Our friends from the Center for Automotive Research e-mailed to say what readers might expect from the new USMC that will likely supersede NAFTA – aka NAFTA Lite at AutoInformed. The United States-Mexico-Canada Agreement or USMCA – and automakers, suppliers. Policymakers are trying to understand the 1800+ pages of text released by the U.S. Trade Representative on 30 September 2018. “While there is a lot that is different in this new agreement about automotive trade, there are some things that remain the same,” CAR notes.

AutoInformed agrees that the text offers greater certainty about the future of North American automotive production, trade, and investments, the USMCA still must be signed, ratified, and the enabling legislation must be passed in each of the three countries before the agreement can go into effect on the target date of 1 January 2020. It’s by no means a sure bet.

What has not changed?

A few significant things did not change between NAFTA and the USMCA. There is still a tri-lateral trade deal, and there are specific rules of origin (ROO) for automotive and automotive parts trade. Some other parts of the original NAFTA remain mostly intact including the dispute resolution mechanism known as “Chapter 19” (now Chapter 31).

What has changed?

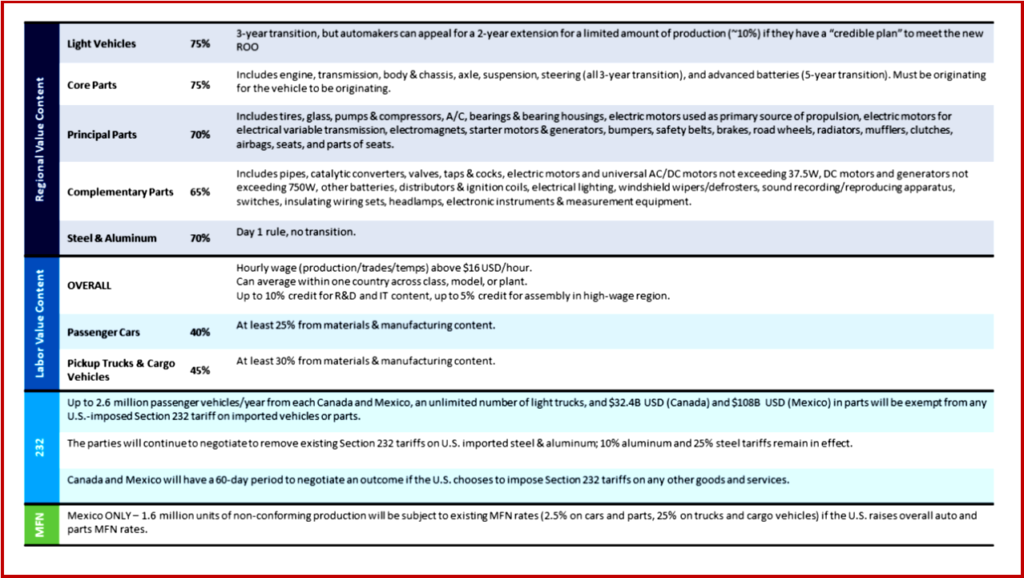

Instead of the 62.5% North American content hurdle in NAFTA, USMCA has a regional value content (RVC) threshold for vehicles and three categories of automotive parts: core, principal, and complementary.

AutoInformed notes that Only three vehicles imported to the U.S. — Nissan Versa, Audi SQ5 and the Fiat 500 — are above that 62.5% threshold and below the new 75% requirement. Those three vehicles sold a combined 177,097 units in the U.S. last year, according to Mexican manufacturing publication Manufactura.

There is a new RVC for North American steel and aluminum content and a new labor value content (LVC) rule that states that 40% of a passenger vehicle and 45% of a pickup or cargo vehicle must be made by hourly workers who earn a wage of US $16/hour or more un-adjusted for inflation so that it becomes meaningless over time.

Automakers can earn up to 10% credit toward the LVC from R&D and information technology work done in the region where the production takes place, and a 5% credit toward the LVC for assembling the vehicle in a high-wage region in North America.

Side Deals

Canada and Mexico also negotiated so-called side letters that mostly exempt light vehicle and parts exports to the United States from potential national security tariffs under Section 232 of the Trade Expansion Act of 1962.

CAR says Canada and Mexico can each send up to 2.6 million vehicles to the U.S. market without incurring Section 232 tariffs if the United States imposes these tariffs. There is no limit on the number of trucks that the countries can export to the U.S. market, and parts exports are limited to US$32.4B for Canada and US$108B for Mexico. For comparison, 2017 U.S. parts imports from Canada were US$15.8B and from Mexico were US$53.1B.

