amount on record for the month of August. Expressed as a percentage of the average vehicle MSRP, incentives for August 2021 are trending toward a record low of 4.3%, down nearly 5.3 percentage points from a year ago and the second consecutive month below 5%,” said Power.

It’s projected that consumers will spend $40.8 billion on new vehicles this month. This would be the fifth-highest on record for the month of August. Total retailer profit per unit, inclusive of grosses and finance & insurance income, should reach an all-time high of $4,430, an increase of $2,321 from a year ago and the second consecutive month above $4,000. Grosses have been above $3,000 for four consecutive months. Despite the supply constrained retail sales pace, total aggregate retailer profits from new-vehicle sales are projected to be $4.4 billion, the fourth-highest on record and up a remarkable 133% from August 2019. August is on track to be the fourth consecutive month for aggregate retailer profits on new vehicle sales to exceed $4 billion, according to Power.

“These record-breaking pricing and profitability results continue to be assisted by exceptionally strong trade-in values as well as comparatively low interest rates. Average trade-in values trending towards $7,715, an increase of $3,184—or 70%—from a year ago are being driven by robust used-vehicle prices. The average interest rate for new-vehicle loans in August is expected to decrease approximately 14 basis points to 4.17% from 4.31% a year ago, but down 128 basis points from August 2019. While average transaction prices are trending to be nearly 16% higher this month than in August 2020, the average monthly finance payment is on pace to be up 10.0%, or $58 to $638 during the same period due to the combination of high trade equity as well as relatively low interest rates,” said Power.

“Global light vehicle demand remains under pressure from the severe inventory constraints caused by the semiconductor shortage as well as disruption from the COVID-19 Delta variant. Global volume in July was off 5% from July 2020 and down 9% from July 2019. The selling rate came in at 83.2 million units, down 5 million from July 2020 but only 0.3 million units down from our expectations. Western Europe saw the largest decline of major markets, falling 24% from July 2020. In addition, weakness continued in China and South Korea as both markets were down about 10%. India was the standout in July, with a year-over-year increase of 48%. Looking at August, we expect volume to slip another 7% from August 2020, and the selling rate is expected to come in at 82 million units, down 7 million units from a year ago,’ said Jeff Schuster, president, Americas operations and global vehicle forecasts, LMC Automotive.

“The one-two punch of inventory shortages and the pandemic are holding back the pace of the global recovery and may lead to permanently lost recovery volume as the effect is expected to last into 2022. The lack of sufficient production volume is the major reason we forecast a 2-million-unit reduction to 83.8 million units in global light-vehicle sales for 2021. Volume is expected to increase just 8% from 2020. The year 2022 has been pulled down slightly, as well, but is still expected to recover to 91.7 million units—which is back to the pre-pandemic level—but further downside risk remains high,” Shuster concluded.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

US Auto Sales Forecast Down Again in August

Click to Enlarge.

New-vehicle retail and fleet sales for the month of August are expected to decline from August 2020 and decline from August 2019, according to a joint forecast from J.D. Power and LMC Automotive. August 2021 has one fewer selling day than August 2020 and three fewer selling days than August 2019. Comparing the same retail sales volume without adjusting for the number of selling days translates to a decrease of 17.6% from 2020 and a decrease of 30.0% from 2019.

Overall new-vehicle sales for August 2021, including retail and non-retail transactions, are projected to reach 1,094,500 units, a 13.7% decrease from August 2020 and a 25.3% decrease from August 2019. Comparing the same sales volume without adjusting for the number of selling days translates to a decrease of 17.0% from 2020 and a decrease of 33.3% from 2019. The seasonally adjusted annualized rate (SAAR) for total new-vehicle sales is expected to be 13.1 million units, down 2.1 million units from 2020 and down 4.0 million units from 2019.

“The month of August is historically a peak selling month as manufacturers launch promotional events to clear inventories of outgoing model-year vehicles and begin sales of the new model year,” said Thomas King, president of the data and analytics division at J.D. Power. “This year, however, the industry has insufficient inventory at dealerships to meet strong consumer demand. The consequence is that the retail sales pace is depressed, but transaction prices are elevated.”

