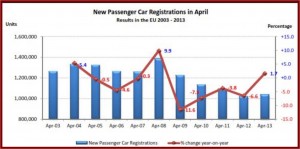

There’s no good news is in sight for the balance of 2013 and likely much longer, a problem for virtually all major automakers, including the Detroit Three who are losing billions in the Eurozone each year

As AutoInformed readers are likely aware, Western European car sales during 2013 will continue to decrease for the sixth straight year. This is bad news for shareholders and employees of the Detroit Three who are losing billions there and will continue to do so in spite of years of turnaround plans. GM has lost more than $18 billion in Europe since 1999, including $1.8 billion in 2012.

According to a new study, a flat auto market outlook in Western Europe is now a realistic scenario, as changes in demand appear to be structural rather than cyclical.

The European auto industry employs 11.6 million people or 5.3% of the EU population. The 3.2 million jobs in automotive manufacturing represent 10.2% of EU’s manufacturing employment. Motor vehicles account for more than €385 billion in tax contributions in the EU.

“Flat is the new up in Western Europe,” claims John Hoffecker, co-president of AlixPartners. “Our models show Western European sales reaching a bottom of 12 million units in 2014, and largely remaining there for the foreseeable future – far from the historical peak of 2007, when 16.8 million units were sold. On the other side of the coin, however, Central and Eastern Europe will continue to grow, adding about 2 million vehicles in the next five years.”

Austerity measures — such as those imposed in the United Kingdom, Spain and Greece — are driving a vicious cycle of spending cuts crushing economic growth, which shrinks revenues, leading to larger deficits and more spending cuts—resulting in increased debt ratios and permanent mass unemployment, according to Richard Trumca, the head of the AFL-CIO in the U.S.

The number of under-utilized assembly plants in Europe is breathtaking in an industry where using 75-80% of production capacity is required to break even. AlixPartners noted last year that an already-discomforting 40% of the top 100 plants across Europe were operating below 75% capacity. Today, that number has increased to 58% of the top 100 plants.

The situation is most critical in Italy, where the average plant utilization has fallen to 46%; France, at 62%; and Spain, at 67%. Russia, which has an average utilization of 60%, represents a special case because several older plants probably need to be taken out of production to make way for new plants needed to prepare for an expected total market growth of 28% through 2018 compared with 2012.

Read AutoInformed on:

- General Motors to Invest €4 Billion in Loss-Making Opel

- World Trade to Remain Weak in 2013 as Eurozone Drags on Economy

- Daimler Group Q1 Earnings Drop Based on EU Crisis

- Chrysler Group Q1 Profits Drop to $166 million

- Fiat Group Posts Slim €31 Million Profit in Q1

- Volkswagen Group Q1 Profit Drops as Europe Mars Results

- EU Car Sales Weak in April. Off -7% YTD

- EU Car Sales Weak in April. Off -7% YTD