Click to Enlarge.

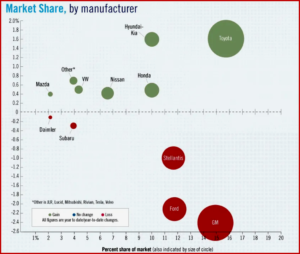

The US daily volume average of light vehicle sales dropped to the lowest level so far in 2021 due to extremely lean inventories, according to LMC Automotive, an independent global forecasting and market intelligence consultancy. Sales totaled 1.05 mn light vehicles, down -23% YoY. Ford led the market, but Toyota outsold GM once again and is now the only OEM that has sold more than 2 million units in the year to date. Several brands, including Hyundai, Kia and Tesla, have already surpassed their 2020 total sales.

Overall vehicle sales were, however, 5% higher than September with the 2 extra selling days in October. The annualized rate grew to 13.1 million units from 12.1 million in the previous month and back to the level registered in August. “However, OEMs sold just 39,000 vehicles per selling day, compared to 40,000 units last month, way down from a peak of 62,000 vehicles in March,” said LMC.

“In October 2021 light-truck market share topped 80% for the first time, at 80.2% of all new light vehicles sold. Through the first 10 months of the year, light trucks have accounted for 77.2% of new-vehicle sales. After setting a record in September 2021, average new light-vehicle transaction prices are expected to set a new record of just under $44,000, says J.D. Power,” said Patrick Manzi, National Automobile Dealers Association Chief Economist.

“Prices have risen due to limited new-vehicle supplies and reduced automaker incentive spending. Accordingly, average incentive spending per unit is also expected to hit a new record low of $1,628. Consumers facing these rising prices have benefited from very strong trade-in values. J.D. Power estimates that the average trade-in value is up 70% year over year,” Manzi said.

For the rest of 2021 NADA predicts that dealers will continue to sell most of their inventory soon after it reaches their lots as they work their way through their customer order books. “Inventory levels should begin to slowly and steadily increase throughout 2022 but will likely remain below pre-COVID levels. Our forecast for new light-vehicle sales in 2021 is 15.2 million units,” said Manzi.

Global Light Vehicle sales in 2021 are now projected by LMC to finish at 80.2 million units, revised down by 400,000 units from last month as disruptions continue hinder vehicle production to keep up with demand. LMC’s 2022 forecast has also been cut by 400,000 to 84.8 million units, “with a higher level of risk in the first half of the year.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

US October Light Vehicle Sales Drop -23% YoY

Click to Enlarge.

The US daily volume average of light vehicle sales dropped to the lowest level so far in 2021 due to extremely lean inventories, according to LMC Automotive, an independent global forecasting and market intelligence consultancy. Sales totaled 1.05 mn light vehicles, down -23% YoY. Ford led the market, but Toyota outsold GM once again and is now the only OEM that has sold more than 2 million units in the year to date. Several brands, including Hyundai, Kia and Tesla, have already surpassed their 2020 total sales.

Overall vehicle sales were, however, 5% higher than September with the 2 extra selling days in October. The annualized rate grew to 13.1 million units from 12.1 million in the previous month and back to the level registered in August. “However, OEMs sold just 39,000 vehicles per selling day, compared to 40,000 units last month, way down from a peak of 62,000 vehicles in March,” said LMC.

“In October 2021 light-truck market share topped 80% for the first time, at 80.2% of all new light vehicles sold. Through the first 10 months of the year, light trucks have accounted for 77.2% of new-vehicle sales. After setting a record in September 2021, average new light-vehicle transaction prices are expected to set a new record of just under $44,000, says J.D. Power,” said Patrick Manzi, National Automobile Dealers Association Chief Economist.

“Prices have risen due to limited new-vehicle supplies and reduced automaker incentive spending. Accordingly, average incentive spending per unit is also expected to hit a new record low of $1,628. Consumers facing these rising prices have benefited from very strong trade-in values. J.D. Power estimates that the average trade-in value is up 70% year over year,” Manzi said.

For the rest of 2021 NADA predicts that dealers will continue to sell most of their inventory soon after it reaches their lots as they work their way through their customer order books. “Inventory levels should begin to slowly and steadily increase throughout 2022 but will likely remain below pre-COVID levels. Our forecast for new light-vehicle sales in 2021 is 15.2 million units,” said Manzi.

Global Light Vehicle sales in 2021 are now projected by LMC to finish at 80.2 million units, revised down by 400,000 units from last month as disruptions continue hinder vehicle production to keep up with demand. LMC’s 2022 forecast has also been cut by 400,000 to 84.8 million units, “with a higher level of risk in the first half of the year.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.