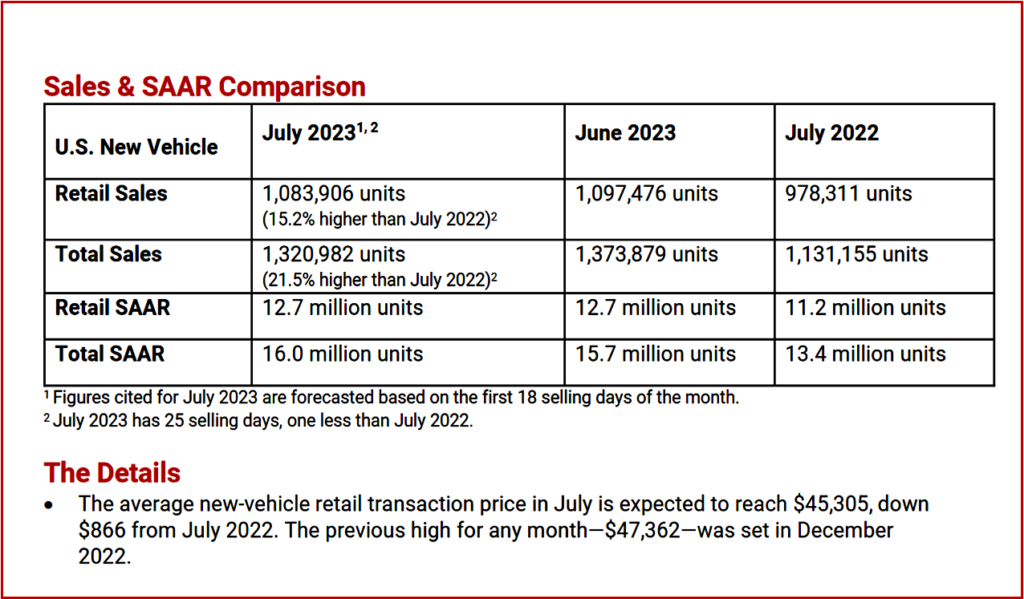

Total new-vehicle sales for July 2023, including retail and non-retail transactions, are projected to reach 1,320,982 units, a 21.5% increase from July 2022, according to a joint forecast released today from J.D. Power and GlobalData.* Total sales of new vehicles this month are expected to reach 1,320,982 units, a 21.5% increase compared with July 2022 when adjusted for selling days.

Bidenomics is clearly working in AutoInformed’s point of view. (July 2023 has 25 selling days, one less than July 2022.) Comparing the same sales volume without adjusting for the number of selling days translates to an increase of 16.8% year-over-year. The seasonally adjusted annualized rate (SAAR) for total new-vehicle sales is expected to be 16 million units, up 2.6 million units from July 2022.

In spite of the Federal Reserve Bank’s best efforts to sink the economy, inflation is dropping, employment is up and consumers are spending.

“July continues the prevailing theme of robust sales growth thus far in 2023, facilitated by amplified vehicle production and pent-up consumer demand. July year-to-date total sales will be slightly more than 9.0 million units – an increase of 14.4% from a year ago, but still below pre-pandemic sales levels, which were north of 9.8 million. As sales volumes improve, the average new-vehicle retail transaction prices are declining modestly, down 1.9% from July 2022,” said Thomas King, president of the data and analytics division at J.D. Power.

July Forecast Details

- The average new-vehicle retail transaction price in July is expected to reach $45,305, down $866 from July 2022. The previous high for any month,$47,362, was set in December 2022.

- Average incentive spending per unit in July is expected to reach $1,888, up from $977 in July 2022. Spending as a percentage of the average MSRP is expected to increase to 3.7%, up 1.7 percentage points from July 2022.

- Average incentive spending per unit on trucks/SUVs in July is expected to be $1972, up $1045 from a year ago, while the average spending on cars is expected to be $1648, up $798 from a year ago.

- Retail buyers are on pace to spend $46.3 billion on new vehicles, up $2.7 billion from July 2022.

- Truck/SUVs are on pace to account for 77.9% of new-vehicle retail sales in July.

- Fleet sales are expected to total 237,076 units in July, up 61.3% from July 2022 on a selling day adjusted basis. Fleet volume is expected to account for 17.9% of total light-vehicle sales, up from 13.5% a year ago.

- Average interest rates for new-vehicle loans are expected to increase to 7.1%, 180 basis points higher than a year ago.

“With a record score of 51 on the J.D. Power EV Index, EVs are more than halfway to achieving parity with gas-powered vehicles. Affordability remains the top factor, improving by one point to a score of 95. Interest and adoption also rise, as the EV market share in June reached an all-time high of 8.6%,” said Elizabeth Krear, vice president, electric vehicle practice at J.D. Power. “This begs the question, how does a record EV Index, supported by record EV retail share, fit with reports that EV inventory is growing rapidly? While EV inventory has more than doubled to 6.7% from 3.3% a year ago, that’s only half of the story. Consumers are buying more EVs, but Tesla’s aggressive price cuts in pursuit of market share have increased its EV lead. Retail share for all other EVs in June ended at 3.0%, an increase of only 0.9 percentage points from a year ago. Tesla, however, has grown 1.9 percentage points to 5.6%.”

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

US July Vehicle Sales Forecast Up Significantly Again

Total new-vehicle sales for July 2023, including retail and non-retail transactions, are projected to reach 1,320,982 units, a 21.5% increase from July 2022, according to a joint forecast released today from J.D. Power and GlobalData.* Total sales of new vehicles this month are expected to reach 1,320,982 units, a 21.5% increase compared with July 2022 when adjusted for selling days.

Bidenomics is clearly working in AutoInformed’s point of view. (July 2023 has 25 selling days, one less than July 2022.) Comparing the same sales volume without adjusting for the number of selling days translates to an increase of 16.8% year-over-year. The seasonally adjusted annualized rate (SAAR) for total new-vehicle sales is expected to be 16 million units, up 2.6 million units from July 2022.

In spite of the Federal Reserve Bank’s best efforts to sink the economy, inflation is dropping, employment is up and consumers are spending.

“July continues the prevailing theme of robust sales growth thus far in 2023, facilitated by amplified vehicle production and pent-up consumer demand. July year-to-date total sales will be slightly more than 9.0 million units – an increase of 14.4% from a year ago, but still below pre-pandemic sales levels, which were north of 9.8 million. As sales volumes improve, the average new-vehicle retail transaction prices are declining modestly, down 1.9% from July 2022,” said Thomas King, president of the data and analytics division at J.D. Power.

July Forecast Details

“With a record score of 51 on the J.D. Power EV Index, EVs are more than halfway to achieving parity with gas-powered vehicles. Affordability remains the top factor, improving by one point to a score of 95. Interest and adoption also rise, as the EV market share in June reached an all-time high of 8.6%,” said Elizabeth Krear, vice president, electric vehicle practice at J.D. Power. “This begs the question, how does a record EV Index, supported by record EV retail share, fit with reports that EV inventory is growing rapidly? While EV inventory has more than doubled to 6.7% from 3.3% a year ago, that’s only half of the story. Consumers are buying more EVs, but Tesla’s aggressive price cuts in pursuit of market share have increased its EV lead. Retail share for all other EVs in June ended at 3.0%, an increase of only 0.9 percentage points from a year ago. Tesla, however, has grown 1.9 percentage points to 5.6%.”

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.