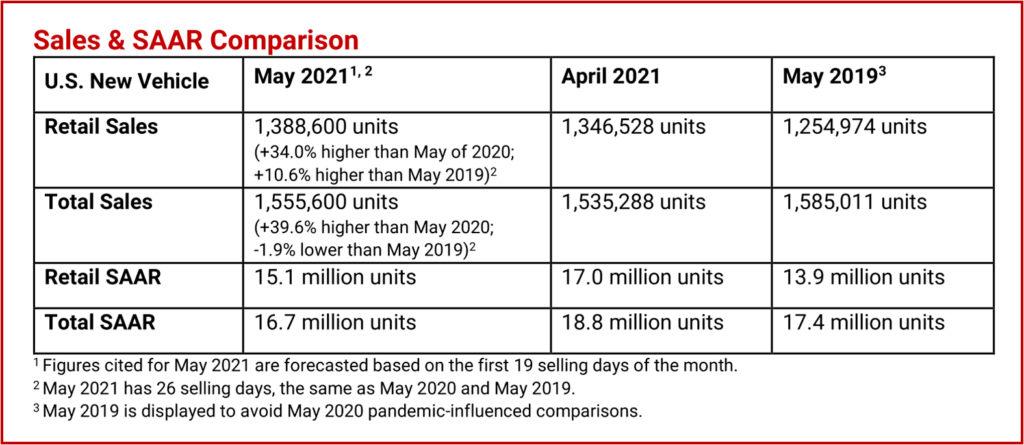

New-vehicle retail sales for May 2021 are forecast to be the highest ever recorded for the month of May, according to a joint prediction from J.D. Power and LMC Automotive. Retail sales for new vehicles could reach 1,388,600 units, a 34.0% increase compared with May 2020, and a 10.6% increase compared with May 2019. May 2021 has the same number of selling days as May 2020 and May 2019. May is usually one of the highest-volume sales months with buying activity peaking around the Memorial Day weekend when manufacturers typically offer incremental incentives.

Total new-vehicle sales for May 2021, including retail and non-retail transactions, are projected to reach 1,555,600, a 39.6% increase from May 2020 and a 1.9% decrease from May 2019. The seasonally adjusted annualized rate (SAAR) for total new-vehicle sales is expected to be 16.7 million units, up 4.7 million units from 2020 but down 0.7 million units from 2019. The overall sales results for manufacturers will be mixed. Some are experiencing greater production problems because of semiconductor shortage. This will hurt, perhaps materially in the financial sense, various manufacturers monthly sales and profit performance for May and the months to come.

“Looking forward to June, with sales continuing to outpace production in aggregate, falling inventory levels may start to put pressure on the current sales pace. However, based on what we have seen so far, retailers may continue to adapt by turning inventory more quickly to maintain sales velocity. However, regardless of inventory position, manufacturers and retailers will continue to benefit from strong consumer demand and a higher profit per unit sold,” said Thomas King, president of the data and analytics division at J.D. Power.

“This year, notwithstanding supply constraints and significantly reduced incentives from manufacturers, May 2021 will be another record-breaking month for the industry. The industry will again set records in May for monthly sales volumes and aggregate retailer profits and as well as all-time records for transaction prices, consumer expenditures and retailer gross per unit sold,” Power said.

A strong sales speed, despite smaller discounts and more expensive vehicle purchases is due in part to extremely high used-vehicle prices. Even with interest rates on vehicle loans increasing slightly, the average monthly finance payment is $596, up only $19, aided by average trade-in values rising to $6,201, an increase of $3,229 (up 108.7%) from a year ago. The average interest rate for loans in May is expected to increase 57 basis points to 4.2% from a year ago, on track for a second consecutive year-over-year increase since July 2019.

