1> Figures cited for February 2020 are forecast based on the first 13 selling days of the month. 2> February 2020 has 26 selling days, two more days than 2019.

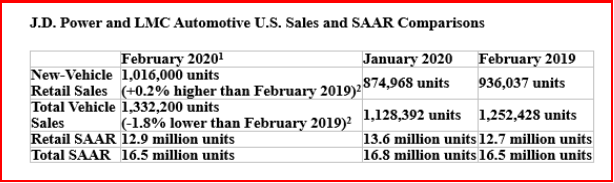

U.S. new-vehicle retail sales in February are projected higher from a year ago, according to a forecast developed by J.D. Power and LMC Automotive. Retail sales are expected to reach 1,016,000 units, a 0.2% increase compared with February 2019. Reporting the same numbers without controlling for the number of selling days translates to an increase of 8.5% over last year. (February 2020 contains one extra weekend and two additional selling days than February 2019.)

Record levels of automaker spending are still being used to support the volume. Incentive spending is on track to reach $4,179 in February, the highest ever for the month and an increase of $293 from last year. Spending on cars is expected to be up $97 to $3,746, while spending on trucks/SUVs is up $353 to $4,335. Car mix is anticipated to fall to 26.4%, down three percentage points from last year and the lowest level ever for February. At the current pace, car mix for the industry will fall below 23% by December.

Record prices, coupled with the growth in sales, means that consumers are expected to spend $34.7 billion on new vehicles in February. This is up nearly $3.6 billion from last year and another record to start the year.

Total Sales Forecast

Total sales in February are projected to reach 1,332,200 units, a 1.8% decrease compared with February 2019. Reporting the same numbers without controlling for the number of selling days translates to an increase of 6.4% over last year. The seasonally adjusted annualized rate (SAAR) for total sales is expected to be 16.5 million units, flat from a year ago.

- The average new-vehicle retail transaction price in February is expected to reach $34,152. The previous high for the month of February, $33,208, was set in February 2019.

- Average incentive spending per unit in February is expected to reach $4,179, up from $3,886 last year. The previous record for the month—$4,008—was set in 2018.

- Incentive spending on cars is expected to be up $97 to $3,746, while spending on trucks/SUVs is up $353 to $4,335.

- Consumers are on pace to spend $34.7 billion on new vehicles in February, up $3.6 billion from February 2019.

- Trucks/SUVs account for 72.9% of new-vehicle retail sales through Feb. 16, the highest level ever for the month of February.

- Days to turn, the average number of days a new vehicle sits on a dealer lot before being sold to a retail customer, is 72 days (through Feb. 16). This is flat from a year ago.

- Fleet sales are expected to total 316,260 units, down 7.7% from February 2019. Fleet volume is expected to account for 24% of total light-vehicle sales, down from 25% a year ago.

“The once-in-a-generation sales calendar quirk means that February retail sales will exceed one million units for only the third time in the last 15 years.” The combination of the leap year and industry sales reporting practice means that this year’s sales month contains five weekends. The last time this happened was 28 years ago in 1992,” said Thomas King, President of the Data and Analytics Division at J.D. Power.

“Last year it took until September for the industry to reach the current spend levels,” King noted. “While the coronavirus has had no meaningful effect on production yet, it does have the potential to reduce overall inventory levels and lower the need for continued elevated incentives. If unhealthy inventory levels persist throughout the year, however, manufacturers may be faced with spend levels that are pacing towards $5,000 by next year.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

US February Retail Vehicle Sales to Surpass a Million

1> Figures cited for February 2020 are forecast based on the first 13 selling days of the month. 2> February 2020 has 26 selling days, two more days than 2019.

U.S. new-vehicle retail sales in February are projected higher from a year ago, according to a forecast developed by J.D. Power and LMC Automotive. Retail sales are expected to reach 1,016,000 units, a 0.2% increase compared with February 2019. Reporting the same numbers without controlling for the number of selling days translates to an increase of 8.5% over last year. (February 2020 contains one extra weekend and two additional selling days than February 2019.)

Record levels of automaker spending are still being used to support the volume. Incentive spending is on track to reach $4,179 in February, the highest ever for the month and an increase of $293 from last year. Spending on cars is expected to be up $97 to $3,746, while spending on trucks/SUVs is up $353 to $4,335. Car mix is anticipated to fall to 26.4%, down three percentage points from last year and the lowest level ever for February. At the current pace, car mix for the industry will fall below 23% by December.

Record prices, coupled with the growth in sales, means that consumers are expected to spend $34.7 billion on new vehicles in February. This is up nearly $3.6 billion from last year and another record to start the year.

Total Sales Forecast

Total sales in February are projected to reach 1,332,200 units, a 1.8% decrease compared with February 2019. Reporting the same numbers without controlling for the number of selling days translates to an increase of 6.4% over last year. The seasonally adjusted annualized rate (SAAR) for total sales is expected to be 16.5 million units, flat from a year ago.

“The once-in-a-generation sales calendar quirk means that February retail sales will exceed one million units for only the third time in the last 15 years.” The combination of the leap year and industry sales reporting practice means that this year’s sales month contains five weekends. The last time this happened was 28 years ago in 1992,” said Thomas King, President of the Data and Analytics Division at J.D. Power.

“Last year it took until September for the industry to reach the current spend levels,” King noted. “While the coronavirus has had no meaningful effect on production yet, it does have the potential to reduce overall inventory levels and lower the need for continued elevated incentives. If unhealthy inventory levels persist throughout the year, however, manufacturers may be faced with spend levels that are pacing towards $5,000 by next year.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.