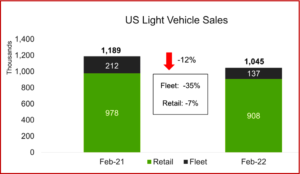

US Light Vehicle sales continued to struggle in February due to sparse inventories. According to the LMC Automotive consultancy, sales fell to 1.05 million units, down by -12% YoY. Only four of the main OEMs – Tesla, BMW, Mazda and Hyundai – had positive results during the month, which was the weakest February since 2011.

The annualized selling rate, aka SAAR, of 14.0 million units declined in both the monthly and annual comparisons. However, the February SAAR was still 1 million higher than the average rate during the second half of 2021. With the same number of selling days as in January, February’s daily average grew by ~2,000 units/day, to 43,600 units/day – it has floated above the 40,000-unit threshold since November 2021 after President Biden was elected and a recovery from the economic reverses and job losses from the Trump Administration began.

While retail has been the mainstay of the industry since the pandemic hit, fleet sales helped in February. Fleet accounted for 13% of sales, its highest share since March 2021. Retail sales fell to 908,000 units in February, or 87% of total sales. With transaction prices ~$44,500, higher content mix continues to drive higher margins.

Augusto Amorim, Senior Manager, Americas Vehicle Sales Forecasts, LMC said: “General Motors finally regained the market leadership in February, but it was ahead of Toyota by just 90 units. Yet, GM’s 15.6% market share was its lowest-ever for a month of February. Despite this title loss, Toyota’s RAV4 was the bestselling Light Vehicle, ahead of the F-150 by more than 6,000 units. The RAV4 helped Compact SUVs to be the top-selling segment – and SUVs to account for 56% of total sales. In the Premium market, Tesla was ahead of BMW for the second consecutive month. Tesla’s volumes doubled from a year ago and drove the Premium gain of 1.5 pp of market share, to a February record of 15.3%.”

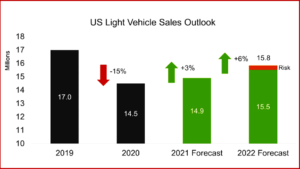

Jeff Schuster, President, Americas Operations and Global Vehicle Forecasts, LMC Automotive noted: “Risks and disruptions have been stacking against auto sales since the beginning of the pandemic. The added geo-political headwind from the Russia/Ukraine conflict not only could have material short-term impact on the supply of vehicles and parts in various markets but it could impact economic growth and consumer’s willingness and ability to purchase a vehicle in the US. There may also be evidence of weaning demand at the current price levels, and pricing pressure will not likely see relief in the near-term. Aside from other variables, the chip shortage remains the top concern and could negatively impact the expected recovery pace in the second half of 2022. However, we do remain cautiously optimistic that the US auto sales outlook will improve as the year progresses.”

Nearshoring Suppliers – A Fix for Supply Chain Interruptions?

For months now, the dominant topic in the global automotive industry has been the semiconductor shortage, which has affected many of the world’s key markets. As production lines have been intermittently halted or at least slowed, inventory has declined, putting a brake on what would otherwise have been a robust sales recovery in 2021. North America has been no exception, but what solutions might help the region to avoid such crises reoccurring in the future?

There are various possible answers to that question, including better supply chain management and building larger inventories – though the latter option seems unlikely to be considered an efficient use of resources. A central feature of the changing North American landscape is the increased desire to see chip manufacturing take place within the region. For example, Intel recently announced a US$20 bn investment in an Ohio chip factory, while Samsung committed US$17 bn to build a facility in Texas.

For the North American auto industry, “nearshoring” – where suppliers are located close to, but not in, the destination market, may be part of the long-term answer to its recent problems. The Mexican government is seeking to encourage increased chip manufacturing within its borders, and the topic has been discussed in meetings with the US.

However, to date, there has been little to report in terms of concrete moves to invest in production facilities within Mexico. Arguably, the administration of Andrés Manuel López Obrador may be an impediment to progress, as it has developed a reputation for erratic policy decisions which appears to have reduced investor confidence. Another obstacle could be the fact that chip production requires a large amount of water, a resource which is relatively scarce in the northern Mexican states where many of the country’s auto plants are located. Therefore, the possibility of chip factories being built in Mexico’s water-rich southern states has been raised. This would represent a major boon for the area, which is generally much poorer than the north of the country.

Mexico has played a part in the semiconductor business for decades, but mainly in packaging chips, the final stage in their production, rather than the actual fabrication of semiconductor wafers. In 2019, Mexico exported US$691 mn of semiconductors, of which 71% went to the USA. However, this only represented 4.5% of the US’s semiconductor imports. Developing the industry in Mexico would make sense, as it would reduce lead times and provide greater security to the supply chain, rather than relying on East Asian countries for chips, as is often the case currently. The lower cost of labor traditionally associated with Mexico is another obvious advantage.

None of this provides a quick-fix solution. Any new plant construction is a major undertaking, and it would be years before any chips were being produced and making their way into vehicles. By that time, it is highly likely that the current crisis will be over, and there is a risk that the additional chip production capacity could be superfluous. Nevertheless, with chips set to be a key component for vehicles and many other products for the foreseeable future, bringing their manufacture closer to home seems to be a worthwhile endeavor.

David Oakley is Senior Analyst, Americas Sales Forecasts for the respected LMC Automotive Consultancy. See https://lmc-auto.com/ – editor