Click for more.

North American automakers faced a sharp increase in tariff duties on imported vehicles in July. Analysis by Anderson Economic Group reveals more than $1.1 billion in tariffs was imposed on assembled vehicles from Canada and Mexico, and another $276 million was levied on auto parts, in the month of July 2025. In total, $1.389 billion in tariff duties was imposed on cars and auto parts from both countries. The data are from the respected Anderson Economic Group (AEG). (Read AutoInformed.com on Tariffs – Trump’s Next Economic Disaster Looming)

“Tariffs hit North American automakers hard in July,” said Patrick L. Anderson, Principal & CEO of Anderson Economic Group. “The automakers made extensive use of temporary allowances that effectively allowed an exemption for the majority of both parts and vehicles through June. That changed in July for assembled vehicles, and we can expect that these costs will become embedded into the prices consumers are paying in the very near future.”

“These costs were imposed on North American automakers and their suppliers. Automakers assembling vehicles in the United States include General Motors, Ford, Stellantis, Toyota, Honda, Hyundai, Kia, Rivian, Tesla, as well as Mercedes-Benz, Volkswagen and BMW. Many of the vehicles assembled in the United States have substantial parts content from Canada and Mexico,” AEG said in a release today.

Surge in Duties Collected from North American Vehicles

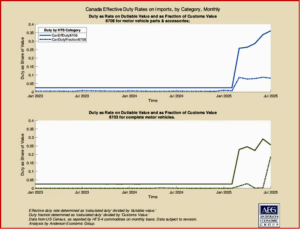

AEG reviewed the September data release by the U.S. Census Bureau and Bureau of Economic Analysis, which includes U.S. international trade statistics through July 2025. Our analysis covered auto parts and assembled vehicles from Canada, Mexico, Germany, and Japan. [More firings coming from Trump over negative facts? – AutoCrat]

“Up until June 2025, duties on Canadian vehicles remained low, as these imports were largely reported as non-dutiable. In July, however, the amount of calculated tariffs for Canadian vehicles jumped to $311 million. That represents roughly 26% of the total dutiable value. In the same month, $72 million was levied on auto parts from Canada, representing 36% of the dutiable value.

“For Mexico, $802 million, or 24% of the total dutiable value, was levied on vehicles in July. Mexican auto parts faced a total of $205 million in tariff, or about 30% of the total dutiable value. However, unlike Canada, Mexico saw a spike in the amount of tariffs collected from vehicles and auto parts earlier in April, a pattern similar to that of German and Japanese auto imports.

“Before July 2025, almost all vehicles and a large share of auto parts from Canada and Mexico were reported as exempt from tariffs. For many of these months, nearly 100% of Canadian automobiles and 80% of Canadian auto parts were not subject to duty. Mexican vehicles and parts were also insulated from tariffs to a lesser extent, with 60-70% of auto parts and 80% of vehicles qualified for tariff-free treatment. This sharply contrasted with vehicles and parts from Germany and Japan, which received very little exemptions.

“This changed dramatically in July. Within one month, the share of exempt Canadian vehicles plunged from 99% to 36%. Mexican vehicles also saw further decline in exemptions, with the share of tariff-free vehicles dropping to just 21% in July from 91% in March.

Benefits of USMCA – a Contrast with Germany and Japan

“North American automakers previously relied upon the USMCA trade agreement (and before that, NAFTA) which exempted a very large share of the voluminous trade in automobiles and parts within North America from imports. With the new tariff policies under the Trump Administration, including the executive orders and proclamations in late March and April, this changed dramatically. The data suggest that US Customs allowed automakers to claim exemptions for most vehicles under the USMCA through April, May, and some or all of June. AEG’s research notes that this is one allowable interpretation of the proclamations and executive orders issued in March and April.

“Germany and Japan did not benefit from the same exemption. Nearly all vehicles and parts from these two countries were subject to the full tariff throughout the entire period. We do not observe any sharp changes in the dutiable value or the share of imports exempt from tariffs for both countries in July 2025.

What It Means for North American Automakers

“The sharp drop in the share of vehicles exempt from tariffs marks a turning point for North American automakers, who benefited from temporary allowances in the first half of 2025. With the end of the allowances that prevailed through May and into June of this year, automakers and suppliers are now facing the tariff-related cost increases that AEG and others noted were coming as early as January of this year.

“Tariffs hit North American automakers hard in July,” said Patrick L. Anderson, Principal & CEO of Anderson Economic Group. “The automakers made extensive use of temporary allowances that effectively allowed an exemption for the majority of both parts and vehicles through June. That changed in July for assembled vehicles, and we can expect that these costs will become embedded into the prices consumers are paying in the very near future.”

