American becoming less great again as Chinese tariffs backfire on the beleaguered, inconsistent and chaotic Trump mis-Administration.

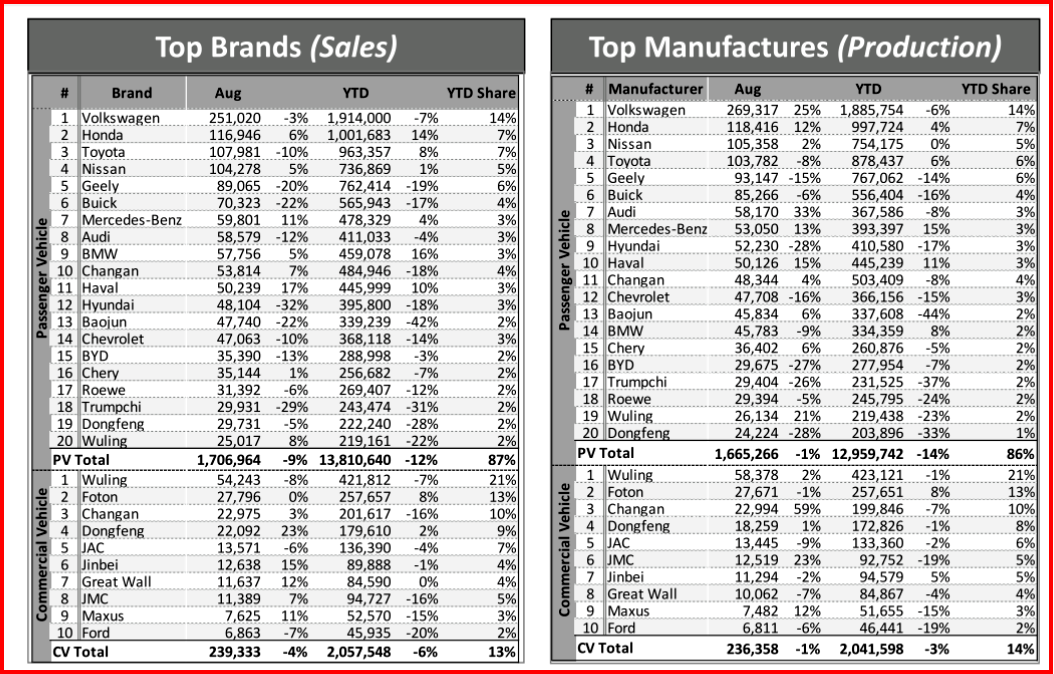

China’s Passenger Vehicle (PV) wholesale sales) in August fell by -8.6% year-on-year (YoY) to 1.71 mn units, while the Light Commercial Vehicle (LCV) segment contracted by -4.0% YoY to 0.24 mn units. The overall Light Vehicle (LV) market ended the month with a decline of 8.1% YoY, on total sales of 1.80 mn units, says consultancy LMC.

Chinese passenger production improved in August, with a drop of -0.7% to 1.66 mn units, recovering from the double-digit declines seen in recent months. LCV output fell by – 0.9% to 0.24 mn units. LV output was down by 0.8% YoY, on total build of 1.90 mn units. Now that vehicle stocks have been unwound, OEMs no longer are carrying bloated inventories and are preparing to resume normal production rhythms, says LMC. However, LMC decided to make a further cut to the passenger vehicle growth forecast for 2019, from -5.5% to -7.4%. This is bad news for the global economy in general and the Detroit Three.

Click to Enlarge.

However, the seasonally adjusted annualized rate (SAAR) of LV sales in August was 27.2 mn units. This nominal uptick (+0.4%) from July suggests that although the market is relatively stable, it lacks strong upward momentum. To fix the decline in the overall auto market, the central government in Beijing has issued a variety of documents since the end of last year. Proposals to stimulate demand range from encouraging more widespread vehicle usage in rural areas to liberalizing purchasing restrictions.

Nonetheless, LMC observes, the plan to encourage sales in the countryside has not received any specific financial support since it was first put forward. So, not only has it failed in its original purpose to stimulate consumption, it has also encouraged potential buyers in the rural-urban fringe to hold back on vehicle purchases, which has had a negative impact on the overall market.

The policy aimed at relaxing purchasing restrictions is not unique because the government has made several similar moves in the past. The take-up by local governments has been lackluster so far. In fact, only Guangzhou, Shenzhen and Guiyang have adhered to the recommendations, while other cities where driving restrictions are in place are still studying their responses.

Vehicle insurance data for August indicate that retail demand for domestic vehicles contracted by around 18% Year-over-Year, the second consecutive month of decline, following the anomalous spike in retail sales in June. Although LMC expected a decline in August, the drop was much sharper than anticipated. The surge in demand in June clearly pulled sales ahead from July and August, even though the discounts and promotions on State V models did little to encourage the spike in June, as we pointed out in our last report.