Things aren’t much better in the UK where car manufacturing output fell -37.6% in July, the first fall since February, with just 53,438 units made, according to the latest figures released today by the Society of Motor Manufacturers and Traders (SMMT). It represented the worst July performance since 1956 (51,4720 as manufacturers struggled with the global shortage of semiconductors and staff absence resulting from the ‘pingdemic,’ with some altering summer shutdown timings to help manage the situation.

AutoInformed.com on

Dealers have approximately 942,000 vehicles in inventory now available for retail sale, compared with roughly 3.0 million in inventory two years ago. Current automaker shipments are just replacing the vehicles being sold, “preventing dealers from increasing inventories to a level necessary to support a higher sales pace. This means the sales pace is being dictated by production levels rather than actual consumer demand,” according to Power.

For August 2021, average transaction prices are expected reach an all-time high of $41,378. This is the first time above $41,000. Average transaction prices are trending to be more than 16% higher in August 2021 than they were in August 2020.

“This is partially due to the continued retraction in manufacturer incentives. The average manufacturer incentive per vehicle is on pace to be $1,823, a decrease of $2,132 from a year ago and the lowest amount on record for the month of August. Expressed as a percentage of the average vehicle MSRP, incentives for August 2021 are trending toward a record low of 4.3%, down nearly 5.3 percentage points from a year ago and the second consecutive month below 5%,” said Power.

It’s projected that consumers will spend $40.8 billion on new vehicles this month. This would be the fifth-highest on record for the month of August. Total retailer profit per unit, inclusive of grosses and finance & insurance income, should reach an all-time high of $4,430, an increase of $2,321 from a year ago and the second consecutive month above $4,000. Grosses have been above $3,000 for four consecutive months. Despite the supply constrained retail sales pace, total aggregate retailer profits from new-vehicle sales are projected to be $4.4 billion, the fourth-highest on record and up a remarkable 133% from August 2019. August is on track to be the fourth consecutive month for aggregate retailer profits on new vehicle sales to exceed $4 billion, according to Power.

“These record-breaking pricing and profitability results continue to be assisted by exceptionally strong trade-in values as well as comparatively low interest rates. Average trade-in values trending towards $7,715, an increase of $3,184—or 70%—from a year ago are being driven by robust used-vehicle prices. The average interest rate for new-vehicle loans in August is expected to decrease approximately 14 basis points to 4.17% from 4.31% a year ago, but down 128 basis points from August 2019. While average transaction prices are trending to be nearly 16% higher this month than in August 2020, the average monthly finance payment is on pace to be up 10.0%, or $58 to $638 during the same period due to the combination of high trade equity as well as relatively low interest rates,” said Power.

“Global light vehicle demand remains under pressure from the severe inventory constraints caused by the semiconductor shortage as well as disruption from the COVID-19 Delta variant. Global volume in July was off 5% from July 2020 and down 9% from July 2019. The selling rate came in at 83.2 million units, down 5 million from July 2020 but only 0.3 million units down from our expectations. Western Europe saw the largest decline of major markets, falling 24% from July 2020. In addition, weakness continued in China and South Korea as both markets were down about 10%. India was the standout in July, with a year-over-year increase of 48%. Looking at August, we expect volume to slip another 7% from August 2020, and the selling rate is expected to come in at 82 million units, down 7 million units from a year ago,’ said Jeff Schuster, president, Americas operations and global vehicle forecasts, LMC Automotive.

“The one-two punch of inventory shortages and the pandemic are holding back the pace of the global recovery and may lead to permanently lost recovery volume as the effect is expected to last into 2022. The lack of sufficient production volume is the major reason we forecast a 2-million-unit reduction to 83.8 million units in global light-vehicle sales for 2021. Volume is expected to increase just 8% from 2020. The year 2022 has been pulled down slightly, as well, but is still expected to recover to 91.7 million units—which is back to the pre-pandemic level—but further downside risk remains high,” Shuster concluded.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.