The land rush of media conferences and announcements at the North American International Auto Show in Detroit early in January pretty much overwhelmed any in-depth analysis of the winners and losers in 2010’s car and truck sales.

So, herewith, are a few sales morsels to gnaw: Total U.S. car sales came to 5,988,536, surpassing “truck” sales of 5,601,738, with import brands contributing overwhelmingly to the car total. Overall, truck sales rose in concert with the economy, up from 4.7 million in 2009. As you’ll see, the new trucks on the road aren’t all driven by soccer moms like the next two types.

- Chrysler’s Town & Country and Dodge Caravan minivans totaled over 215,000 units, well ahead of either the vaunted Honda Odyssey at 108,000 or the Toyota Sienna at 98,000. The T&C alone topped all others with 112,000 reported deliveries, up from 84,600 in 2009. This is especially notable given the beating Chrysler has been taking lately.

- Ford’s Explorer, once the 800-pound gorilla of SUVs, clocked fewer than 61,000 in 2010 sales, behind such competitors as Chevrolet Traverse at nearly 107,000, Honda Pilot at 102,000, Nissan Rogue a hair under 100,000, Toyota Highlander at 92,000 and Hyundai Santa Fe 77,000, and Dodge Journey at49,000. Ford is hoping its new Explorer can reverse this ranking, and December sales of Explorer were up 53% from the same month a year earlier—but about even with Traverse, Pilot and Rogue.

- Among working trucks, once again Ford’s full-sized pickups and Econoline boxes-on-wheels led the pack. Econoline sales of 108,000 were overshadowed by the F-series’ 528,000 (Super Duty not included) and both swept past the competition. GM’s boxy Chevy Express, GMC Savana and G-vans came to only 74,000 total and there were no import brands in that market. Trailing Ford’s F-series, the Chevy Silverado pickup logged 370,000, Dodge Ram 200,000, GMC Sierra 130,000, Toyota Tacoma 106,000, Nissan Titan 23,000 and Honda Ridgeline, a pathetic 16,000. Nissan has announced it is entering the U.S. van market but they have a long way to go to match the venerable E-Series. However, Ford is moving to substitute Turkish Transit Connects for Econolines and maybe Nissan sees an opportunity there.

- Alas, small pickups seem to be almost a dying breed. Here the leader last year was Toyota Tundra at 93,000, well ahead of Ford Ranger (scheduled to end US production later this year) 55,000, Nissan Frontier 40,000, Chevrolet Colorado a bit under 25,000 and GMC Canyon 8,000. These small haulers hit the U.S. market with a bang 30 some years ago, paving the way for Japanese passenger cars in the process. You’d think they would be in demand in the ongoing quest for better fuel economy and less waste of natural resources, but that has not proven to be the case. For most pickup buyers, it is my opinion that the small ones would be wiser purchases than the big ones—but they’re just not the rage anymore. Anecdotally, I hear the Ranger plant at St. Paul, MN, is running way behind on orders by people—and fleets—not quite so willing to give the Ranger up.

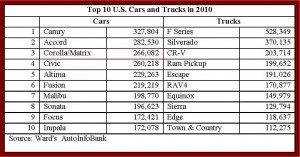

- Among passenger cars, the sales leaders in 2010 are pretty well known: Toyota Camry, 328,000; Honda Accord, 311,000; Toyota Corolla, 266,000; Honda Civic, 260,000; Nissan Altima, 229,000; Ford Fusion, 219,000; Chevrolet Malibu, 199,000; Hyundai Sonata, 197,000; Ford Focus, 172,421; Chevrolet Impala, 172,078; Hyundai Elantra, 132,000; Mazda3, 106,000, and BMW 3 Series, 101,000. Other vehicles in the over-100,000 volume category, more car-like than truck-like, include Honda CR-V, 204,000; Ford Escape, 191,000; Chevrolet Equinox, 150,000; Ford Edge, 119,000, and Kia Sorento, 109,000.

Finally, what is one to make of all these numbers?

First, as everyone knows, Japanese makes rule the passenger car market by a considerable margin, while Korean Hyundai is rising fast.

Second, up until the last couple of decades with the boom in SUVs and CUVs, trucks got little notice in overall vehicle sales analysis reports.

Third, the total sales of cars and trucks (so categorized) in 2010 came to 11.6 million, a boost of more than a million from the year before but a long way from the 16-17-million years the industry enjoyed a few years ago.

Finally, to put these matters in half-century historical perspective, in the first post-war boom year of 1955, Chevrolet registered 1,840,681 cars, all the same size and model except for a handful of Corvettes, while Ford—losing the registration race—tallied 1,547,276, all “full-sized” except for a handful of Thunderbirds. That fat year for the industry saw total registrations for all car makes of not quite 7.2 million, to which were added a mere 858,000 trucks.

Relatively few “luxury” cars were sold in 1955–240,000 (Cadillac, Imperial, Lincoln and Packard). It’s hard to say what a luxury car is in 2010/11, but if we add together my choice of the marques that make the claim, we come up with about 880,000 luxury-brand car sales in 2010; if luxury-brand trucks were added it would be another story.