Click to Enlarge.

COVID-19 pandemic has simultaneously strained day-to-day operations and pushed more transactions than ever to digital, according to the J.D. Power, which released the 2020 U.S. Dealer Financing Satisfaction Study.

“The pandemic has severely disrupted dealer-lender communication, with many dealers reporting that lenders were delayed or not available when they needed them, or not able to assist in a timely manner,” said Patrick Roosenberg, director of automotive finance intelligence at J.D. Power. This of course begs the question of there’s another solution – such as borrowers dealing directly digitally with lenders, which will eliminate a lucrative profit center at dealerships.

Study Rankings

Captive – Mass Market Segment

- Volkswagen Credit ranks highest in overall dealer satisfaction with a score of 939 (on a 1,000-point scale),

- followed by Subaru Motors Finance (934) and

- Honda Financial Services (902).

National Banking

- TD Auto Finance ranks highest in overall dealer satisfaction with a score of 931,

- followed by Ally Financial (922) and

- Chase Automotive Finance (872).

Regional Banking

- Citizens One Auto Finance ranks highest in overall dealer satisfaction with a score of 954,

- followed by Huntington National Bank (910) and

- Fifth Third Bank (879).

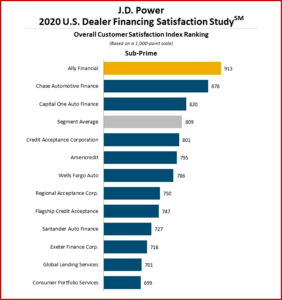

Sub-Prime

- Ally Financial ranks highest in overall dealer satisfaction with a score of 913,

- followed by Chase Automotive Finance (878) and

- Capital One Auto Finance (820).

Lease

- Audi Financial Services ranks highest in overall dealer satisfaction with a score of 970,

- followed by Subaru Motors Finance (946) and

- Volkswagen Credit (941).

The 2020 U.S. Dealer Financing Satisfaction Study is based on responses from 3,960 auto dealer financial professionals. The study, which was fielded in August-September 2020, measures auto dealer satisfaction in six segments of lenders: captive luxury–prime;1* captive mass market–prime; lease; non-captive national–prime; non-captive regional–prime; and non-captive sub-prime.

1* The captive luxury segment did not meet requirements to be award eligible.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

COVID Changes – Digital Auto Lending Infected

Click to Enlarge.

COVID-19 pandemic has simultaneously strained day-to-day operations and pushed more transactions than ever to digital, according to the J.D. Power, which released the 2020 U.S. Dealer Financing Satisfaction Study.

“The pandemic has severely disrupted dealer-lender communication, with many dealers reporting that lenders were delayed or not available when they needed them, or not able to assist in a timely manner,” said Patrick Roosenberg, director of automotive finance intelligence at J.D. Power. This of course begs the question of there’s another solution – such as borrowers dealing directly digitally with lenders, which will eliminate a lucrative profit center at dealerships.

Study Rankings

Captive – Mass Market Segment

National Banking

Regional Banking

Sub-Prime

Lease

The 2020 U.S. Dealer Financing Satisfaction Study is based on responses from 3,960 auto dealer financial professionals. The study, which was fielded in August-September 2020, measures auto dealer satisfaction in six segments of lenders: captive luxury–prime;1* captive mass market–prime; lease; non-captive national–prime; non-captive regional–prime; and non-captive sub-prime.

1* The captive luxury segment did not meet requirements to be award eligible.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.