Click for more info.

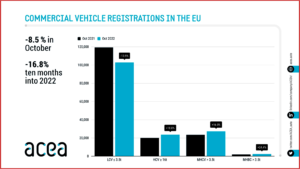

In a demonstration of the murky answer to the question “is the ongoing European-recession glass half-empty or half-full?”, ACEA* said today that the EU market for new commercial vehicles continued to scuffle, declining for the sixteenth month in a row at -8.5% vehicles.

However, year-to-date registrations of new commercial vehicles across the European Union contracted by 16.8% to 1.3 million units. So things are improving somewhat since the rate of decline is decreasing. Moreover, the truck and bus segments performed better than in October 2021.

Among the region’s four largest markets, Germany saw the sharpest decline in total commercial vehicle sales (-12.4%), followed by France and Italy with more restrained losses (-5.3% and -3.9% respectively). Spain posted a slight increase (+1.2%).

Click for more information.

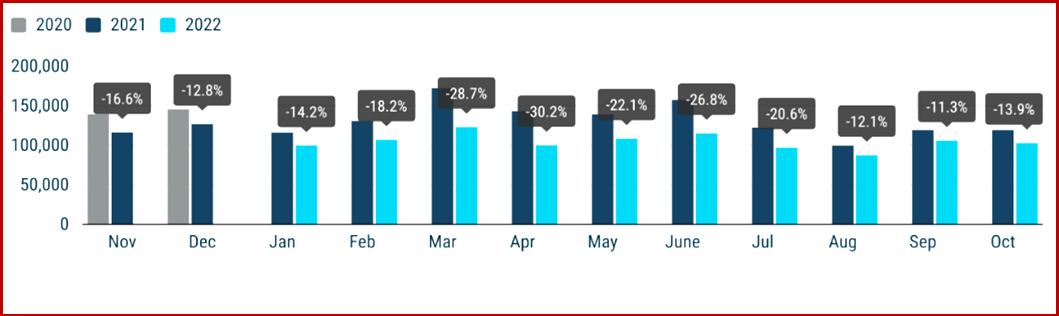

From January to October 2022, EU light commercial vehicle registrations were down by 20.6%, to 1 million units. Aside from the Czech Republic (+1.6%) and Slovakia (+0.1%), all the EU markets contributed to the overall decline, including the four largest ones, which all faced double-digit losses: Spain (-25.5%), France (-21.1%), Germany (-18.7%) and Italy (-11.9%).

*ACEA – The European Automobile Manufacturers’ Association is the Brussels-based trade association of the 16 major car, van, truck and bus producers in Europe.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

EU Commercial Vehicle Registrations -8.5% in October

Click for more info.

In a demonstration of the murky answer to the question “is the ongoing European-recession glass half-empty or half-full?”, ACEA* said today that the EU market for new commercial vehicles continued to scuffle, declining for the sixteenth month in a row at -8.5% vehicles.

However, year-to-date registrations of new commercial vehicles across the European Union contracted by 16.8% to 1.3 million units. So things are improving somewhat since the rate of decline is decreasing. Moreover, the truck and bus segments performed better than in October 2021.

Among the region’s four largest markets, Germany saw the sharpest decline in total commercial vehicle sales (-12.4%), followed by France and Italy with more restrained losses (-5.3% and -3.9% respectively). Spain posted a slight increase (+1.2%).

Click for more information.

From January to October 2022, EU light commercial vehicle registrations were down by 20.6%, to 1 million units. Aside from the Czech Republic (+1.6%) and Slovakia (+0.1%), all the EU markets contributed to the overall decline, including the four largest ones, which all faced double-digit losses: Spain (-25.5%), France (-21.1%), Germany (-18.7%) and Italy (-11.9%).

*ACEA – The European Automobile Manufacturers’ Association is the Brussels-based trade association of the 16 major car, van, truck and bus producers in Europe.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.