A closer look at the retail sales numbers for domestically made vehicles shows that the overall market declined by 2.9% in the first eight months of the year, largely as a result of a drop demand in the lower-tier cities. Retail sales in the year to August contracted in Tier 4 (-6.4%), Tier 5 (-5.9%) and Tier 6 (-5.4%) cities as they continued to suffer from the payback effect of the cut to the purchase tax incentive. Tier 1 and Tier 3 cities, in contrast, saw sales rise by 3.4% and 0.9%, respectively. Surprisingly, sales in Tier 2 cities declined, which warrants further attention.

Exports make up a large proportion of the local economy of several Tier 2 cities. The decline in vehicle demand in August could be an indication that the recent escalation in the US-China tariff war has started to directly impact the market, building on the unease that had been felt since the start of the retaliatory dispute.

With the negative effects of the Trump trade war spreading, demand for supportive government measures is gathering steam as the industry seeks to avoid further pressure on the market in the months ahead. “Judging by the central government’s initiatives in the year so far, however, we are not holding our breath in the expectation of strong supportive policies in the short term,” says LMC.

The impact of the sluggish retail sales result in August will be to delay a recovery in the wholesale market. When factoring in the expectation of weak supportive government measures, LMC decided to make a further cut to the PV growth forecast for 2019, from -5.5% to -7.4%.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Weak Chinese Retail Sales in August Delay Recovery

American becoming less great again as Chinese tariffs backfire on the beleaguered, inconsistent and chaotic Trump mis-Administration.

China’s Passenger Vehicle (PV) wholesale sales) in August fell by -8.6% year-on-year (YoY) to 1.71 mn units, while the Light Commercial Vehicle (LCV) segment contracted by -4.0% YoY to 0.24 mn units. The overall Light Vehicle (LV) market ended the month with a decline of 8.1% YoY, on total sales of 1.80 mn units, says consultancy LMC.

Chinese passenger production improved in August, with a drop of -0.7% to 1.66 mn units, recovering from the double-digit declines seen in recent months. LCV output fell by – 0.9% to 0.24 mn units. LV output was down by 0.8% YoY, on total build of 1.90 mn units. Now that vehicle stocks have been unwound, OEMs no longer are carrying bloated inventories and are preparing to resume normal production rhythms, says LMC. However, LMC decided to make a further cut to the passenger vehicle growth forecast for 2019, from -5.5% to -7.4%. This is bad news for the global economy in general and the Detroit Three.

Click to Enlarge.

However, the seasonally adjusted annualized rate (SAAR) of LV sales in August was 27.2 mn units. This nominal uptick (+0.4%) from July suggests that although the market is relatively stable, it lacks strong upward momentum. To fix the decline in the overall auto market, the central government in Beijing has issued a variety of documents since the end of last year. Proposals to stimulate demand range from encouraging more widespread vehicle usage in rural areas to liberalizing purchasing restrictions.

Nonetheless, LMC observes, the plan to encourage sales in the countryside has not received any specific financial support since it was first put forward. So, not only has it failed in its original purpose to stimulate consumption, it has also encouraged potential buyers in the rural-urban fringe to hold back on vehicle purchases, which has had a negative impact on the overall market.

The policy aimed at relaxing purchasing restrictions is not unique because the government has made several similar moves in the past. The take-up by local governments has been lackluster so far. In fact, only Guangzhou, Shenzhen and Guiyang have adhered to the recommendations, while other cities where driving restrictions are in place are still studying their responses.

Vehicle insurance data for August indicate that retail demand for domestic vehicles contracted by around 18% Year-over-Year, the second consecutive month of decline, following the anomalous spike in retail sales in June. Although LMC expected a decline in August, the drop was much sharper than anticipated. The surge in demand in June clearly pulled sales ahead from July and August, even though the discounts and promotions on State V models did little to encourage the spike in June, as we pointed out in our last report.

A closer look at the retail sales numbers for domestically made vehicles shows that the overall market declined by 2.9% in the first eight months of the year, largely as a result of a drop demand in the lower-tier cities. Retail sales in the year to August contracted in Tier 4 (-6.4%), Tier 5 (-5.9%) and Tier 6 (-5.4%) cities as they continued to suffer from the payback effect of the cut to the purchase tax incentive. Tier 1 and Tier 3 cities, in contrast, saw sales rise by 3.4% and 0.9%, respectively. Surprisingly, sales in Tier 2 cities declined, which warrants further attention.

Exports make up a large proportion of the local economy of several Tier 2 cities. The decline in vehicle demand in August could be an indication that the recent escalation in the US-China tariff war has started to directly impact the market, building on the unease that had been felt since the start of the retaliatory dispute.

With the negative effects of the Trump trade war spreading, demand for supportive government measures is gathering steam as the industry seeks to avoid further pressure on the market in the months ahead. “Judging by the central government’s initiatives in the year so far, however, we are not holding our breath in the expectation of strong supportive policies in the short term,” says LMC.

The impact of the sluggish retail sales result in August will be to delay a recovery in the wholesale market. When factoring in the expectation of weak supportive government measures, LMC decided to make a further cut to the PV growth forecast for 2019, from -5.5% to -7.4%.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.