“Starting in January of this year, we stated that tariffs at this level would hit suppliers, dealers, and consumers this year,” said Anderson. “With over a billion dollars in tariff costs in just one month and for just two countries, the price shock will become impossible to ignore,” said Anderson.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Trump Tariffs Hit N.A. Automakers $1.389B

Click for more.

North American automakers faced a sharp increase in tariff duties on imported vehicles in July. Analysis by Anderson Economic Group reveals more than $1.1 billion in tariffs was imposed on assembled vehicles from Canada and Mexico, and another $276 million was levied on auto parts, in the month of July 2025. In total, $1.389 billion in tariff duties was imposed on cars and auto parts from both countries. The data are from the respected Anderson Economic Group (AEG). (Read AutoInformed.com on Tariffs – Trump’s Next Economic Disaster Looming)

“Tariffs hit North American automakers hard in July,” said Patrick L. Anderson, Principal & CEO of Anderson Economic Group. “The automakers made extensive use of temporary allowances that effectively allowed an exemption for the majority of both parts and vehicles through June. That changed in July for assembled vehicles, and we can expect that these costs will become embedded into the prices consumers are paying in the very near future.”

“These costs were imposed on North American automakers and their suppliers. Automakers assembling vehicles in the United States include General Motors, Ford, Stellantis, Toyota, Honda, Hyundai, Kia, Rivian, Tesla, as well as Mercedes-Benz, Volkswagen and BMW. Many of the vehicles assembled in the United States have substantial parts content from Canada and Mexico,” AEG said in a release today.

Surge in Duties Collected from North American Vehicles

AEG reviewed the September data release by the U.S. Census Bureau and Bureau of Economic Analysis, which includes U.S. international trade statistics through July 2025. Our analysis covered auto parts and assembled vehicles from Canada, Mexico, Germany, and Japan. [More firings coming from Trump over negative facts? – AutoCrat]

“Up until June 2025, duties on Canadian vehicles remained low, as these imports were largely reported as non-dutiable. In July, however, the amount of calculated tariffs for Canadian vehicles jumped to $311 million. That represents roughly 26% of the total dutiable value. In the same month, $72 million was levied on auto parts from Canada, representing 36% of the dutiable value.

“For Mexico, $802 million, or 24% of the total dutiable value, was levied on vehicles in July. Mexican auto parts faced a total of $205 million in tariff, or about 30% of the total dutiable value. However, unlike Canada, Mexico saw a spike in the amount of tariffs collected from vehicles and auto parts earlier in April, a pattern similar to that of German and Japanese auto imports.

“Before July 2025, almost all vehicles and a large share of auto parts from Canada and Mexico were reported as exempt from tariffs. For many of these months, nearly 100% of Canadian automobiles and 80% of Canadian auto parts were not subject to duty. Mexican vehicles and parts were also insulated from tariffs to a lesser extent, with 60-70% of auto parts and 80% of vehicles qualified for tariff-free treatment. This sharply contrasted with vehicles and parts from Germany and Japan, which received very little exemptions.

“This changed dramatically in July. Within one month, the share of exempt Canadian vehicles plunged from 99% to 36%. Mexican vehicles also saw further decline in exemptions, with the share of tariff-free vehicles dropping to just 21% in July from 91% in March.

Benefits of USMCA – a Contrast with Germany and Japan

“North American automakers previously relied upon the USMCA trade agreement (and before that, NAFTA) which exempted a very large share of the voluminous trade in automobiles and parts within North America from imports. With the new tariff policies under the Trump Administration, including the executive orders and proclamations in late March and April, this changed dramatically. The data suggest that US Customs allowed automakers to claim exemptions for most vehicles under the USMCA through April, May, and some or all of June. AEG’s research notes that this is one allowable interpretation of the proclamations and executive orders issued in March and April.

“Germany and Japan did not benefit from the same exemption. Nearly all vehicles and parts from these two countries were subject to the full tariff throughout the entire period. We do not observe any sharp changes in the dutiable value or the share of imports exempt from tariffs for both countries in July 2025.

What It Means for North American Automakers

“The sharp drop in the share of vehicles exempt from tariffs marks a turning point for North American automakers, who benefited from temporary allowances in the first half of 2025. With the end of the allowances that prevailed through May and into June of this year, automakers and suppliers are now facing the tariff-related cost increases that AEG and others noted were coming as early as January of this year.

“Tariffs hit North American automakers hard in July,” said Patrick L. Anderson, Principal & CEO of Anderson Economic Group. “The automakers made extensive use of temporary allowances that effectively allowed an exemption for the majority of both parts and vehicles through June. That changed in July for assembled vehicles, and we can expect that these costs will become embedded into the prices consumers are paying in the very near future.”

“Starting in January of this year, we stated that tariffs at this level would hit suppliers, dealers, and consumers this year,” said Anderson. “With over a billion dollars in tariff costs in just one month and for just two countries, the price shock will become impossible to ignore,” said Anderson.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.