Mexico also negotiated provisions that exempt USMCA non-conforming automotive exports from any increases in the U.S. Most Favored Nation (MFN) tariff rates that the U.S. must offer to all members of the World Trade Organization. Under this provision, up to 1.6 million vehicles that do not meet the USMCA ROO, RVC, or LVC will be grandfathered in at the current 2.5% tariff rate for passenger cars and automotive parts and 25%t tariff for pickup trucks and cargo vehicles.

The Mexican government announced that 32% of that country’s current vehicle output does not conform to the new USMCA rules – about 780,000 vehicles, well under the 1.6 million cap.

What happens next?

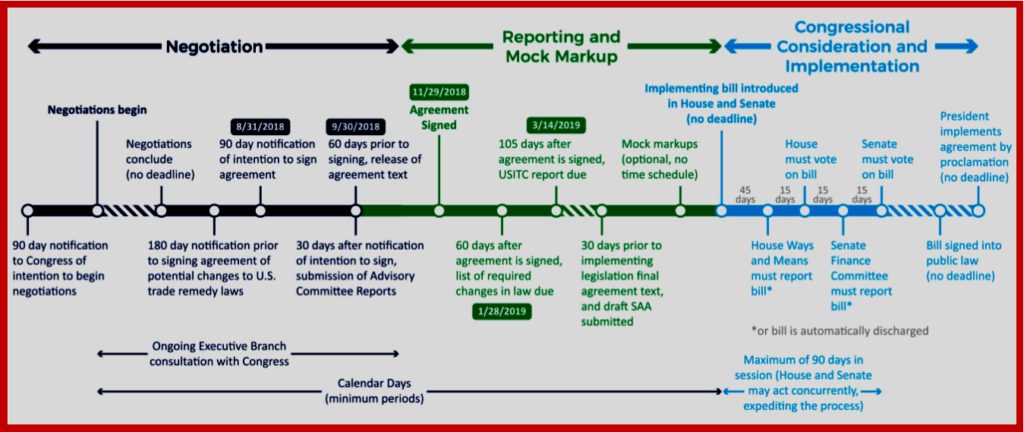

Canadian, Mexican, and U.S. leaders are expected to sign the USMCA while attending the G20 summit in Buenos Aires in November 2018. Signing the agreement is an essential step before the deal can be entered into force, but much more must be done in each of the three countries before the USMCA can become law, accoring to CAR.

In Mexico, the legislative process to ratify the deal and enact the enabling legislation is expected to be quick. The deadlines to notify the U.S. Congress of the agreement on 31 August 2018 and release the text of the agreement on 30 September 2018 were all aimed at getting the USMCA approved by outgoing Mexican President Enrique Peña Nieto who leaves office on 1 December 2018.

In Canada, the USMCA must be approved by the Cabinet and considered by the Parliament, which is comprised of the House of Commons, the Senate, and the Sovereign. The Parliament will make necessary legislative and regulatory changes, and the deal must receive “royal assent” (approval by the Governor General). The only hard timeline in this process is that the House of Commons must sit with the agreement for 21 days of consideration and debate before moving forward. Canada holds federal elections in October 2019 – so for USMCA to go into effect on 1 January 2020, Canada will likely have to complete the ratification process before the election.

In the United States, the Congress is considering the USMCA under the Trade Promotion Authority (TPA) rules which set out milestones that are required to “fast track” the legislation (receive an up/down vote in the Congress without amendments).

A critical milestone is that the TPA requires a report on the economic impact of the trade deal from the U.S. International Trade Commission within 105 days after the agreement is signed (which would be in mid-March 2019 if the parties sign the deal at the end of November 2018).

Republicans in Congress are considering trying to pass the bills in 2018 during a lame duck session of Congress, but it is not certain that the ITC report would be available that quickly. The Congress could vote to modify the rules and not require the ITC report for passage to meet a more aggressive timeline. Without strong bipartisan support for the deal, the normal timeline is more likely, and the 116th Congress that takes office in January 2019 will likely be the one that considers the agreement.

IndustriALL Global Union, in consultation with its trade union affiliates in the base metals sector, has issued the following statement in relation to the U.S. government’s recent decisions on tariffs on steel and aluminum imports which take effect today 23 March.

IndustriALL affiliates represent millions of base metals workers in leading countries in the sector including in Argentina, Australia, Brazil, Canada, across the EU, India, Japan, Kazakhstan, Korea, Mexico, Russia, South Africa, Turkey, Ukraine and the U.S.

IndustriALL Global Union’s 2nd Congress in Rio de Janeiro in October 2016 intensively debated trade issues. According to the unanimously adopted Political Resolution, “IndustriALL Global Union must play a leading role within the global trade union movement and wider society to advocate our vision of fair global trade that works for all.”

