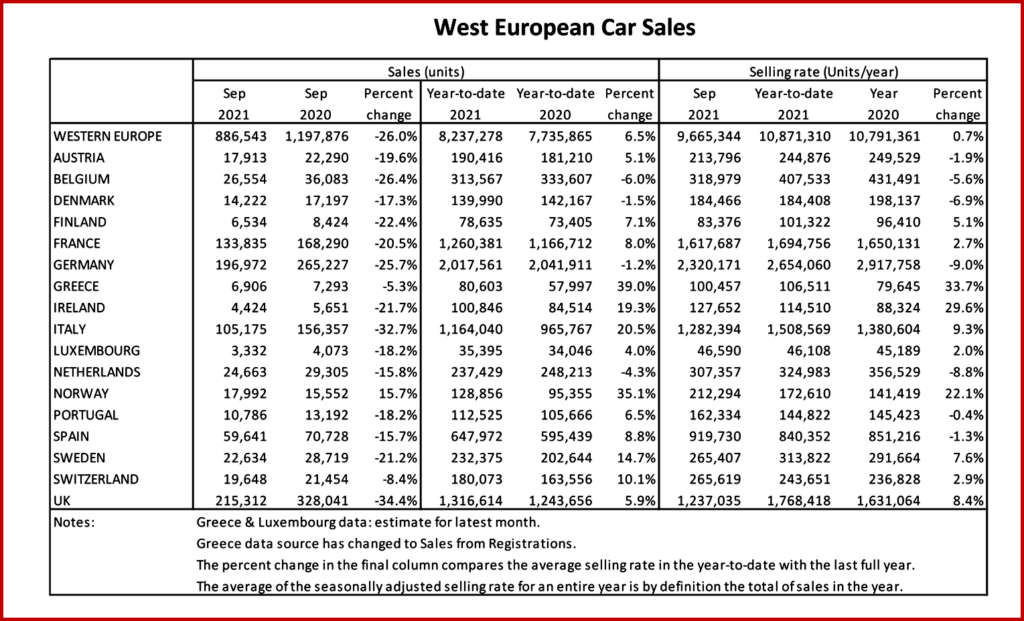

The West European passenger car selling rate dropped to 9.7 million units annually during September. This was a sharp drop from the 11.9 mn units/year in August, according to consultancy LMC Automotive.

“The latest monthly results are clear evidence of the major sourcing issues that are haunting global vehicle production currently, with dealerships unable to meet consumer demand. Adding to market headwinds, those vehicles that are available are generally higher priced, as OEMs look to target the production of higher margin products,” said LMC.

Click to Enlarge.

In Germany, the selling rate dropped to 2.3 mn units/year in September, from 2.8 mn units/year the previous month. The UK selling rate nosedived to 1.2 mn units/year, in what was the worst September for over two decades. In France, the selling rate fell to 1.6 mn units/year. The Spanish selling rate was the only market to mark a slight improvement on the month before, this time to 920k units/year, “though this is still well below 2019’s output of 1.3 mn units,” observed LMC. In Italy, the selling rate fell to 1.3 mn units/year, marking the worst result since May last year.

LMC has cut its forecast once again – reflecting the ongoing and deeper impact of the supply disruption, with tight inventory unable to absorb the impact of the disruption. LMC is currently saying 2021 will not eclipse “the desperately weak 2020 result.”

LMC assumes that sourcing issues will remain throughout next year – weakening the connection between positive underlying demand and new vehicle sales. “The downside risk of some form of virus-related restrictions remains, though in terms of the market, this is presently being overshadowed by vehicle production bottlenecks,” said LMC.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

September West EU Car Sales in Severe Supply Slump

The West European passenger car selling rate dropped to 9.7 million units annually during September. This was a sharp drop from the 11.9 mn units/year in August, according to consultancy LMC Automotive.

“The latest monthly results are clear evidence of the major sourcing issues that are haunting global vehicle production currently, with dealerships unable to meet consumer demand. Adding to market headwinds, those vehicles that are available are generally higher priced, as OEMs look to target the production of higher margin products,” said LMC.

Click to Enlarge.

In Germany, the selling rate dropped to 2.3 mn units/year in September, from 2.8 mn units/year the previous month. The UK selling rate nosedived to 1.2 mn units/year, in what was the worst September for over two decades. In France, the selling rate fell to 1.6 mn units/year. The Spanish selling rate was the only market to mark a slight improvement on the month before, this time to 920k units/year, “though this is still well below 2019’s output of 1.3 mn units,” observed LMC. In Italy, the selling rate fell to 1.3 mn units/year, marking the worst result since May last year.

LMC has cut its forecast once again – reflecting the ongoing and deeper impact of the supply disruption, with tight inventory unable to absorb the impact of the disruption. LMC is currently saying 2021 will not eclipse “the desperately weak 2020 result.”

LMC assumes that sourcing issues will remain throughout next year – weakening the connection between positive underlying demand and new vehicle sales. “The downside risk of some form of virus-related restrictions remains, though in terms of the market, this is presently being overshadowed by vehicle production bottlenecks,” said LMC.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.