Soft sales and getting softer…

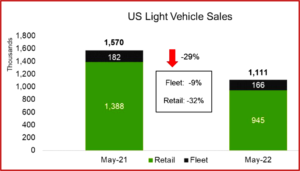

Memorial Day weekend was a bust for US light vehicle auto sales. As a result the whole auto market sped in reverse back to levels seen during the pandemic un-merry month of May 2020. May 2022 volume totaled 1.11 million units, down by -29% YoY. The annualized rate dropped by nearly 2 million units to 12.7 million units from 14.5 million in April of 2022. (AutoInformed.com on: US April Sales Up 6.5%. SAAR Down -21.9% YoY)

May had two fewer selling days in 2022, and even adjusting for the difference, sales still fell by -14% YoY. The number of vehicles sold by selling day fell to 51,900 units from 60,400 units a year ago. With prices remaining at record high levels and monthly payments increasing as interest rates go up, retail sales are looking soft. Retail sales fell to ~945,000 units, down by -32% YoY. Fleet sales were also down in the yearly comparison, but they represented for 14.9% of total sales, up from 11.6% a year ago.

Click to Enlarge.

According to J.D. Power, average incentive spending per unit in May 2022 is expected to be just $965.Larger luxury mixes of vehicles, combined with low incentive spending, has moved transaction prices higher. J.D. Power expects the average transaction price in May 2022 to total $44,832, a record for the month of May and up 15.7% year-over-year.

High values for consumers’ trade-ins have increased the equity they have in those vehicles and that higher equity has helped keep average new-vehicle monthly payments from increasing as much as new-vehicle transaction prices over the past year. According to J.D. Power, the average monthly payment for a new-vehicle finance contract is expected to hit a record high of $687, up $90 from May 2021.

“That payment increase represents a year-over-year increase of 15.1%, still below the 15.7% increase year-over-year increase in transaction prices. Looking ahead, we expect that interest rates on new- and used-vehicle finance contracts will increase throughout the rest of the year as the Fed increases the federal funds rate in its effort to combat inflation. The Fed’s two interest rate increases this year, totaling 75 basis points, have already pushed rates higher. J.D. Power says that the average interest rate on a new-vehicle finance contract in May 2022 is expected to be 4.92%, up 62 basis points year-over-year,” observed Patrick Manzi, chief economist of the National Automobile Dealers Association.

“Headwinds continue to stack against a sustained market recovery and stability in vehicle supply. We expect the economy and auto market to remain plagued by volatility for the foreseeable future. Given the elevated risk, it is plausible for 2022 to turn to negative from the 2021 level, with volume down to 14.7 million units. The auto industry will continue to have to manage lean inventory and an increasing possibility of a recession in 2023, so the near-term outlook has once again tilted negative,” said Jeff Schuster, President, Americas Operations and Global Vehicle Forecasts, LMC Automotive, now part of GlobalData.

