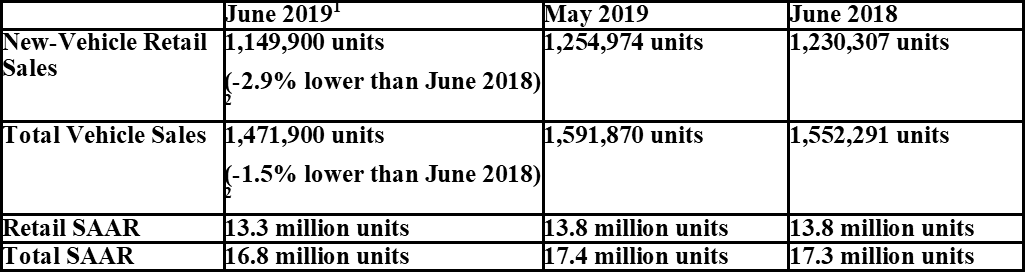

New-vehicle retail sales in June are projected to fall from a year ago as Transaction Prices, Dealer Profitability rise to record Levels. According to a forecast developed jointly by J.D. Power and LMC Automotive, June retail sales are predicted to reach 1,149,900 units, a 2.9% decrease compared with June 2018. The seasonally adjusted annualized rate or SAAR for retail sales is expected to be 13.3 million units, down 500,000 from a year ago. New-vehicle retail sales through the first half of 2019 are projected to reach 6,477,400 units, a 3.3% decrease from 2018.

- J.D. Power and LMC Automotive U.S. Sales and SAAR Comparisons

- Total sales in June are projected at 1,471,900 units, a 1.5% decrease compared with June 2018.

- SAAR total sales is expected to be 16.8 million units, down 500,000 from a year ago.

“While the first half of 2019 is expected to deliver its weakest retail sales since 2013, the growth in prices has been nothing short of remarkable. Average transaction prices set a record during the first half, which has big implications for manufacturer revenues,” said Thomas King, Senior Vice President of the Data and Analytics Division at J.D. Power.

- New-vehicle prices are on pace to reach $33,346—the highest ever for the first half of the year and are up nearly 4% (+$1,158) from last year.

- Reduced sales volumes coupled with higher overall prices, means that consumers are anticipated to spend $216 billion on new vehicles through the first half, down just 0.4% from last year.

- Incentive discipline to start the year has continued through the second quarter.

- Spending to-date through the first half has fallen to $3,788 per unit, $130 less than the same period a year ago.

- Spending on cars is down $304 to $3,588.

- Spending on trucks/SUVs is down $65 to $3,871.

“The decline in new sales have been disappointing, but it’s important not to overlook the effect of growth in the used-vehicle market,” King said. “Used sales at franchised dealers are expected to increase by nearly 9% through the first half. Most significant for retailers is the greater profit opportunity due to higher front-end gross and F&I income earned compared with new vehicles. Overall combined new and used retailer profits through the first half are on pace to reach $23.4 billion, up 3.7% from last year. Shifting away from the traditional focus on volumes, 2019 remains on target to be one of the best years recorded.”

DATA

- The average new-vehicle retail transaction price to date in June is $33,665. The previous high for the month of June—$32,074—was set last year.

- Average incentive spending per unit to date in June is $3,782, down from $3,880 last year.

- Consumers are on pace to spend $38.6 billion on new vehicles in June, down $800 million from last year’s level.

- Truck/SUVs account for 71.1% of new-vehicle retail sales through June 23, the highest level ever for the month of June.

- Days to turn, the average number of days a new vehicle sits on a dealer lot before being sold to a retail customer, is 75 days through June 23. This is up 6 days from last year.

- Fleet sales are expected to total 322,000 units, up 3.9% from June 2018. Fleet volume is expected to account for 22% of total light-vehicle sales, up from 21% last year.

Outlook for the Year

“Auto sales are nearing the halfway point for 2019 and despite all of the external noise, the beat goes on! A much more dovish Fed is under pressure and is now expected to make a series of interest rate cuts,” said Jeff Schuster, President, Americas Operations and Global Vehicle Forecasts, LMC Automotive. “This will provide support for auto sales in the second half of the year and help offset rising vehicle prices and the current level of incentives. Trucks overall are expected to remain strong on further SUV growth, but the pickup war is heating up. We expect pickup share to reach 17.8% in 2019, a percentage point increase from 2018.”

LMC’s forecast for 2019 total light-vehicle sales is holding at 16.9 million units, a decline of 2.1% from 2018. The retail light-vehicle sales forecast is also stable with volume at 13.5 million units, a decline of 3.1% rom 2018.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

First Half of 2019 to Deliver Lowest US Retail Sales Since 2013

New-vehicle retail sales in June are projected to fall from a year ago as Transaction Prices, Dealer Profitability rise to record Levels. According to a forecast developed jointly by J.D. Power and LMC Automotive, June retail sales are predicted to reach 1,149,900 units, a 2.9% decrease compared with June 2018. The seasonally adjusted annualized rate or SAAR for retail sales is expected to be 13.3 million units, down 500,000 from a year ago. New-vehicle retail sales through the first half of 2019 are projected to reach 6,477,400 units, a 3.3% decrease from 2018.

“While the first half of 2019 is expected to deliver its weakest retail sales since 2013, the growth in prices has been nothing short of remarkable. Average transaction prices set a record during the first half, which has big implications for manufacturer revenues,” said Thomas King, Senior Vice President of the Data and Analytics Division at J.D. Power.

“The decline in new sales have been disappointing, but it’s important not to overlook the effect of growth in the used-vehicle market,” King said. “Used sales at franchised dealers are expected to increase by nearly 9% through the first half. Most significant for retailers is the greater profit opportunity due to higher front-end gross and F&I income earned compared with new vehicles. Overall combined new and used retailer profits through the first half are on pace to reach $23.4 billion, up 3.7% from last year. Shifting away from the traditional focus on volumes, 2019 remains on target to be one of the best years recorded.”

DATA

Outlook for the Year

“Auto sales are nearing the halfway point for 2019 and despite all of the external noise, the beat goes on! A much more dovish Fed is under pressure and is now expected to make a series of interest rate cuts,” said Jeff Schuster, President, Americas Operations and Global Vehicle Forecasts, LMC Automotive. “This will provide support for auto sales in the second half of the year and help offset rising vehicle prices and the current level of incentives. Trucks overall are expected to remain strong on further SUV growth, but the pickup war is heating up. We expect pickup share to reach 17.8% in 2019, a percentage point increase from 2018.”

LMC’s forecast for 2019 total light-vehicle sales is holding at 16.9 million units, a decline of 2.1% from 2018. The retail light-vehicle sales forecast is also stable with volume at 13.5 million units, a decline of 3.1% rom 2018.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.