Click to Enlarge.

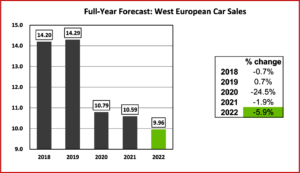

The Western Europe selling rate decreased to 10.5 million units/year in September, from 12.4 million in August the LMC Automotive* consultancy said today.

Western European countries continue to be afflicted with supply problems. Compared to September 2021, registration numbers grew by 7.6% to 953,000 units. The year-to-date (YTD) selling rate was up a tad, but remains flat at 10.0 million units/year, with a 6% drop compared to 2021.

The German Passenger Vehicle selling rate in September slipped to 2.6 million units/year from a year-long high of 2.9 million units/year in August. In the UK, the PV selling rate fell from 2.3 million units/year in August to 1.3 million units/year. The French PV selling rate also eased back from the August figure of 1.9 million units/year to 1.7 million units/year in September. In Italy, the PV selling rate dropped from 1.8 million units/year in August to 1.4 million units/year in September.

Unlike the others, the Spanish PV selling rate improved again in September as for the first time in 2022, it climbed above the 1-mn unit/year mark, around 50k up on the August SAAR.

“The 2022 forecast remains relatively flat at 10.0 million units with strong signs that the selling rate will strengthen for the remainder of the year. Although supply constraints are still dictating the pace of vehicle sales, demand is also being eroded by low consumer confidence, high inflation, rising energy prices and contractionary monetary policy. For 2023, while we expect supply-side disruptions to ease, there is a greater likelihood that falling demand will supersede supply factors as the main barrier to sales,” LMC said.

LMC Automotive

*LMC Automotive is a respected independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s clients from around the globe include car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group. LMC is the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, see www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Western Europe Car Sales Plunge in September

Click to Enlarge.

The Western Europe selling rate decreased to 10.5 million units/year in September, from 12.4 million in August the LMC Automotive* consultancy said today.

Western European countries continue to be afflicted with supply problems. Compared to September 2021, registration numbers grew by 7.6% to 953,000 units. The year-to-date (YTD) selling rate was up a tad, but remains flat at 10.0 million units/year, with a 6% drop compared to 2021.

The German Passenger Vehicle selling rate in September slipped to 2.6 million units/year from a year-long high of 2.9 million units/year in August. In the UK, the PV selling rate fell from 2.3 million units/year in August to 1.3 million units/year. The French PV selling rate also eased back from the August figure of 1.9 million units/year to 1.7 million units/year in September. In Italy, the PV selling rate dropped from 1.8 million units/year in August to 1.4 million units/year in September.

Unlike the others, the Spanish PV selling rate improved again in September as for the first time in 2022, it climbed above the 1-mn unit/year mark, around 50k up on the August SAAR.

“The 2022 forecast remains relatively flat at 10.0 million units with strong signs that the selling rate will strengthen for the remainder of the year. Although supply constraints are still dictating the pace of vehicle sales, demand is also being eroded by low consumer confidence, high inflation, rising energy prices and contractionary monetary policy. For 2023, while we expect supply-side disruptions to ease, there is a greater likelihood that falling demand will supersede supply factors as the main barrier to sales,” LMC said.

LMC Automotive

*LMC Automotive is a respected independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s clients from around the globe include car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group. LMC is the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, see www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.