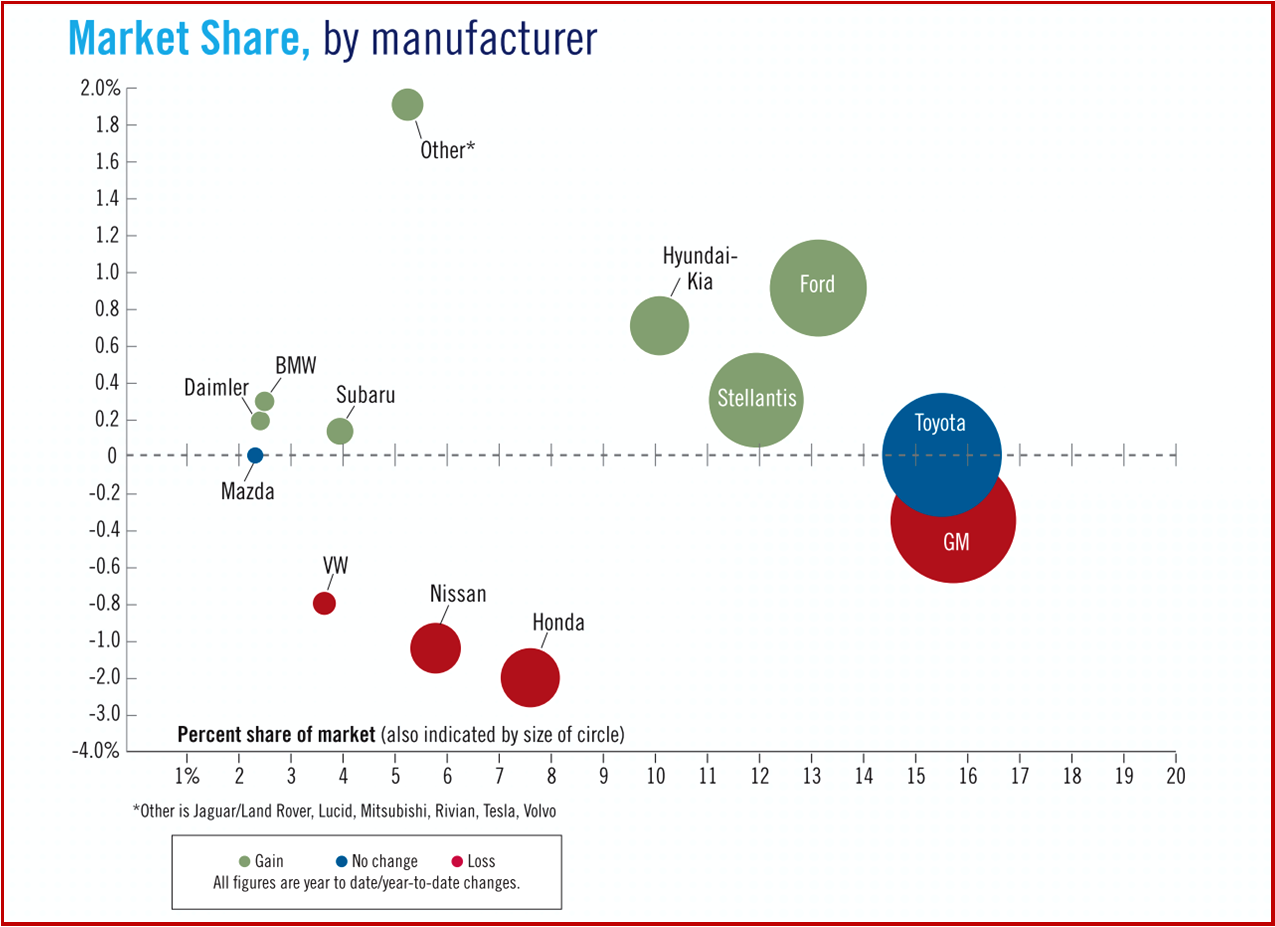

General Motors led the market once again. However, Toyota is a threat. The difference between the giants was a mere 5,000 units, down from 16,000 in April. Among other large OEMs, Ford had the best performance, but mainly due to poor May 2021 results. Ford has still fallen behind its competitors in the sales ranking.

“The Chevrolet Silverado was the best-selling model for the second consecutive month, and the Toyota brand was ahead of Ford by more than 12,000 units. Through May, Toyota is in front of Ford by more than 65,000 units,” added Augusto Amorim, Senior Manager, Americas Vehicle Sales Forecasts, LMC Automotive.

Large Pickups remained the third largest segment of the industry – behind Midsize SUV and Compact SUV – this helped Pickups gain the most share YoY. Compact models also gained ground, contributing to the body type accounting for 19% of May sales, up by 1.5 pp YoY. Cars lost the most share in May, down by 2.0 pp, as both Honda and Nissan had weak performance during the month. SUVs continue to dominate the market with a 55% share.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

US May Auto Sales – Record Prices as Sales Plunge -29%

Soft sales and getting softer…

Memorial Day weekend was a bust for US light vehicle auto sales. As a result the whole auto market sped in reverse back to levels seen during the pandemic un-merry month of May 2020. May 2022 volume totaled 1.11 million units, down by -29% YoY. The annualized rate dropped by nearly 2 million units to 12.7 million units from 14.5 million in April of 2022. (AutoInformed.com on: US April Sales Up 6.5%. SAAR Down -21.9% YoY)

May had two fewer selling days in 2022, and even adjusting for the difference, sales still fell by -14% YoY. The number of vehicles sold by selling day fell to 51,900 units from 60,400 units a year ago. With prices remaining at record high levels and monthly payments increasing as interest rates go up, retail sales are looking soft. Retail sales fell to ~945,000 units, down by -32% YoY. Fleet sales were also down in the yearly comparison, but they represented for 14.9% of total sales, up from 11.6% a year ago.

Click to Enlarge.

According to J.D. Power, average incentive spending per unit in May 2022 is expected to be just $965.Larger luxury mixes of vehicles, combined with low incentive spending, has moved transaction prices higher. J.D. Power expects the average transaction price in May 2022 to total $44,832, a record for the month of May and up 15.7% year-over-year.

High values for consumers’ trade-ins have increased the equity they have in those vehicles and that higher equity has helped keep average new-vehicle monthly payments from increasing as much as new-vehicle transaction prices over the past year. According to J.D. Power, the average monthly payment for a new-vehicle finance contract is expected to hit a record high of $687, up $90 from May 2021.

“That payment increase represents a year-over-year increase of 15.1%, still below the 15.7% increase year-over-year increase in transaction prices. Looking ahead, we expect that interest rates on new- and used-vehicle finance contracts will increase throughout the rest of the year as the Fed increases the federal funds rate in its effort to combat inflation. The Fed’s two interest rate increases this year, totaling 75 basis points, have already pushed rates higher. J.D. Power says that the average interest rate on a new-vehicle finance contract in May 2022 is expected to be 4.92%, up 62 basis points year-over-year,” observed Patrick Manzi, chief economist of the National Automobile Dealers Association.

“Headwinds continue to stack against a sustained market recovery and stability in vehicle supply. We expect the economy and auto market to remain plagued by volatility for the foreseeable future. Given the elevated risk, it is plausible for 2022 to turn to negative from the 2021 level, with volume down to 14.7 million units. The auto industry will continue to have to manage lean inventory and an increasing possibility of a recession in 2023, so the near-term outlook has once again tilted negative,” said Jeff Schuster, President, Americas Operations and Global Vehicle Forecasts, LMC Automotive, now part of GlobalData.

General Motors led the market once again. However, Toyota is a threat. The difference between the giants was a mere 5,000 units, down from 16,000 in April. Among other large OEMs, Ford had the best performance, but mainly due to poor May 2021 results. Ford has still fallen behind its competitors in the sales ranking.

“The Chevrolet Silverado was the best-selling model for the second consecutive month, and the Toyota brand was ahead of Ford by more than 12,000 units. Through May, Toyota is in front of Ford by more than 65,000 units,” added Augusto Amorim, Senior Manager, Americas Vehicle Sales Forecasts, LMC Automotive.

Large Pickups remained the third largest segment of the industry – behind Midsize SUV and Compact SUV – this helped Pickups gain the most share YoY. Compact models also gained ground, contributing to the body type accounting for 19% of May sales, up by 1.5 pp YoY. Cars lost the most share in May, down by 2.0 pp, as both Honda and Nissan had weak performance during the month. SUVs continue to dominate the market with a 55% share.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.