Consumers are on course to spend $53.1 billion on new vehicles this month, the highest on record for any month. Total retailer profit per unit, inclusive of grosses and finance & insurance income, are on pace to reach an all-time high of $3,245, an increase of $1,678 from a year ago and the first time above $3,000 on record. Grosses have been above $2,000 for nine of the past 10 months. Coupled with the strong retail sales pace, total aggregate retailer profits from new-vehicle sales will be $4.5 billion, the highest ever for the month of May and up an astounding 162% from May 2019, according to Power.

Global Sales Outlook for March 2021

Jeff Schuster, president, Americas operations and global vehicle forecasts, LMC Automotive:

“Global light-vehicle sales in April increased 81 % from a year ago, which is not surprising given sales in the early stages of the pandemic last April fell 45% from 2019. April’s selling rate increased to 88.1 million units, up from 87.1 million units in March and brings the year-to-date rate to 84.8 million units, still well below pre-pandemic levels. April received a boost from the vigorous US market, which nearly hit a 19-million-unit selling rate.

“In addition, Western Europe recovered significantly with an increase of 280% from a year ago. Brazil, India, and Eastern Europe also all performed well. Given China’s low point in 2020 was March, the improvement in April was subdued at just a 9% increase. South Korea is the only market that declined this April, with an 11 % decline.

“Looking at May, global sales are expected to post a strong year-on-year increase of 35%, but the selling rate looks to slip back to 82 million units and the year-to-date level. In addition to the U.S. being below the 17-million rate, India is expected to drop from a 3.9- million-unit SAAR to under one million units and China is slowing to the 25-million-unit level.

“There is becoming a clear divergence in the global auto market, with the U.S. on the verge of running out of enough sellable vehicle inventory to support the surge in consumer demand while the virus is doing its own surging across much of Asia, triggering stronger restrictions and new risk to auto sales across the region.

“Despite the strength in the U.S., the new restriction risks and flattening demand performance across Asia has resulted in a pull back of our 2021 forecast for global light-vehicle sales, the first decrease in our outlook since the recovery started. We now expect 2021 to finish at 87.5 million units, a decrease of only 500,000, but it illustrates the volatility of the market and the recovery from the pandemic,” concluded Schuster.

The Biden-Harris Administration announced (8 June 2021) key findings from the reviews directed under Executive Order (E.O.) 14017 “America’s Supply Chains,” as well as immediate actions the Administration will take to strengthen American supply chains to promote economic security, national security, and good-paying, union jobs here at home.

On February 24, 2021, the President signed E.O. 14017, directing a whole-of-government approach to assessing vulnerabilities in, and strengthening the resilience of, critical supply chains. Stemming from that effort, the Biden-Harris Administration has already begun to take steps to address supply chain vulnerabilities:

• The Administration’s COVID-19 Response Team has drastically expanded the manufacture of vaccines and other essential supplies, enabling more than 137 million Americans to get fully vaccinated.

• The Administration has also worked with companies that manufacture and use semiconductor chips to identify improvements in supply chain management practices that can strengthen the semiconductor supply chain over time.

• The Department of Defense (DOD) has announced an investment in the expansion of the largest rare earth element mining and processing company outside of China to provide the raw materials necessary to help combat the climate crisis.

• And the Biden-Harris Administration is working to address critical cyber vulnerabilities to U.S. supply chains and critical infrastructure, including issuing E.O. 14028 on “Improving the Nation’s Cyber Security” just last month.

Today, building on these efforts, the Administration released findings from the comprehensive 100-day supply chain assessments for four critical products: semiconductor manufacturing and advanced packaging; large capacity batteries, like those for electric vehicles; critical minerals and materials; and pharmaceuticals and active pharmaceutical ingredients (APIs). The Administration is taking immediate action to address vulnerabilities and strengthen resilience with the launch of a new effort aimed at addressing near-term supply chain disruptions. And, pursuant to E.O. 14017, it is crafting strategies for six industrial bases that underpin America’s economic and national security, which will be completed within a year. The supply chain reviews reinforce the need for the transformative investments proposed in the President’s American Jobs Plan.

More Here key findings