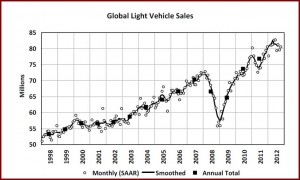

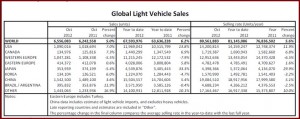

Global sales of light vehicles were flat in October as declines in the EU offset modest gains elsewhere. Nonetheless, on a seasonally adjusted annual basis or SAAR, 2012 is tracking at a rate of 80.6 million units a year, with 68 million vehicles sold year-to-date.

This means that the trend line of ever increasing global sales is now restored to a pre-2008 slope, before the global collapse of the financial and real estate markets created a Grand Canyon-sized dip from more than 70 million units in 2007 to a trough of ~55 million in 2008 and 2009.

China, at 1.5 million units (+3.6% year-over-year) in October remains by far the largest market, with a modest increase from September 2012 when government allowed (encouraged?) anti-Japanese protests over disputed Pacific Islands hurt Japanese brand sales. Since the Japanese companies are all linked by Chinese communist party policies to local Chinese partners who also suffered from the lost sales, presumably the short-term glitch is now over as local profits take precedence over politics. The current Chinese selling rate according to LMC Automotive is tracking at 19.1 million units annually.

The Number Two Global market, the U.S., is continuing its modest recovery at a 14.2 million unit SAAR. LMC Automotive, the source of the data, recently upped its 2012 prediction to 14.4 million light vehicles, with 11.7 million units at retail as opposed to fleet. The consultancy, nevertheless, remains cautious about 2013, forecasting 15 million units, 12.2 retail – far below the rate during the early part of this century when sales were consistently in the 16-17 million-unit range.

Canada’s October 2012 sales were up 7.3% with 1.7 million units at year. Car sales led the gains with a 19.1% increase, attributed to new model introductions, while light truck sales fell slightly (-1%).

Europe, any way you tally it, remains troublesome. In Western Europe, five straight years of declines continued with the selling rate dipping to under 13 million units/year in October. For 2013, LMC – and virtually everyone else – expects a further contraction in sales in Western Europe. However, Russian sales remained stable at 2.9 million units annually, helping to port East European sales at a rate of around 4.8 million units a year. Stability in Eastern Europe, if not strong growth, is LMC’s prediction for 2013.

Japan’s October sales increased 2.5% from the previous month despite the fact that a temporary “eco-car” subsidy ended in September.

In Korea, temporary tax incentives for passenger vehicles helped boost sales in October. The incentives are set to expire at the end of this year after the December presidential election, which it is said will slow sales.

In Brazil, the selling rate was close to a near record-high of 4 million units per year in October, up 21% from September, following a 17% decline in the previous month. The government has extended the temporary IPI tax cut to the end of this year, which is thought to be the cause of the volatility in the market.

Argentina’s market has continued a general downward trend since December 2011. Both the economy and vehicle market continue to be distorted by what LMC says is the government’s interventionist economic policies, such as price and import controls.