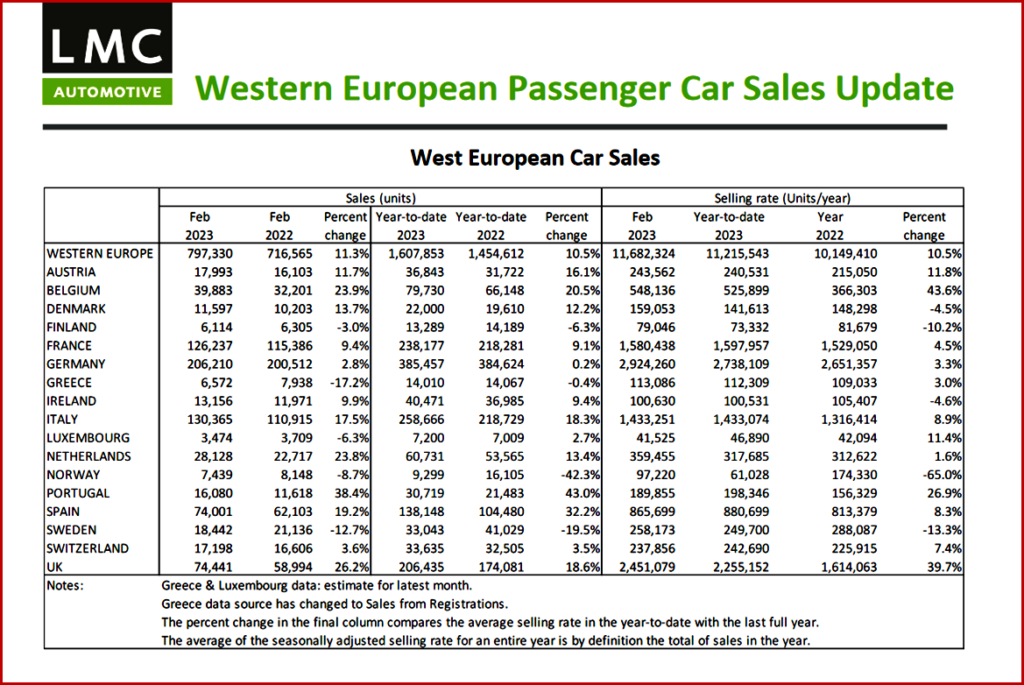

The Western Europe passenger vehicle selling rate climbed from 10.7 million units/year in January to 11.7 million units/year in February 2023, with improved sales in Germany and the UK. The monthly registrations of ~800,000 units resulted in a year‐on‐year (YoY) growth of 11.3%, according to the latest data just released by the LMC Automotive consultancy*. (autoinformed.com on: Recession? US Consumer Auto Spending at Record Levels; January 2023 Western EU Passenger Vehicles Sales Plunge)

However, LMC hedged by saying that 2022 is a weak base for comparison. “In YoY terms, the market was up 2.8%, though the same period last year was particularly weak”

Click for more information.

LMC Observations

“While France and Italy experienced stagnant growth in selling rates, Spain recorded a monthly selling rate decline. although The February PV market selling rate for Germany stood at 2.9 million units/year, comfortably better than the January result (2.6 million units/year), which was experiencing the after‐effects of a pull forward of sales into the end of 2022, related to changes to government incentives. The UK PV market recorded a 26% YoY increase in volumes for February, with the first two months together up nearly 19% on the same period in 2022. The UK’s PV selling rate of 2.5 million units/year was the strongest monthly selling rate performance since August 2020, though the seasonal weakness of both months flatters their results.

“The French PV selling rate remained stable, with January’s selling rate at 1.6 million units/year. In raw monthly registration terms, the PV market recorded 9.4% YoY growth at 126k units. The Italian PV selling rate remained flat for February 2023 at 1.4 million units/year after posting a raw monthly registration figure of 130k units (+17.5% YoY), the highest since June 2021. Spain’s PV market continues to see selling rates languish by pre‐ pandemic standards. The latest selling rate, for February, was the lowest since October – the near‐1 million units/year result in November having been proceeded by month‐on‐month deterioration thereafter,” LMC said.

The Forecast

LMC continues to predict YoY growth for Western Europe in 2023 because of a weak 2022. However, supply constraints still loom. “Underlying demand faces challenges too, with many the West European countries currently facing recessionary conditions and weak growth thereafter. In recent months though, consumer sentiment has become a little less pessimistic, and with a backlog of orders, we still view that a faster recovery in production this year would be supported by demand. However, it remains clear that rising costs of living and elevated levels of inflation seen across the region pose a downside risk to our forecasts,” LMC said.

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s global clients include car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

February 2023 Western EU Passenger Vehicle Sales Up 11%

The Western Europe passenger vehicle selling rate climbed from 10.7 million units/year in January to 11.7 million units/year in February 2023, with improved sales in Germany and the UK. The monthly registrations of ~800,000 units resulted in a year‐on‐year (YoY) growth of 11.3%, according to the latest data just released by the LMC Automotive consultancy*. (autoinformed.com on: Recession? US Consumer Auto Spending at Record Levels; January 2023 Western EU Passenger Vehicles Sales Plunge)

However, LMC hedged by saying that 2022 is a weak base for comparison. “In YoY terms, the market was up 2.8%, though the same period last year was particularly weak”

Click for more information.

LMC Observations

“While France and Italy experienced stagnant growth in selling rates, Spain recorded a monthly selling rate decline. although The February PV market selling rate for Germany stood at 2.9 million units/year, comfortably better than the January result (2.6 million units/year), which was experiencing the after‐effects of a pull forward of sales into the end of 2022, related to changes to government incentives. The UK PV market recorded a 26% YoY increase in volumes for February, with the first two months together up nearly 19% on the same period in 2022. The UK’s PV selling rate of 2.5 million units/year was the strongest monthly selling rate performance since August 2020, though the seasonal weakness of both months flatters their results.

“The French PV selling rate remained stable, with January’s selling rate at 1.6 million units/year. In raw monthly registration terms, the PV market recorded 9.4% YoY growth at 126k units. The Italian PV selling rate remained flat for February 2023 at 1.4 million units/year after posting a raw monthly registration figure of 130k units (+17.5% YoY), the highest since June 2021. Spain’s PV market continues to see selling rates languish by pre‐ pandemic standards. The latest selling rate, for February, was the lowest since October – the near‐1 million units/year result in November having been proceeded by month‐on‐month deterioration thereafter,” LMC said.

The Forecast

LMC continues to predict YoY growth for Western Europe in 2023 because of a weak 2022. However, supply constraints still loom. “Underlying demand faces challenges too, with many the West European countries currently facing recessionary conditions and weak growth thereafter. In recent months though, consumer sentiment has become a little less pessimistic, and with a backlog of orders, we still view that a faster recovery in production this year would be supported by demand. However, it remains clear that rising costs of living and elevated levels of inflation seen across the region pose a downside risk to our forecasts,” LMC said.

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s global clients include car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.