In addition, the Political Resolution states: “Trade and investment must ensure a more equitable redistribution of wealth between and within countries and must reject a failed neo-liberal economic ideology based on deregulation, liberalisation and privatisation that this new generation of trade agreements still supports. We call for a new global debate on a fair trading framework that safeguards democratic standards and the public interest, and has the scope for social policy that puts people first.”

The U.S. Government announced in early March that it would impose tariffs of 25% on imports of steel and tariffs of 10% on imports of aluminum in order to protect U.S. national security. As of 23 March, the day the tariffs are to go into effect, the U.S. has exempted, often for uncertain reasons and an uncertain period without a clear connection to national security, the following countries from these tariffs, with the understanding the exemptions may end if governments of these countries don’t offer some other uncertain concessions to the U.S. government in separate negotiations – Argentina, Australia, Brazil, Canada, the EU, Mexico and South Korea.

In these circumstances, IndustriALL Global Union and affiliated unions in the base metals sector worldwide reiterate once again their call for a fair global trade that works for all, and increased efforts to combat the persistent global problem of steel and aluminum overcapacity. Although we strongly support efforts to preserve and create jobs in the steel and aluminum industries, we criticize the implementation of tariffs which, as in this case, are indiscriminate, unilateral, and unfair and can provoke a trade war. IndustriALL Global Union reiterates its call for a system of fair global trade that works for all and that builds on the principle of cross-border worker solidarity.

Although global steel and aluminium markets have improved somewhat since our unions released a Declaration on the Global Steel Crisis at the IndustriALL Global Union’s World Base Metals Conference in November 2016, steel and aluminum workers around the world continue to be threatened by overcapacity. This overcapacity is overwhelmingly in China, which continues to unfairly subsidize its steel and aluminium industries, and which continues to dump steel and aluminum in our countries, sometimes shipping it indirectly through third countries.

We therefore reiterate, from the Declaration, our “call for urgent action to protect our jobs and communities from the current wave of industrial destruction that is wiping out industrial jobs on a global scale and systematically eroding workers’ rights and working conditions.”

While it is obvious that pragmatic and daily attempts cannot be sustainable solutions, “complex political problems can only be solved by multilateral political initiatives” as stated in the Political Resolution from our 2nd Congress. In this context, it is critically important to seek viable rules and regulations for global trade instead of seeking temporary ways out such as exemptions. It can never be possible to find a proper way forward in between protectionism and dumping.

We are committed to encouraging multilateral negotiations and to making all necessary efforts to avoid triggering a global trade war, a war in which workers around the world stand to lose the most.

Our governments must coordinate efforts in international forums such as the OECD Steel Committee and the Global Forum on Steel Excess Capacity to pressure China to reduce its capacity, to end unfair practices that create overcapacity, and to prevent overcapacity from emerging or increasing in other countries. IndustriALL Global Union will continue to support those efforts, continue to participate in the OECD Steel Committee, and will continue to seek to open the Global Forum on Steel Excess Capacity to trade union participation.

We commit to demanding our governments take strong actions to defend our unions’ members against unfairly traded steel and aluminum, while urging our governments to ensure that those actions do not harm steel and aluminum workers who are also threatened by that overcapacity.

We also demand our governments put industrial policies in place to preserve and create jobs in the steel and aluminum industries. We must work to strengthen the internal consumption of certain regions of the world where consumption per capita is low in order to minimize dependence on international decisions and to promote local development.

We further commit to increasing collaboration among our unions in combating the problem of global overcapacity of steel and aluminum. This collaboration will help to ensure the overcapacity does not serve to divide and thereby weaken us, but rather our global union power and solidarity is strengthened.

Details of USMCA are still being absorbed, and auto manufacturers in particular are assessing how they will be impacted by new requirements and standards. Dealers, for the most part, are hopeful that these recent developments are a positive sign that we are putting some of the instability surrounding trade in our rear view mirror. While KORUS and USMCA do offer details and stability, the threat of damaging 25 percent tariffs on imported autos and auto parts remains, as part on an ongoing Department of Commerce 232 investigation. All eyes now are on President Trump and his trade negotiators, as they (hopefully) work to come to trade agreements with Japan and the EU. If we can open dialogue and secure pacts with those trading partners, we’ll be moving in a positive direction

FCA US LLC appreciates the tireless efforts of the U.S., Mexican and Canadian negotiators to reach an agreement. While we still need to review the final text carefully, we expect – based on discussions with the negotiators – that the new United States-Mexico-Canada Agreement will allow FCA’s North American production to remain competitive at home and in export markets around the world.